Global Dental Implants and Prosthetics Market 2024-2029: High Investment Activity in Dental Practices in US and UK

Global Dental Implants and Prosthetics Market

Dublin, March 14, 2024 (GLOBE NEWSWIRE) -- The "Global Dental Implants and Prosthetics Market by product (Dental Implants Market, Dental Prosthetics Market), Dental Implants Market (Material, Design, Type, Price and Type of Facility), Dental Prosthetics Market, Region- Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

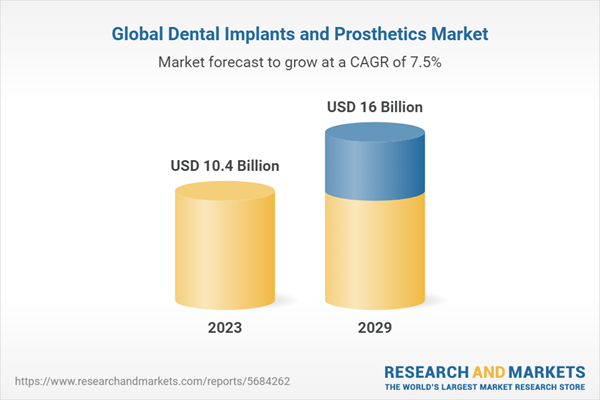

The global dental implants and prosthetics market is projected to reach USD 16 billion by 2029 from USD 10.4 billion in 2023, at a CAGR of 7.5% from 2023 to 2029. The factors driving the growth of the global dental implants and prosthetics market include the upsurge in the demand of cosmetic dentistry and increasing prevalence of tooth disorders will help the global dental implants and prosthetics market to generate great revenue in the forecasted period. Nonetheless, during the anticipated period, factors such as limited insurance coverage for dental treatments and increasing healthcare facility expenses will probably constrain market expansion to some degree.

The two stage procedure segment is expected to grow with the highest CAGR in titanium implants by procedure segment of the dental implants market

Due to a rise in number of titanium based procedures, the two stage procedure segment is expected to grow at the highest CAGR in the dental implants market. In two stage procedure, The two-stage approach allows for better bone integration and healing around the implant before the permanent crown is placed. This is because the implant has more time to bond with the jawbone without the pressure of the crown. This leads to greater stability and long-term success of the implant. The two-stage procedure allows for greater control over the final crown placement and appearance.

The external hexagonal connectors segment is expected to grow with the highest CAGR in the titanium implants by connectors segment of the dental implants market

The hexagonal design creates a secure and interlocking connection between the implant body and the prosthetic restoration, minimizing the risk of loosening or micromotion. Titanium's inherent biocompatibility and strength further contribute to a stable and durable connection that can withstand long-term chewing forces. The hexagonal shape provides good grip and control for the dentist during the prosthetic connection process.

Based on the price type, the premium implants segment is expected to grow by the highest CAGR in the dental implants market

Premium materials: Often made from high-grade titanium or zirconia with enhanced surface treatments, providing superior strength and resistance to corrosion and wear. Premium materials like zirconia closely resemble natural teeth in color and translucency, creating a more aesthetically pleasing result also the advanced manufacturing techniques ensure a seamless integration with the surrounding teeth, restoring natural chewing function and speech.

Based on the dental bridges by type, 1 unit bridges segment is expected to grow with the highest CAGR in the dental prosthetics market

Unlike traditional bridges, which require preparing adjacent teeth for crowns, one-unit bridges typically only require minimal shaping of the adjacent tooth to accommodate the bridge's wing. This preserves more natural tooth structure. By minimizing the need to prepare additional teeth, one-unit bridges help prevent bone loss around the missing tooth. This can be beneficial for long-term oral health and future treatment options.

Based on the dental bridges and crown by material, the porcelain-fused-to-metal segment is expected to grow with the highest CAGR in the dental prosthetics market

The metal substructure provides exceptional strength, making PFM crowns ideal for high-stress areas like molars. They can withstand strong chewing forces and resist chipping or cracking better than some other materials. PFM crowns can be used for single teeth, bridges, or even full-mouth restorations. Their versatility makes them a suitable option for a wide range of dental needs which is driving the growth of the market.

Asia-Pacific to grow with the highest CAGR in the dental implants and prosthetics market during the forecast period

The dental implants and prosthetics market in Asia Pacific is expected to grow at the highest CAGR due to an array of factors that highlight the region's changing healthcare landscape. Dental implants and prosthetics are becoming more and more popular due to the rising incidence of dental infections and rising knowledge of non-invasive medication delivery techniques. The huge and aging population in the area is a major factor in the rising cost of healthcare, which in turn is driving up demand for accessible and patient-friendly treatment choices. The dental implants and prosthetics market in Asia Pacific is also expected to rise as a result of breakthroughs in pharmaceutical research and development, rising disposable incomes, and improved healthcare infrastructure.

Research Coverage

The market study covers the dental implants and prosthetics market across various segments. It aims to estimate the market size and the growth potential of this market across different segments by product, dental implants market, dental prosthetics market and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Premium Insights

Rising Incidence of Dental Diseases to Drive Market

Dental Implants Segment Accounted for Largest Share of Asia-Pacific Market in 2022

China and India to Register Highest Growth During Forecast Period

North America Will Continue to Dominate Dental Implants and Prosthetics Market During Forecast Period

Developing Markets to Register Higher Growth During Forecast Period

Market Dynamics

Drivers

Increasing Patient Pool for Dental Treatments

Rising Prevalence of Dental Caries and Other Dental Disorders

Rising Geriatric Population and Edentulism

Periodontal Diseases

Changing Lifestyles and Unhealthy Food Habits

Rising Demand for Advanced Cosmetic Dental Procedures

Increasing Demand for Same-Day Dentistry

Growing Consumer Awareness and Rising Focus on Aesthetics

Restraints

High Cost of Dental Implants and Limited Reimbursement

Greater Risk of Tooth Loss Associated with Dental Bridges

Opportunities

Potential for Growth in Emerging Countries

Consolidation of Dental Practices and Rising DSO Activity

Challenges

Dearth of Trained Dental Practitioners

Pricing Pressure Faced by Prominent Market Players

Industry Trends

Increasing Market Consolidation

Rising Number of Industry-Academia Collaborations

High Investment Activity in Dental Practices in US and UK

Key Attributes

Report Attribute | Details |

No. of Pages | 384 |

Forecast Period | 2023-2029 |

Estimated Market Value (USD) in 2023 | $10.4 Billion |

Forecasted Market Value (USD) by 2029 | $16 Billion |

Compound Annual Growth Rate | 7.5% |

Regions Covered | Global |

Companies Profiled

Institut Straumann AG

Envista Holdings Corporation

Dentsply Sirona Inc.

Henry Schein, Inc.

Osstem Implant Co. Ltd.

3M Company

Zimvie Inc.

Mitsui Chemicals, Inc.

Coltene Group

Kuraray Co. Ltd.

Ivoclar Vivadent AG

Avinent Implant System

Bicon, LLC

Adin Dental Implant Systems Ltd.

Dio Corporation

Thommen Medical AG

Southern Implants

Keystone Dental

Bego GmbH & Co. KG

Ultradent Products Inc.

SDI Dental Implants

Advin Healthcare

Shofu Inc.

Bioline Dental Implants

Dentaurum GmbH & Co. KG.

For more information about this report visit https://www.researchandmarkets.com/r/i67q1i

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance