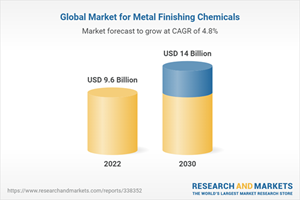

Global Metal Finishing Chemicals Strategic Markets Report 2023: Market to Reach $14 Billion by 2030 from $9.6 Billion in 2022 - Revival of Major End-Use Markets Will Spur Demand Recovery

Global Market for Metal Finishing Chemicals

Dublin, March 08, 2023 (GLOBE NEWSWIRE) -- The "Metal Finishing Chemicals: Global Strategic Business Report" report has been added to ResearchAndMarkets.com's offering.

Global Metal Finishing Chemicals Market to Reach $14 Billion by 2030

The global market for Metal Finishing Chemicals estimated at US$9.6 Billion in the year 2022, is projected to reach a revised size of US$14 Billion by 2030, growing at a CAGR of 4.8% over the analysis period 2022-2030.

Plating Chemicals, one of the segments analyzed in the report, is projected to record a 4.7% CAGR and reach US$5.3 Billion by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Cleaning Chemicals segment is readjusted to a revised 5.5% CAGR for the next 8-year period.

The U.S. Market is Estimated at $2.3 Billion, While China is Forecast to Grow at 7.4% CAGR

The Metal Finishing Chemicals market in the U.S. is estimated at US$2.3 Billion in the year 2022. China, the world's second largest economy, is forecast to reach a projected market size of US$2.4 Billion by the year 2030 trailing a CAGR of 7.4% over the analysis period 2022 to 2030.

Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.7% and 3% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 4.4% CAGR. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$1.6 Billion by the year 2030.

Looking Ahead to 2023

The global economy is at a critical crossroads with a number of interlocking challenges and crises running in parallel. The uncertainty around how Russia`s war on Ukraine will play out this year and the war`s role in creating global instability means that the trouble on the inflation front is not over yet.

Lower capital expenditure is in the offing as companies go slow on investments, held back by inflation worries and weaker demand. With slower growth and high inflation, developed markets seem primed to enter into a recession. Fears of new COVID outbreaks and China's already uncertain post-pandemic path poses a real risk of the world experiencing more acute supply chain pain and manufacturing disruptions this year.

Volatile financial markets, growing trade tensions, stricter regulatory environment and pressure to mainstream climate change into economic decisions will compound the complexity of challenges faced. Year 2023 is expected to be tough year for most markets, investors and consumers. Nevertheless, there is always opportunity for businesses and their leaders who can chart a path forward with resilience and adaptability.

What`s New for 2023?

Special coverage on Russia-Ukraine war; global inflation; easing of zero-Covid policy in China and its `bumpy` reopening; supply chain disruptions, global trade tensions; and risk of recession.

Global competitiveness and key competitor percentage market shares

Market presence across multiple geographies - Strong/Active/Niche/Trivial

Online interactive peer-to-peer collaborative bespoke updates

Access to digital archives and Research Platform

Complimentary updates for one year

Key Attributes:

Report Attribute | Details |

No. of Pages | 660 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $9.6 Billion |

Forecasted Market Value (USD) by 2030 | $14 Billion |

Compound Annual Growth Rate | 4.8% |

Regions Covered | Global |

Key Topics Covered:

MARKET OVERVIEW

Influencer Market Insights

World Market Trajectories

Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2022 (E)

Surface Preparation: An Important Part of the Metal Products Manufacturing Process

Automotive End-Use Industry

Manufacturing & Machinery End-Use Industry

Semiconductor End-Use Industry

Electronics End-Use Industry

Aerospace Manufacturing End-Use Sector

How Will the Scenario in These End-Use Industries Pan Out for the Metalworking Industry Now & Going Forwards?

Metal Finishing Chemicals: Definition, Scope, Types & Applications

Recent Market Activity

Innovations

MARKET TRENDS & DRIVERS

Here's What to Expect in the Post COVID-19 Market

Revival of Major End-Use Markets Will Spur Demand Recovery for Metal Finishing Chemicals

Aerospace Manufacturing to Revive as Travel Restrictions Ease

Increased Manufacturing Activity & MRO Operations Will Spur Parallel Increase in Demand for Metal Finishing Chemicals

Automobile Production to Recover as Economy Rebounds

Electronics Production to Jump Post Pandemic, Thanks to Pandemic Induced Digitalization & Electronification

Environmental Concerns & Strict Anti-Pollution Laws Plague Future Growth Outlook

Electroplating Chemicals Bear the Brunt of Growing Environmental Concerns

Hexavalent Chrome Plating Buckles Under Environmental Pressures

Non-Chrome Passivation (NCP) Emerges as an Alternative to Hexavalent Chromium

Migration to Eco-Friendly Metal Finishing Chemicals Catches Fire as the Heat Turns Up on Inorganic Chemical Solutions

Bio-Based Industrial Metal Cleaning Chemicals Witness Encouraging Gains

Environmental Advantages Spur the Popularity of Powder Coatings

Automation Trends Emerge High Over Surface Finishing Processes. Here is What the Market is Experiencing

FOCUS ON SELECT PLAYERS (Total 139 Featured)

Advanced Chemical Company

Atotech Deutschland GmbH

Chemetall GmbH

Coral Chemical Company

DuPont de Nemours, Inc.

Element Solutions Inc.

MacDermid, Inc.

Elementis plc

Houghton International, Inc.

McGean-Rohco, Inc.

NOF Metal Coatings North America

PPG Industries, Inc.

Quaker Chemical Corporation

Solvay S.A.

For more information about this report visit https://www.researchandmarkets.com/r/2ya508

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance