Will going nuclear drive the Rolls-Royce share price even higher?

I’ve long believed that the Rolls-Royce (LSE:RR.) share price is expensive.

Analysts are forecasting earnings per share of 15.8p in 2024. This means the stock currently has a forward price-to-earnings ratio of 29. Compare this to, for example, RTX, the world’s largest aerospace and defence company. Its stock trades on a multiple of 20.

However, despite my misgivings, investors continue to prove me wrong and keep driving the share price higher.

Going nuclear

But there’s one new product line that I think could transform the fortunes of the engineering giant.

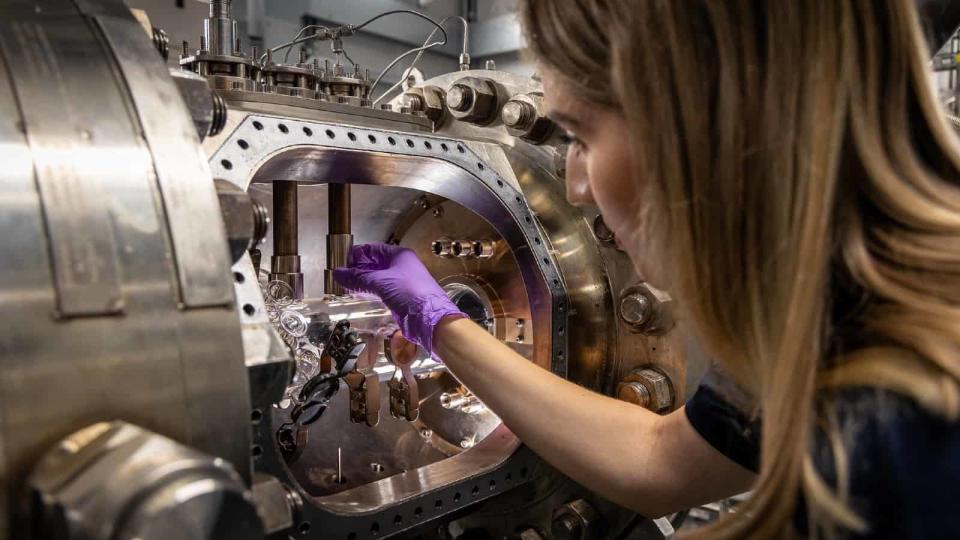

A small modular reactor (SMR) is a factory-made mini nuclear power station. Each one is expected to power 1m homes and occupy a site equivalent in size to two football pitches.

In 2023, the UK government published a plan outlining how it intends to have 24GW of nuclear power generation capacity by 2050.

Under the stewardship of Great British Nuclear, a competitive process was launched to select the best SMR technologies to help meet the government’s target.

Six companies — including Rolls-Royce SMR — have been invited to tender and must submit their bids before the end of June.

Size matters

As well as using SMRs, the government intends to build a large-scale nuclear power station, similar to the ones at Hinkley and Sizewell. But these have been plagued by construction delays and cost overruns.

Hinkley Point C is now believed to be the most expensive object on earth. When it’s finally completed, it’s likely to have cost £10.03m per MW of capacity.

Rolls-Royce plans to build its 470MW SMRs at a cost of £1.8bn each. That’s only £3.83m per MW. I’m sure the government will soon see sense and abandon its plans for another large power station and concentrate on smaller ones instead.

If I’m right, it means 51 plants will be needed to meet the 24GW target. And potentially £91.8bn of revenue for Rolls-Royce.

At a margin of (say) 20%, this could translate into an additional operating profit of £18.4bn.

This ignores the potential from export markets. And there will be recurring revenue from maintenance contracts.

To put these figures in perspective, analysts are expecting a group operating profit of £1.95bn in 2024.

Cautious optimism

But I’m not getting too carried away.

The first UK SMR isn’t expected to be operational until the mid-2030s. And their delivery will be spread across a decade or so.

Also, there’s no guarantee that Rolls-Royce will be successful with its bid. The government may also choose several suppliers.

In addition, not everyone is convinced that nuclear power is a clean source of energy as the waste remains highly dangerous for thousands of years. A new government could lead to a change in policy and a shift towards other methods of energy generation.

Although share prices are supposed to be forward-looking, I doubt many investors are buying the company’s shares today in anticipation of increased earnings in 10 years’ time. It’s therefore a little early to assess how this new technology might impact the Rolls-Royce share price.

The middle of the next decade is a long time to wait for the commercialisation of SMRs. But when the future does become clearer, I’m sure the technology’s potential will be factored in to the company’s share price.

The post Will going nuclear drive the Rolls-Royce share price even higher? appeared first on The Motley Fool UK.

More reading

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance