Global Food Robotics Market Report 2023: Increasing Digitalization in the Food and Beverage Industries Bolsters Growth

Global Food Robotics Market

Dublin, March 01, 2023 (GLOBE NEWSWIRE) -- The "Global Food Robotics Market Size, Share & Industry Trends Analysis Report By Application, By Payload, By Type, By Regional Outlook and Forecast, 2022-2028" report has been added to ResearchAndMarkets.com's offering.

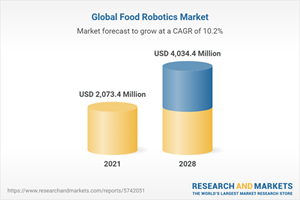

The Global Food Robotics Market size is expected to reach $4 billion by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Food robotics are referred to as robots employed in the food and beverage business to carry out intricate tasks like picking, packing, and palletizing. Robots from science fiction are already a reality owing to various technological developments. Furthermore, robots are becoming a crucial component of many sectors due to the rise in demand for increased productivity and the introduction of robots to job or task automation.

Automation and robotics play a significant role in the solution. The food manufacturing business has been particularly sluggish in incorporating robotics compared to other industries. Robotics, however, has begun to penetrate practically every stage of the food supply chain in the past few years, from the farm to the kitchen. Seedling planting, identification, and sorting are examples of robotic applications.

Additionally, self-driving tractors are also present nowadays along with robots for harvesting and weeding. Robotics are also being brought to the dairy, poultry, and cattle production sectors of non-plant agriculture. Applications include self-sufficient milking and feeding, egg gathering and sorting, and self-sufficient cleaning. Despite being originally developed to lift heavy metal components, modern technology can pick up delicate items like bread loaves, cheese, and fruits without causing any harm.

Manufacturers of food are now able to keep an eye on products as well as consumer demand, then use data analysis to tailor the output to this need. Robotics and the creation of AI software enable this. Companies can better monitor food quality and safety when they are better equipped to assess crucial processes like shipping, processing, and storage, as well as whether food is accidentally contaminated, where that food was shipped, and where that food was acquired from. Several large food service companies have recently invested in robots and artificial intelligence.

Market Growth Factors

Demand for packaged foods is increasing

The need for ready-to-cook and ready-to-eat foods has increased in recent years, necessitating the packaging of food goods to extend their shelf life and meet consumer demand. The mass production of packaged food goods has pushed the market for food robotics, especially in nations such as the United States, Japan, France, and Italy. Most large-scale food manufacturing factories are automating their procedures to assure quality and consistency in the Stock Keeping Units (SKUs). Agriculture and food manufacturing tasks are more difficult to automate using robots, yet companies continue to implement them. As a result, the expansion of the packaged dairy products and baked goods industries is also driving the market for food robotics, as these products are mass-produced across regions.

Increasing digitalization in the food and beverage industries

Digitalization is the optimization of corporate operations by emerging digital technologies, such as IT/OT convergence, big data analytics, digital twin, 3D printing, artificial intelligence, and automation technologies. IoT and AI are assisting businesses in achieving high levels of food safety, enhancing food traceability, reducing food waste, and lowering food processing and packaging-related costs and risks. In recent years, digitalization has emerged as a crucial driver for automation, where artificial intelligence (AI) pushes operational productivity through enhancing workforce productivity. Hence, the growing adoption of digitalization across the F&B industry will propel the growth of the food robotics market in the coming years.

Application Outlook

Based on application, the food robotics market is divided into palletizing & processing, packaging, repackaging, pick & place, and others. In 2021, the palletizing & processing segment dominated the food robotics market with maximum revenue share. Robotic palletizing ensures quick and effective operations to increase throughput, improve quality, and improve working conditions for personnel. Robotics use grippers for either cases, bags, or crates and operate with people to increase production. They smoothly integrate into the current manufacturing line. Humans do not best perform numerous tasks involved in meat preparation.

Payload Outlook

On the basis of payload, the food robotics market is fragmented into low, medium and high. The low segment covered a remarkable revenue share in the food robotics market in 2021. Many of the available SCARA food robots fall under the low payload category as picking objects is considered a rather simplistic task. The expertise in food handling, pick-and-place, packaging & palletizing, sealing, labeling, and spraying, among many other things, is largely responsible for the segment's explosive expansion.

Type Outlook

By type, the food robotics market is segmented into articulated, cartesian, SCARA, cylindrical, collaborative and others. The SCARA segment generated the prominent revenue share in the food robotics market in 2021. A selective compliance articulated robot arm (SCARA) robot is intended for pick-and-place applications and has a relatively high speed and a high degree of precision. SCARA robots can easily and adaptably solve a number of automated assembling applications. Demand is rising with the expanding use of food robotics in this industry.

Regional Outlook

Region wise, the food robotics market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region held the highest revenue share in the food robotics market. The rapid expansion of the food robotics market in this region is ascribed to the population's shift toward prepared and packaged foods as a result of growing concerns about food safety and lifestyle. The region's desire for high-tech packaged foods and beverages has been spurred by the rise in consumer income. In Asia Pacific, China is well-known as the nation that sets the standard for food robot adoption.

Strategies deployed in Food Robotics Market

Partnerships, Collaborations and Agreements:

Jan-2022: Mitsubishi came into partnership with Cartken, a US-based developer of an outdoor delivery robot. The partnership involves jointly working to introduce Cartken's delivery robots to a Japanese mall. The partnership allows Mitsubishi to explore other applications of the technology and enables them to enter the Japanese autonomous delivery market

Apr-2021: Rockwell Automation partnered with Comau, an Italy-based provider of industrial automation and a manufacturer of robots. The partnership involves providing businesses globally with essential tools to boost efficiency in manufacturing processes. Moreover, the integration of Rockwell's expertise in food and beverage, life sciences, automated material handling, and Comau's competence in industrial and robotics automation benefits customers through improved value

Feb-2021: Epson Robots, part of Seiko Epson came into partnership with Heitek Automation, a distributor of automation products and solutions. The partnership agreement involves establishing Heitek as Epson's official distributor for robot automation solutions

Product Launches and Product Expansions:

Oct-2022: Yaskawa launched MOTOMAN-HC30PL, a collaborative robot. The new cobot features a 30 kg payload capacity, 1600 mm reach, easy connection with peripheral devices, secure design, increased safety, and is easy to operate

Mar-2022: FANUC launched CRX-5iA, CRX-20iA/L and CRX-25iA cobots. These new cobots are a part of the CRX series. The new products are developed to serve every type of manufacturer. Further, these robots perfectly fit and align with FANUC's already existing CR and CRX series

Geographical Expansions:

Aug-2022: YASKAWA India, part of Yaskawa Electric Corporation opened a new robotic solution facility in Haryana, India. The new facility focuses on advancing and promoting innovation, and further aims to develop and advance industrial robotic automation

Jul-2022: FANUC America expanded its Michigan facility to nearly two million square feet. This expansion of the facility allows FANUC to cater to the heavy demand for its automation solutions

Jul-2022: FANUC expanded its footprint by setting up a new 109,000-sq.-ft. a facility in Aguascalientes, Mexico which would also act as robotics and automation headquarters. This geographical expansion enables FANUC to better take care of the needs of its clients operating in the aerospace, consumer goods, and aerospace industry. Moreover, the expansion further reflects FANUC's devotion to supporting organizations in enhancing their production processes

Key Market Players

Mitsubishi Electric Corporation

ABB Group

Rockwell Automation, Inc

Kawasaki Heavy Industries, Ltd

Kuka AG (Midea Investment Holding Co., Ltd.)

FANUC Corporation

Yaskawa Electric Corporation

Seiko Epson Corporation

Teradyne, Inc. (Universal Robots A/S)

Denso Corporation

Report Attribute | Details |

No. of Pages | 239 |

Forecast Period | 2021 - 2028 |

Estimated Market Value (USD) in 2021 | $2073.4 Million |

Forecasted Market Value (USD) by 2028 | $4034.4 Million |

Compound Annual Growth Rate | 10.2% |

Regions Covered | Global |

Key Topics Covered:

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Food Robotics Market by Application

Chapter 5. Global Food Robotics Market by Payload

Chapter 6. Global Food Robotics Market by Type

Chapter 7. Global Food Robotics Market by Region

Chapter 8. Company Profiles

For more information about this report visit https://www.researchandmarkets.com/r/qt7mke-food?w=12

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance