Global Carbon Credit Trading Platform Market Report 2023: Featuring Nasdaq, European Energy Exchange, Xpansiv Data Systems, CME Group and More

Global Carbon Credit Trading Platform Market

Dublin, May 05, 2023 (GLOBE NEWSWIRE) -- The "Global Carbon Credit Trading Platform Market Size and Share Analysis by Type, System Type, End-use - Industry Demand Forecast to 2030" report has been added to ResearchAndMarkets.com's offering.

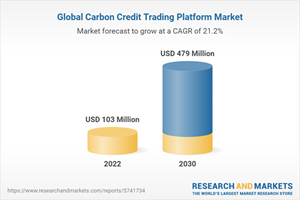

The worth of the carbon credit trading platform market was USD 103 million in 2022, which is predicted to touch USD 479 million by 2030, powering at a CAGR of 21.20% in the years to come, as stated by the report.

Cap-and-Trade System is Extensively Accepted

Cap-and-trade was the larger category in the past. It is a system establishing a limit on the maximum volume of permissible emissions, for reducing the collective emissions from a group of entities.

Furthermore, it is a market-based approach for lowering the total emissions and promoting corporate investments in alternative sources of electricity and energy efficiency measures.

Moreover, numerous UN members have accepted the cap-and-trade system under the Kyoto Protocol for the reduction of GHG emissions.

For decreasing the concentration of the pollutants responsible for the depletion of the ozone layer, the Montreal Protocol has also formulated a cap-and-trade system, as has the EU.

Utilities Sector Accounts for 30% of Carbon Credit Sales

The utilities category dominates the industry with a share of about 30%. This is because power corporations are concentrating on innovative methods for reducing carbon emissions, such as smart electrical grids.

Fossil fuels are burned for producing most of the heat and powering the majority of the steam turbines, thus resulting in CO2 emissions. As a result, the power sector is responsible for about 40% of all the emissions worldwide.

Moreover, the voluntary type was the larger, with an over 60% share, in the past. This can be attributed to the increasing focus of corporations on their CSR, which is why many are taking steps to reduce their emissions.

Voluntary Carbon Credit Purchases Are Favored

A market supporting businesses' efforts of reducing their emissions is evolving, as big corporates make commitments for reducing emissions. This is the voluntary carbon credits market. The use of voluntary carbon credits has helped direct private funding toward climate change mitigation projects that would have failed to commence otherwise.

Sold Carbon Credits Have Second-Highest Worth in APAC

Europe dominated the industry, with a 32% share, in the recent past. The EU Emissions Trading System is the mainstay of the EU's strategy for climate change mitigation and for decreasing the emissions of greenhouse gases in a cost-effective and efficient manner. Moreover, Europe was the first substantial carbon market globally and also the largest.

Moreover, APAC follows Europe because of the pledges made by the regional countries at the COP26 to achieve their net-zero targets. On its efforts of achieving this target by 2050, Singapore aims at increasing its carbon purchase rates in 2024.

Key Attributes:

Report Attribute | Details |

No. of Pages | 150 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $103 Million |

Forecasted Market Value (USD) by 2030 | $479 Million |

Compound Annual Growth Rate | 21.2% |

Regions Covered | Global |

Key Topics Covered:

Chapter 1. Research Scope

Chapter 2. Research Methodology

Chapter 3. Executive Summary

Chapter 4. Voice of Industry Experts/KOLs

Chapter 5. Market Indicators

Chapter 6. Industry Outlook

Chapter 7. Global Market

Chapter 8. North America Market

Chapter 9. Europe Market

Chapter 10. APAC Market

Chapter 11. LATAM Market

Chapter 12. MEA Market

Chapter 13. Competitive Landscape

Chapter 14. Company Profiles

Chapter 15. Appendix

Companies Mentioned

Nasdaq Inc.

European Energy Exchange AG

Carbon Trade Exchange

Xpansiv Data Systems Inc.

CME Group Inc.

Climate Impact X

Carbonplace

Likvidi Technologies Ltd.

BetaCarbon Pty Ltd.

Carbonex Ltd.

Intercontinental Exchange Inc.

AirCarbon Pte Ltd.

Planetly

Toucan

For more information about this report visit https://www.researchandmarkets.com/r/cz13z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance