Gold Price Futures (GC) Technical Analysis – Strengthens Over $1637.00, Weakens Under $1631.80

Gold futures are trading marginally lower on Friday as traders await the release of the March U.S. non-farm payrolls report at 12:30 GMT. The numbers are expected to offer further cues on the economic impact of the coronavirus pandemic.

A stronger U.S. Dollar is also weighing on prices. The greenback is currently hovering close to a one-week high reached on Thursday, as investors worried about the prospect of a global recession.

At 08:18 GMT, June Comex gold futures are trading $1635.10, down $2.60 or -0.16%.

Look for heightened volatility after the release of the jobs report. We could be looking at a whip-saw trade. Really bad numbers won’t necessarily be bullish for gold prices either. A steep drop in the employment numbers could actually drive the selling pressure as demand for cash would likely heat up again.

Daily Technical Analysis

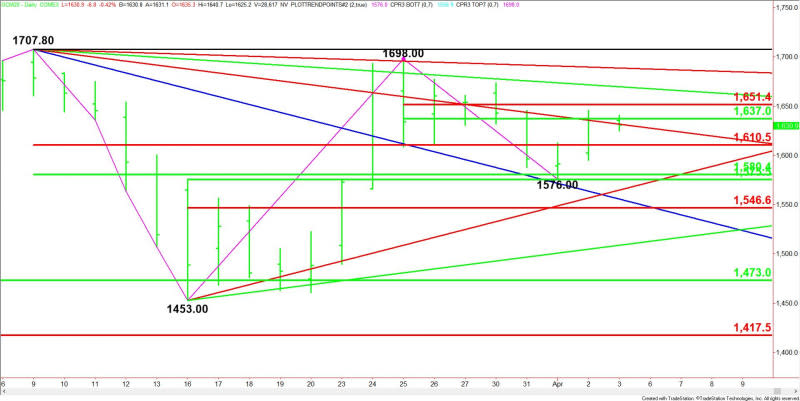

The main trend is down according to the daily swing chart. A trade through the two main tops at $1698.00 and $1707.80 will change the main trend to up. This could trigger an acceleration to the upside. A move through $1453.00 will signal a resumption of the downtrend.

The minor trend is also down, but a new minor bottom was formed at $1576.00. Taking out this level will indicate the selling pressure is getting stronger.

The main range is $1707.80 to $1453.00. Its retracement zone at $1610.50 to $1580.40 is potential support.

The intermediate range is $1453.00 to $1698.00. Its retracement zone at $1575.50 to $1546.60 is another potential support zone.

Combining the two retracement zones makes $1580.40 to $1575.50 a support cluster. This area stopped the selling at $1576.00 on Wednesday.

The short-term range is $1698.00 to $1576.00. Its retracement zone at $1637.00 to $1651.40 is the first upside target. This zone is currently being tested.

Daily Technical Forecast

Based on the early price action, the direction of the June Comex gold futures contract the rest of the session on Friday is likely to be determined by trader reaction to the short-term 50% level at $1637.00 and the downtrending Gann angle at $1631.80.

Bullish Scenario

A sustained move over $1637.00 will indicate the presence of buyers. The first upside target is $1641.40. Taking out this level could trigger an acceleration to the upside with potential target angles coming in at $1669.80 and $1688.80. The latter is the last potential resistance angle before the $1698.00 and $1707.80 main tops.

Bearish Scenario

A sustained move under $1631.80 will signal the presence of sellers. This could trigger a steep break into $1610.50. If this fails then look for the selling to possibly extend into $1580.40 – $1575.50.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance