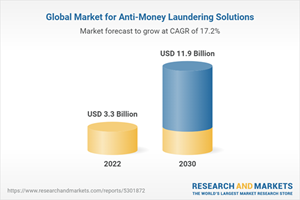

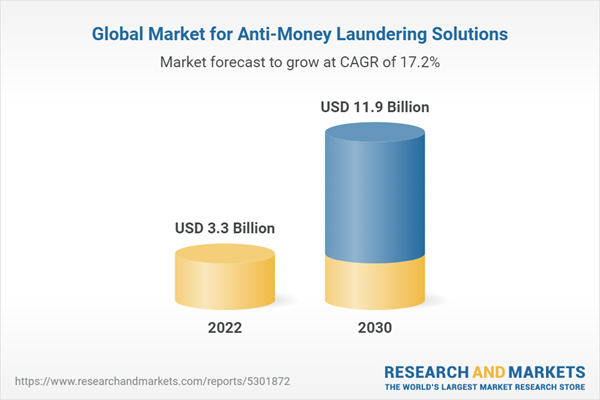

Global Anti-Money Laundering Solutions Market to Reach $11.9 Billion by 2030

Global Market for Anti-Money Laundering Solutions

Dublin, Jan. 24, 2024 (GLOBE NEWSWIRE) -- The "Anti-Money Laundering Solutions - Global Strategic Business Report" report has been added to ResearchAndMarkets.com's offering.

The financial landscape is undergoing rapid transformation with increasing emphasis on regulatory compliance and risk management. The global market for Anti-Money Laundering (AML) Solutions is experiencing unprecedented growth, with a forecast to expand to a staggering $11.9 billion by the year 2030. This remarkable growth trajectory, with a compound annual growth rate (CAGR) of 17.2% from 2022 to 2030, reflects the intensified focus on combating financial crime worldwide.

In a new market research report added to our comprehensive collection, it is anticipated that the Solutions segment within the AML market will register a significant CAGR of 16.6%, achieving a market size of $6.9 billion by 2030. This sector stands as a cornerstone in the fight against money laundering activities, offering advanced technologies to detect and prevent illicit financial flows.

U.S. Market Demonstrates Steady Growth; China's Market Soars

The United States holds a substantial share of the AML solutions market, valued at $904.9 million in 2022. On the other hand, China emerges as a rapidly growing market with a projected CAGR of 23.3% through 2030, indicating the country's dynamic response to money laundering threats and regulatory enforcement.

Other countries such as Japan and Canada are also contributing to the market growth with expected CAGRs of 11.1% and 14.7%, respectively, over the forecast period. Europe too sees a robust performance with Germany’s market anticipated to expand at a CAGR of approximately 12.8%. The global expanse of the AML solutions market speaks volumes about the universal urgency to maintain financial integrity and security.

Competitive Landscape and Future Innovations

The market report features a detailed analysis of 36 major players who are shaping the future of Anti-Money Laundering Solutions. This competitive landscape highlights the diverse range of innovative products and services that these companies bring to the table, carving out their unique presence in this vital sector.

What’s Driving the AML Solutions Market?

Regulatory Compliance: Tightened regulations around the globe are compelling financial institutions to adopt sophisticated AML solutions.

Technological Advancements: Cutting-edge technologies such as machine learning and artificial intelligence are enhancing the effectiveness of AML tools.

Financial Crime Complexity: The increasing sophistication of money laundering techniques necessitates more robust AML frameworks.

This in-depth report shines a light on current geopolitical events such as the Russia-Ukraine conflict, global trade tensions, and the economic impacts of the pandemic recovery, all of which influence the AML solutions market dynamics. The insights provided in this comprehensive analysis are pivotal for financial institutions, technology providers, and policy-makers in formulating strategies to mitigate money laundering risks.

Key Attributes:

Report Attribute | Details |

No. of Pages | 92 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $3.3 Billion |

Forecasted Market Value (USD) by 2030 | $11.9 Billion |

Compound Annual Growth Rate | 17.4% |

Regions Covered | Global |

A selection of companies mentioned in this report includes

ACI Worldwide

Acuant

Alessa, Inc.

BAE Systems

Comarch SA

Complyadvantage

Dixtior

Experian

FeatureSpace

Feedzai

FICO

Finacus Solutions

FIS

Fiserv

LexisNexis Risk Solution

Napier

Nelito Systems

Nice Actimize

Oracle Corporation

Quantaverse

SAS Institute

TCS

Temenos

TransUnion

Wolter's Kluwer

Workfusion

For more information about this report visit https://www.researchandmarkets.com/r/jspvbq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance