Global Welding Machinery Strategic Business Report 2023: Use of Collaborative Welding Systems and Adaptative Controls on the Rise

Global Market for Welding Machinery

Dublin, March 02, 2023 (GLOBE NEWSWIRE) -- The "Welding Machinery: Global Strategic Business Report" report has been added to ResearchAndMarkets.com's offering.

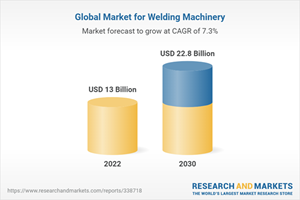

The global market for Welding Machinery estimated at US$13 Billion in the year 2022, is projected to reach a revised size of US$22.8 Billion by 2030, growing at a CAGR of 7.3% over the analysis period 2022-2030.

Arc Welding, one of the segments analyzed in the report, is projected to record a 8.3% CAGR and reach US$9.1 Billion by the end of the analysis period.

Taking into account the ongoing post pandemic recovery, growth in the Oxy-Fuel Welding segment is readjusted to a revised 6.5% CAGR for the next 8-year period.

The U.S. Market is Estimated at $3.2 Billion, While China is Forecast to Grow at 9.6% CAGR

The Welding Machinery market in the U.S. is estimated at US$3.2 Billion in the year 2022. China, the world's second largest economy, is forecast to reach a projected market size of US$4.8 Billion by the year 2030 trailing a CAGR of 9.6% over the analysis period 2022 to 2030.

Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 4.9% and 6.2% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 5.8% CAGR. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$3.6 Billion by the year 2030.

Select Competitors (Total 382 Featured) -

ACRO Automation Systems, Inc.

Carl Cloos Schweisstechnik GmbH

Coherent, Inc.

Daihen Corporation

Denyo Co., Ltd.

ESAB

Fronius International GmbH

IDEAL-Werk

IGM Robotersysteme AG

Illinois Tool Works, Inc.

Hobart Brothers LLC

Miller Electric Mfg. LLC

Kemppi Oy

Kiefel GmbH

Kobe Steel, Ltd.

KUKA AG

Manufacturing Technology, Inc.

Panasonic Corporation

Sonics & Materials, Inc.

The Lincoln Electric Company

Tianjin Bridge Welding Materials Group Co., Ltd.

voestalpine Bohler Welding Group GmbH

What`s New for 2023?

Special coverage on Russia-Ukraine war; global inflation; easing of zero-Covid policy in China and its `bumpy` reopening; supply chain disruptions, global trade tensions; and risk of recession.

Global competitiveness and key competitor percentage market shares

Market presence across multiple geographies - Strong/Active/Niche/Trivial

Online interactive peer-to-peer collaborative bespoke updates

Access to digital archives and Research Platform

Complimentary updates for one year

Report Metrics:

Report Attribute | Details |

No. of Pages | 1144 |

Forecast Period | 2022 - 2030 |

Estimated Market Value (USD) in 2022 | $13 Billion |

Forecasted Market Value (USD) by 2030 | $22.8 Billion |

Compound Annual Growth Rate | 7.3% |

Regions Covered | Global |

Key Topics Covered:

I. METHODOLOGY

II. EXECUTIVE SUMMARY

1. MARKET OVERVIEW

The Race Between the Virus & Vaccines Intensifies. Amidst this Chaotic Battle, Where is the World Economy Headed?

Progress on Vaccinations: Why Should Businesses Care?

Welding Equipment Industry to Recuperate Losses after COVID-19 Setback

Competitive Scenario

Welding Machinery - Global Key Competitors Percentage Market Share in 2022 (E)

Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2022 (E)

An Introductory Prelude to Welding Machinery

Global Market Prospects & Outlook

Global Welding Machinery Market by End-Use Sector (2021E): Percentage Breakdown of Value Sales for Automotive, Building & Construction, Aerospace, Energy, Oil & Gas, Marine, and Other End-Uses

Growth Drivers

Select Product Segments: A Review

Developed Nations Make Way for Emerging Markets

Global Welding Machinery Market - Geographic Regions Ranked by % CAGR (Sales) for 2020-2027: China, Asia-Pacific, Latin America, Middle East, Africa, Canada, USA, Europe, and Japan

Developed Regions Remain the Primary Revenue Contributors for World Welding Machinery Market - Percentage Breakdown of Sales for Developed Regions & Developing Regions (2021 & 2027P)

Asian Markets: An Impregnable Turf for International Giants

Anticipated STable Economic Scenario to Extend Growth Opportunities

A Strong Yet Exceedingly Patchy & Uncertain Recovery Shaped by New Variants Comes Into Play: World Economic Growth Projections (Real GDP, Annual % Change) for 2020 through 2023

Welding Machinery: Product Overview

Welding Machinery Industry: A Categorization

Robotic Welding

Recent Market Activity

Select Global Brands

2. FOCUS ON SELECT PLAYERS

3. MARKET TRENDS & DRIVERS

Emerging Welding Technology Trends: Key Insights into 2022

Diverse Challenges Encountered by Welding Companies & Relevant Answers

Innovations Galore!

SpeedCore System Emerges to Replace Reinforced Concrete Core System, PAUT Offers Advantages

Select Latest Innovations

Laser Welding: A Fast Emerging Trend

Ample Room for Future Growth of Global Arc Welding Equipment Market

Use of Collaborative Welding Systems and Adaptative Controls on the Rise

Automated Welding Offers Significant Potential

Robotic Welding Systems Offer Various Benefits

Novarc Technologies' Collaborative Robot Powered by AI and Machine Vision Technologies to Improve Quality Consistency in Welding

Deployment of Robotic Welding Systems based on Advanced Technologies to Become Easier in the Future

John Deere in Association with Intel Develops a System with Machine Vison and Neural Network AI Algorithm for Improved Defect Detection

Solid Wires Replacing Stick Electrodes

Adhesives Reduce Need for Welding

User Friendly Equipment: Order of the Day

Rising Demand for Aluminum Welding Equipment

Measures to Overcome Issues with Aluminum Welding

Advances in TIG Welding Offer Growth Opportunities

FCAW Gains Acceptance

Hybrid Welding Technology to Drive Growth

Plastics Welding Sidelines Metal Welding

Maintenance & Repair Projects to Drive Demand

Increased Emphasis on Improving Welding Process

Favorable HSAW Pipes Market Signals Opportunities

Steel Production & Consumption: Key Indicators of Welding Market Dynamics

World Steel Consumption in Million Metric Tons: 2020-2027

Hit by COVID-19 Outbreak, Steel Industry & Demand Speedily Returning to Normalcy: The Current Scenario

Regional Recovery Scenario

Healthy Prospects for Steel Industry in Developing Countries

An Overview of End-Use Segments

Construction Sector Remains Prominent Consumer

World Construction Industry (in US$ Trillion) for the Years 2017, 2019 & 2022

Global Value of Megacity Construction Projects (US$ Billion) in 2019

Oil & Gas: Rise in Pipeline Projects Signals Growth Avenues for Welding Equipment

Global Capital Spending (in $ Billion) on Planned & Announced Oil & Gas Projects by Segment (2018-2025)

Pipeline Investments to Soar Post-Pandemic

Number of Crude Oil Pipeline Worldwide by Project Status: 2020

Number of Natural Gas Pipeline Worldwide by Project Status: 2020

Changing Energy Mix Set to Influence Market Prospects

Global Energy Demand & Growth (In Million Tonnes of Oil Equivalent (Mtoe)) for the Years 1990, 2000, 2010, 2020, 2030 and 2040

Global Primary Energy Consumption by Source (in %) for 2018 and 2040

Pipeline Operating Conditions Determine Welding Equipment Usage

Welded Line Pipe Makes Inroads

Pure Welds Achieved for Interiors of Crude Oil Pipes Using Oxygen Sensors

Power Generation

Global Electricity Generation in Billion kWh for the Years 2010, 2020, 2030, 2040 and 2050

China and India Lead the Global Rise in Demand for Electricity: Change in Gross Electricity Demand in TWh for 2017-50

Wind Energy

Nuclear Power Plants

Automotive Manufacturing

World Automobile Production in Million Units: 2008-2022

Railroad Industry

Heavy Fabrication

Shipbuilding

New Welding Technologies Seek Role in Shipbuilding Programs

ESAB's Welding Systems Equipped with WeldCloud

Orbital Welding Systems for Precision Welds for Semiconductor and Biopharmaceutical Industries

New Technology Improves Capabilities of Orbital Welding Systems for Improved Manufacturing

4. GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

IV. COMPETITION

For more information about this report visit https://www.researchandmarkets.com/r/phfwlv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance