Global Pet Care Market (2022 to 2030) - Size, Share & Trends Analysis Report

Global Pet Care Market

Dublin, June 03, 2022 (GLOBE NEWSWIRE) -- The "Pet Care Market Size, Share & Trends Analysis Report by Pet Types (Dog, Cat, Fish, Bird), by Type (Products, Services, Food), by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

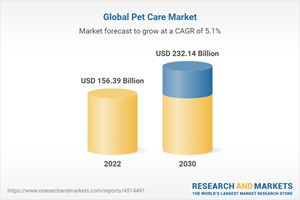

The global pet care market size is expected to reach USD 232.14 billion by 2030. The year 2020 was not very promising for most industries, but it has been a boon to the pet care industries due to repeated lockdowns and the work from home culture, which led people to take better care of their pets. This has stipulated the demand for pet services and products a significant rise in the market.

Moreover, the growing awareness about pet humanization, and increasing purchasing power of the consumers, coupled with a rise in the demand for premium pet care products, are driving the growth of the market. Due to urbanization people have been living in smaller residential spaces, this has, however, increased the adoption of smaller pets such as dogs, fish, hamsters, cats, and so on. Consumers are looking to plug the familial gap with their pet companion.

Premium pet care products are natural and of higher quality, and safer than regular pet care products. With the increase in demand for premium pet grooming products globally, several companies are trying to occupy the majority of shares in this segment. For instance, in 2020, BASF Care Creations in North America launched 3 formulations for the dog grooming segment: Creamy Co-Wash for Dogs, Fresh Obsessed Dry Shampoo Mist, and Micellar Dog Shampoo. Similarly, in 2021, Pure and Natural Pet, a U.S.-based pet care company added new USDA-certified products to their line of pet grooming and health essentials.

According to Pet Biz Marketer, pet food makes up about 3/4s of all pet industry sales. There has been a noticeable increase in the trend of pet food brands gaining market share via niche pet foods. One of the fastest-growing niche food categories is freeze-dried dog food, it is a dog food that's freeze-dried to extend shelf life. Petfoodindustry.com reports that sales for non-traditional pet food formats are growing faster than traditional pet food.

Pet Care Market Report Highlights

During the forecast period, the dog pet type segment is expected to account for the largest market share. The growth is attributed to an expected considerable rise in dog adoption in the future years as a result of changing lifestyles and growing knowledge of the benefits of dog companionship.

The pet care services segment is projected to register growth at a 5.2% CAGR during the forecast period. Innovation in products such as moisturizers, creams & lotions is likely to propel the segment growth.

North America contributed a majority of the revenue share of global revenue in 2021. During the forecast period, the rising demand for natural and premium goods is expected to drive the regional market growth.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Pet care market Variables, Trends & Scope

3.1. Market Introduction

3.2. Penetration & Growth Prospect Mapping

3.3. Impact of COVID-19 on the Pet Care Market

3.4. Industry Value Chain Analysis

3.4.1. Sales/Retail Channel Analysis

3.4.2. Profit Margin Analysis

3.5. Market Dynamics

3.5.1. Driver Impact Analysis

3.5.2. Restraint Impact Analysis

3.5.3. Industry Challenges

3.5.4. Industry opportunities

3.6. Business Environment Analysis

3.6.1. Industry Analysis-Porter's Five Forces

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.7. Roadmap of Pet Care market

3.8. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

4.1. Demographic Analysis

4.2. Consumer Trends and Preferences

4.3. Factors Affecting Buying Decision

4.4. Consumer Product Adoption

4.5. Observations & Recommendations

Chapter 5. Pet care market: Pet Type Estimates & Trend Analysis

5.1. Pet Type Movement Analysis & Market Share, 2022 & 2030

5.2. Dog

5.2.1. Market estimates and forecast for dog, 2017-2030 (USD Million)

5.3. Cat

5.3.1. Market estimates and forecast for cat, 2017-2030 (USD Million)

5.4. Fish

5.4.1. Market estimates and forecast for fish, 2017-2030 (USD Million)

5.5. Bird

5.5.1. Market estimates and forecast for bird, 2017-2030 (USD Million)

5.6. Others

5.6.1. Market estimates and forecast for others, 2017-2030 (USD Million)

Chapter 6. Pet care market: Type Estimates and Trend Analysis

6.1. Type Movement Analysis and Market Share, 2022 & 2030

6.2. Products

6.2.1. Market estimates and forecast by products, 2017-2030 (USD Million)

6.2.2. Pet Litter

6.2.2.1. Market estimates and forecast by pet litter, 2017-2030 (USD Million)

6.2.3. Pet Grooming Products

6.2.3.1. Market estimates and forecast by pet grooming products, 2017-2030 (USD Million)

6.2.4. Fashion, Toys and Accessories

6.2.4.1. Market estimates and forecast by fashion, toys and accessories, 2017-2030 (USD Million)

6.3. Services

6.3.1. Market estimates and forecast by services, 2017-2030 (USD Million)

6.3.2. Pet Boarding

6.3.2.1. Market estimates and forecast by pet boarding, 2017-2030 (USD Million)

6.3.3. Over-The-Counter/Supplies

6.3.3.1. Market estimates and forecast by over-the-counter/supplies, 2017-2030 (USD Million)

6.3.4. Pet Training

6.3.4.1. Market estimates and forecast by pet training, 2017-2030 (USD Million)

6.3.5. Veterinary Care/ Medical Care

6.3.5.1. Market estimates and forecast by veterinary care/ medical care, 2017-2030 (USD Million)

6.3.6. Pet Grooming Service

6.3.6.1. Market estimates and forecast by pet grooming service, 2017-2030 (USD Million)

6.4. Pet Food

6.4.1. Market estimates and forecast by pet food, 2017-2030 (USD Million)

6.4.2. Dry Food

6.4.2.1. Market estimates and forecast by dry food, 2017-2030 (USD Million)

6.4.3. Wet/ Canned Food

6.4.3.1. Market estimates and forecast by wet/canned food, 2017-2030 (USD Million)

6.4.4. Treats/snacks

6.4.4.1. Market estimates and forecast by treats/snacks, 2017-2030 (USD Million)

Chapter 7. Pet care market: Regional Estimates and Trend Analysis

Chapter 8. Competitive Analysis

8.1. Key global players, recent developments & their impact on the industry

8.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

8.3. Vendor Landscape

8.3.1. Key company market share analysis, 2021

Chapter 9. Company Profiles

9.1. Ancol Pet Products Limited

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Blue Buffalo Co., Ltd.

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Champion Petfoods LP

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. Hill`s Pet Nutrition, Inc.

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Mars, Incorporated

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Nestle Purina PetCare

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Petmate Holdings Co.

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. Saturn Petcare GmbH

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Tail Blazers

9.9.1. Company Overview

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. The Hartz Mountain Corporation

9.10.1. Company Overview

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

For more information about this report visit https://www.researchandmarkets.com/r/qqfdsd

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance