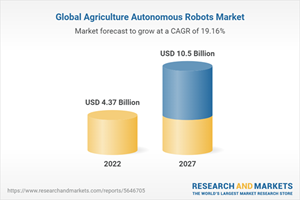

Global Agriculture Autonomous Robots Market Report 2022: A 10.5 Billion Industry in 2027 - Escalating Adoption of Precision Agriculture Technologies

Global Agriculture Autonomous Robots Market

Dublin, Oct. 05, 2022 (GLOBE NEWSWIRE) -- The "Agriculture Autonomous Robots Market - A Global and Regional Analysis: Focus Product and Application, Supply Chain Analysis, and Country Analysis - Analysis and Forecast, 2022-2027" report has been added to ResearchAndMarkets.com's offering.

The global agriculture autonomous robots market was valued at $3.92 billion in 2021 and is projected to reach $10.50 billion in 2027, growing at a CAGR of 19.16% during the forecast period 2022-2027

The growth in the global agriculture autonomous robots market is expected to be driven by increasing demand for food and the growing need for precision, digital, and smart agriculture practices.

Market Lifecycle Stage

The agriculture autonomous robots market is still in an evolving phase. Increased research and development activities are underway to develop agriculture autonomous robotic technologies and products, which are expected to increase due to the increased demand for food and the need for automation in the agriculture sector.

Increasing investment in smart agriculture is one of the major opportunities in the global agriculture autonomous robots market. Moreover, agriculture autonomous robot technologies also help in reducing crop losses due to undetected pest infestation and diseases. The agriculture autonomous robots also facilitate the safe and quality harvesting and picking of crops including fruits and vegetables.

With an increased worldwide focus on achieving the global food demand, the shift to digital, smart, and data-driven products in the agriculture sectors brings significant sales and financing opportunities. The shift is more prominent in automation and robotics segments in regions such as North America and Europe.

Furthermore, agriculture autonomous robots have a moderate to high impact on crop protection systems to reduce crop losses due to crop diseases and pest infestations.

Impact of COVID-19

In the wake of the pandemic, labor shortages have caused disruptions in the agricultural processes, thereby leading every country to re-emphasize food security and increase domestic food production.

With an aim to solve labor shortages, the increased application of automated technologies such as sensors, data analytics, robotics, and others have been introduced into the production system. Each country continued to promote policies on increasing the adoption of agriculture autonomous robots techniques, which have proved to be the appropriate solution.

Market Segmentation

Dairy farm management is one of the major applications of agriculture autonomous robots owing to the high adoption of milking robots in Europe and North America.

The milking robots segment is expected to grow at a CAGR of 20.34% during the forecast period 2022-2027 due to the rising use of automation in dairy farms. These robots increase the efficiency of farm operations by reducing the overall cost. Hence, farmers are inclining toward adopting milking robots and reducing dependence on manual labor.

North America generated the highest revenue of $1.33 billion in 2021, which is attributed to the R&D advancements and supporting government regulations in the region. Europe is an attractive region for the agriculture autonomous robots market because of the availability of the different market fragments.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The top segment players leading the market include crop monitoring and dairy farm management, which capture around 65% of the presence in the market. Players in other technologies, such as inventory management, and harvesting and picking, account for approximately 35% of the presence in the market, as of 2021.

Recent Developments in Global Agriculture Autonomous Robots Market

In April 2022, Verdant Robotics announced a robotic solution for farms that can help in spraying and weeding simultaneously with the help of machine learning, AI perception, and robotics technology.

In December 2021, Lely collaborated with Dutch based Connectera B.V. With this collaboration, Lely aims to use Connecterra B.V.'s advancements in machine learning and artificial intelligence to provide more insights to farmers. Also, the technologies aid in integrating farm technologies with artificial intelligence for developing farm management systems.

In October 2021, BouMatic acquired SAC Group, a well-reputed full-line producer of complete milking systems for cows, sheep, and goats. This acquisition is expected to aid BouMatic in expanding its global presence and product catalogue.

In November 2020, Robert Bosch GmbH and BASF SE began a joint venture for digital technologies in the agricultural sector. They jointly developed a smart spraying technology to apply herbicide on weeds without spraying unaffected areas of crops.

In October 2020, AGCO Corporation announced the launch of Fendt Xaver, which comes with an embedded solution developed by the AGCO Group and a seed unit for precision planting. It is equipped with the Vario Guide Lane guidance system, which controls the robot with centimetre accuracy.

Some of the prominent names established in this market are:

AGCO Corporation

Agrobot

BouMatic

DAIRYMASTER

Deere & Company

Ecorobotix SA

GEA Group Aktiengesellschaft

KUBOTA Corporation

Lely

Naio Technologies

Robert Bosch GmbH

Saga Robotics AS

Uniseed

Verdant Robotics

Trabotyx

FarmWise Labs, Inc.

XMACHINES

Blue White Robotics Ltd.

Iron Ox, Inc.

Key Topics Covered:

1 Markets

1.1 Industry Outlook

1.1.1 Market Definition

1.1.2 Ecosystem/Ongoing Programs

1.1.2.1 Governments Initiatives

1.1.2.2 Consortiums and Associations

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Growing Focus on Environmental Sustainability

1.2.1.2 Aging Workforce Leading to Skill Shortage

1.2.1.3 Escalating Adoption of Precision Agriculture Technologies

1.2.2 Business Challenges

1.2.2.1 High Initial Investment and Cost

1.2.2.2 Less Adoption among Small-Scale Farmers

1.2.3 Market Strategies and Developments

1.2.3.1 Business Strategies

1.2.3.1.1 Product Development and Innovation

1.2.3.1.2 Business Expansions

1.2.3.2 Corporate Strategies

1.2.3.2.1 Mergers and Acquisitions

1.2.3.2.2 Partnerships, Collaborations, and Joint Ventures

1.2.3.2.3 Others

1.2.4 Business Opportunities

1.2.4.1 Growing Adoption of Smart Farming Techniques

1.2.4.2 Increasing Demand for Harvesting Automation

1.2.5 Impact of COVID-19 on Global Agriculture Autonomous Robots Market

1.3 Investment Landscape

1.3.1 Investment and Funding Landscape Share (by Company)

1.3.2 Investment and Funding Landscape Share (by Country)

2 Application

2.1 Global Agriculture Autonomous Robots Market (by Application)

2.1.1 Crop Monitoring

2.1.2 Dairy Farm Management

2.1.3 Inventory Management

2.1.4 Harvesting and Picking

2.1.5 Others

2.2 Demand Analysis of Global Agriculture Autonomous Robots Market, (by Application), $Million, 2021-2027

3 Products

3.1 Global Agriculture Autonomous Robots Market (by Product)

3.1.1 Crop Harvesting Robots

3.1.2 Weeding Robots

3.1.3 Milking Robots

3.1.4 Others

3.2 Demand Analysis of Global Agriculture Autonomous Robots Market, (by Product), $Million

3.3 Patent Analysis

3.3.1 Patent Analysis (by Status)

3.3.2 Patent Analysis (by Inventor Type)

3.3.3 Patents Analysis (by Patent Office)

3.3.4 Patent Analysis (by Application)

3.4 Supply Chain Analysis

4 Regions

5 Market-Competitive Benchmarking and Company Profiles

5.1 Market Share Analysis

5.1.1 Market Share Analysis of Global Agriculture Autonomous Robots Market Manufacturers

5.2 Competitive Benchmarking

5.3 Company Profiles

5.3.1 Company Overview

5.3.1.1 Role in the Global Agriculture Autonomous Robots Market

5.3.1.2 Product Portfolio

5.3.2 Business Strategies

5.3.2.1 Product Developments

5.3.3 Corporate Strategies

5.3.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

5.3.4 Analyst View

For more information about this report visit https://www.researchandmarkets.com/r/vx3hr2

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance