Global Endoscopes Market Report 2022: Advancement in Endoscopic Technology and Rapid Increase of Its Application to Diagnose and Treat Various Diseases Presents Avenues For Further Growth

Global Endoscopes Market

Dublin, Aug. 15, 2022 (GLOBE NEWSWIRE) -- The "Endoscopes Market Size, Share & Trends Analysis Report by Application (GI Endoscopy, Urology Endoscopy), by Product (Disposable, Flexible, Rigid), by End Use (ASCs/Clinics, Hospitals), by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

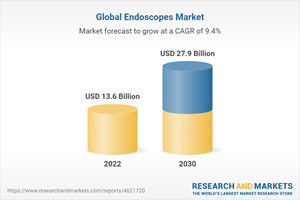

The global endoscopes market size is expected to reach USD 27.9 billion by 2030. It is expected to expand at a CAGR of 9.4% from 2022 to 2030. Growing awareness levels about minimally invasive surgical procedures and the increasing prevalence of chronic disorders are the major factors accelerating the market growth.

The benefits, such as less surgery-related blood loss, no muscle cutting, quicker recovery, offered by minimally invasive surgeries boost the adoption of endoscopic procedures over traditional/open invasive surgeries. In addition, advancement in endoscopic technology and rapid increase of its application to diagnose and treat various diseases are other key factors anticipated to propel the market growth over the forecast years. The flexible endoscopes product segment dominated the market in 2021.

This is attributed to the high demand for these devices on account of their unique features, such as the ability to reach viscera and cavities, better safety and efficiency, and improved ergonomic features. These devices are most commonly used in several endoscopic procedures, such as esophagogast roduodenoscopy (OGD), bronchoscopy, sigmoidoscopy, laryngoscopy, pharyngoscopy, nasopharyngoscopy, rhinoscopy, and colonoscopy procedures, which supports the product demand and segment growth.

Based on application, in 2021, the Gastrointestinal (GI) endoscopy segment dominated the market owing to an increase in gastrointestinal disorders and a high preference for minimally invasive procedures. High volumes of GI endoscopic procedures and the availability of technologically advanced endoscopes to treat &diagnose functional gastrointestinal disorders are also driving the segment.

In 2021, the hospitals end-use segment dominated the market owing to favorable reimbursement policies and growing utilization of endoscopes in hospital systems. Furthermore, a larger number of endoscopic procedures is performed in hospital settings as compared to other healthcare systems, which boosts the segment growth.

In addition, North America accounted for the highest revenue share in 2021 owing to its better healthcare infrastructure, high preference for minimally invasive surgical procedures among individuals, and quick adoption of advanced technologies. The increasing burden of functional gastrointestinal disorders and cancer is anticipated to further propel market growth in this region. For instance, as per the data reported by the National Cancer Institute, in 2020, over 1.8 million new cancer cases were estimated to be diagnosed in the U.S.

The overall decrease in the number of surgical procedures during COVID-19, in turn, impacted the growth of the market. Furthermore, to reduce the COVID-19 transmission risk, endoscopy centers have postponed and canceled the semi-urgent and elective cases, which affected the endoscopy procedure adoption in 2020.

In addition, supply chain interruptions due to constant lockdown and shutdown imposed by the governments of top countries all over the globe also hampered the market growth in 2020. For instance, a study published in the Arab Journal of Gastroenterology in 2020stated that the endoscopy procedures volume decreased about 50% due to the COVID-19 pandemic in the majority of countries.

Key Topics Covered:

Chapter 1 Research Methodology & Scope

Chapter 2 Executive Summary

Chapter 3 Global Endoscopes Market Variables, Trends, & Scope

Chapter 4 Endoscopes Market: Competitive Landscape Analysis

Chapter 5 Endoscopes Market: Product Estimates & Trend Analysis

Chapter 6 Endoscopes Market: Application Estimates & Trend Analysis

Chapter 7 Endoscopes Market: End-use Estimates & Trend Analysis

Chapter 8 Endoscopes Market: Regional Estimates & Trend Analysis, By Product, Application, and End Use

Chapter 9 Competitive Landscape

Companies Mentioned

Olympus Corporation

Ethicon US, LLC

Fujifilm Holdings Corporation

Boston Scientific Corporation

Karl Storz GmbH & Co. KG

Stryker

PENTAX Medical

CONMED Corporation

Richard Wolf Medical Instruments Corporation

Medtronic

For more information about this report visit https://www.researchandmarkets.com/r/g9w1js

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance