Global Functional Food Ingredients Market Forecast to 2029 with Cargill, BASF, ADM, International Flavors & Fragrances, Arla Foods, Kerry, Ajinomoto, DSM, Ingredion, and Tate & Lyle Dominating

Global Functional Food Ingredients Market

Dublin, July 01, 2024 (GLOBE NEWSWIRE) -- The "Global Functional Food Ingredients Market by Type (Probiotics, Protein & Amino Acids, Phytochemicals & Plant Extracts, Prebiotics, Omega-3 Fatty Acids, Carotenoids, Vitamins), Application, Source, Form, Health Benefits and Region - Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

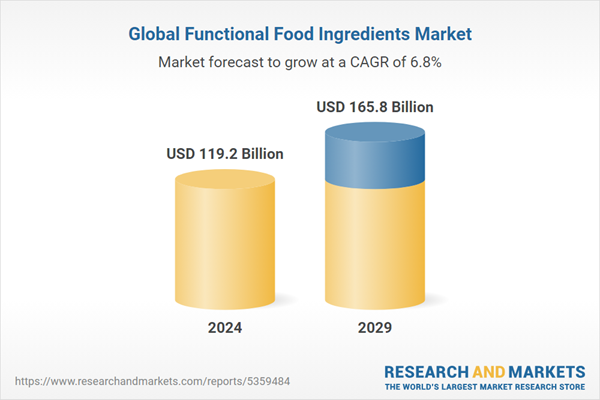

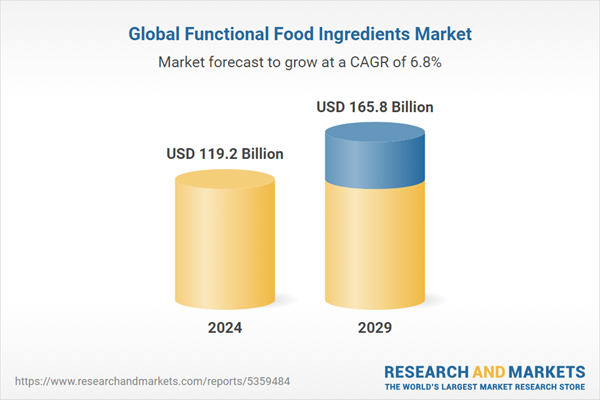

The global functional food ingredients market is estimated to be valued at USD 119.2 billion in 2024 and is projected to reach USD 165.8 billion by 2029, at a CAGR of 6.8%

The global demand for functional food ingredients has surged significantly in the post-pandemic era, driven by heightened awareness of health and wellness among consumers worldwide. For instance, the World Economic Forum highlights a shift where 62% of Americans believe their health is more important than before the pandemic, with a growing openness to adopting healthier lifestyles. [Source: World Economic Forum, 6 trends that define the future of health and wellness].

Moreover, a 2022 scientific review published by the National Institutes of Health in the journal Nutrition, Immunity, and COVID-19 found a significant rise in search engine queries related to immunity-boosting foods and supplements during and post-pandemic. Thus, the pandemic underscored the critical importance of immunity and overall well-being, prompting individuals to prioritize their health like never before. This shift in mindset has led to a significant willingness to invest in premium functional and fortified food and beverages known for their immune-boosting properties.

Moreover, consumers have become increasingly cognizant of the inadequacy of their daily diets in providing essential nutrients. This awareness has fueled a growing demand for functional food ingredients that offer targeted health benefits, such as vitamins, minerals, and antioxidants. As a result, there is a heightened interest in products fortified with these ingredients to fill nutritional gaps effectively.

Furthermore, the growing interest in preventive healthcare has fueled the demand for functional foods that not only satisfy hunger but also deliver added health benefits. Manufacturers are responding to this demand by innovating and introducing a wide array of functional food and beverages fortified with functional food ingredients tailored to meet diverse consumer needs.

Prominent companies include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), International Flavors & Fragrances Inc. (US), Arla Foods amba (Denmark), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), DSM (Netherlands), Ingredion (US), and Tate & Lyle (UK) among others.

During the forecast period, the natural functional food ingredients within the source segment are estimated to dominate the functional food ingredients market

Natural functional food ingredients, sourced from diverse origins such as plant-based, animal-based, mineral, microbial, fermentation, and dairy-derived ingredients, are poised to dominate the functional food ingredients market. Consumer preference for natural ingredients continues to surge, driven by a growing awareness of health and wellness.

Natural sources are perceived as safer and healthier alternatives to synthetic counterparts, aligning with the transparent sourcing and the clean label trend. With consumers increasingly scrutinizing ingredient lists, manufacturers are compelled to utilize natural sources to meet demand and maintain market competitiveness.

Natural functional food ingredients offer inherent nutritional benefits. Plant-based sources, for instance, provide essential vitamins, minerals, and fiber, contributing to overall health and well-being. Similarly, dairy-derived ingredients boast high protein content and other micronutrients, appealing to health-conscious consumers. Moreover, natural sources often undergo minimal processing, preserving their nutritional integrity.

This authenticity resonates with consumers seeking wholesome, minimally processed foods. In contrast, synthetic functional food ingredients may raise concerns regarding safety and long-term health implications, deterring some consumers. Furthermore, the versatility of natural sources allows for innovation and formulation flexibility, catering to diverse dietary preferences and functional needs. Hybrid or blended sources, while offering certain advantages, may lack the perceived purity and authenticity associated with natural ingredients.

Prevalence of chronic diseases and presence of key industry players have positioned the US in North America region as the dominant market in the functional food ingredients market.

The US boasts a robust economy with a high level of consumer spending, providing ample opportunity for the growth of functional food products. Additionally, the presence of major players in the functional food ingredients market such as Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), and Ingredion (US) further strengthens the US position.

These companies have extensive resources, research capabilities, and distribution networks, allowing them to innovate and introduce new products efficiently. For instance, in August 2022, International Flavors & Fragrances Inc. (US) launched its newest initiative, the Nourish Innovation Lab, located within the company's Union Beach, New Jersey research and development (R&D) center. This facility functions as a vibrant center where scientists, flavorists, and designers collaborate alongside modern technologies, such as food harness tools, and deep ingredient expertise, providing customers with holistic product design solutions.

Moreover, the prevalence of chronic diseases in the US, as highlighted by the Centers for Disease Control, underscores the growing consumer demand for functional foods that offer additional health benefits. With six in ten Americans living with at least one chronic disease, there is an increased awareness of the importance of diet and nutrition in managing health conditions. This has led to an increased interest in functional food ingredients that address specific health concerns such as heart health, weight management, and digestive wellness.

Unlike other North American countries such as Canada and Mexico, the US market benefits from its sheer size and diversity, offering a larger consumer base and greater opportunities for product innovation and market penetration. Additionally, the US regulatory environment is conducive to the development and marketing of functional food ingredients, providing companies with a supportive framework for product development and commercialization.

The report provides insights on the following pointers:

Analysis of key drivers (Rise in incidences of chronic diseases), restraints (Higher cost for functional food products due to the inclusion of healthier or naturally sourced ingredients), opportunities (Adoption of new technologies in the functional food industry), and challenges (Complexities related to the integration and adulteration of functional food products) influencing the growth of the functional food ingredients market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the functional food ingredients market.

Market Development: Comprehensive information about lucrative markets - the report analyses the functional food ingredients market across varied regions.

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the functional food ingredients market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cargill, Incorporated (US), BASF SE (Germany), ADM (US), International Flavors & Fragrances Inc. (US), Arla Foods amba (Denmark), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), DSM (Netherlands), Ingredion (US), and Tate & Lyle (UK) among others in the functional food ingredients market strategies. The report also helps stakeholders understand the functional food ingredients market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Key Attributes:

Report Attribute | Details |

No. of Pages | 459 |

Forecast Period | 2024 - 2029 |

Estimated Market Value (USD) in 2024 | $119.2 Billion |

Forecasted Market Value (USD) by 2029 | $165.8 Billion |

Compound Annual Growth Rate | 6.8% |

Regions Covered | Global |

Companies Featured

Cargill, Incorporated

BASF SE

Adm

International Flavors & Fragrances Inc.

Arla Foods Amba

Kerry Group PLC

Ajinomoto Co. Inc.

DSM

Ingredion

Tate & Lyle

Teijin Limited

Chr. Hansen A/S

Glanbia PLC

Kemin Industries, Inc.

Beneo

Cosun

Roquette Freres

Soylent

A&B Ingredients, Inc.

Golden Grain Group Limited

Aminola

Stratum Nutrition

Foodchem International Corporation

For more information about this report visit https://www.researchandmarkets.com/r/w56wf

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance