Goldman Sachs: Brexit has cost the UK £600m a week since the vote

Britain has lost £600m of economic growth per week since the Brexit vote in 2016, according to Goldman Sachs.

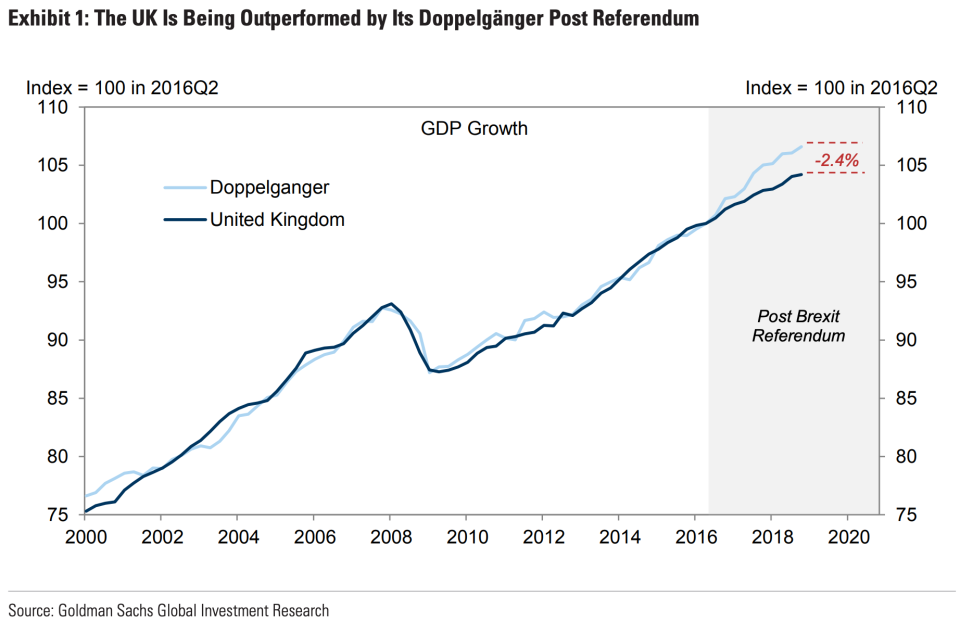

“Our estimates suggest that the UK economy has underperformed other advanced economies since mid-2016, losing nearly 2.5% of GDP relative to its pre-referendum growth path,” analysts at the investment bank wrote in a note to clients on Monday.

Goldman Sachs used economic modelling to predict how the UK economy would have grown had Britain not voted to leave in June 2016. The model suggests Brexit has cost the UK economy about £600m every week since the referendum.

Goldman said that the major cause of this lost economic output is a big decline in investment, as well as a fall in spending by individuals.

“We find evidence that Brexit uncertainty is a major driver of these output losses as they are concentrated in investment,” the team of analysts led by Sven Stehn wrote.

“Uncertainty shocks weighed on investment growth in the immediate aftermath of the Brexit vote, as well as more recently amid the renewed intensification of Brexit uncertainty.”

Goldman Sachs itself has put off investment in the UK as a result of the vote. CEO David Soloman said in January that UK headcount has been frozen since the vote and Brexit makes it “difficult” to invest. The bank employs about 6,000 people in Britain.

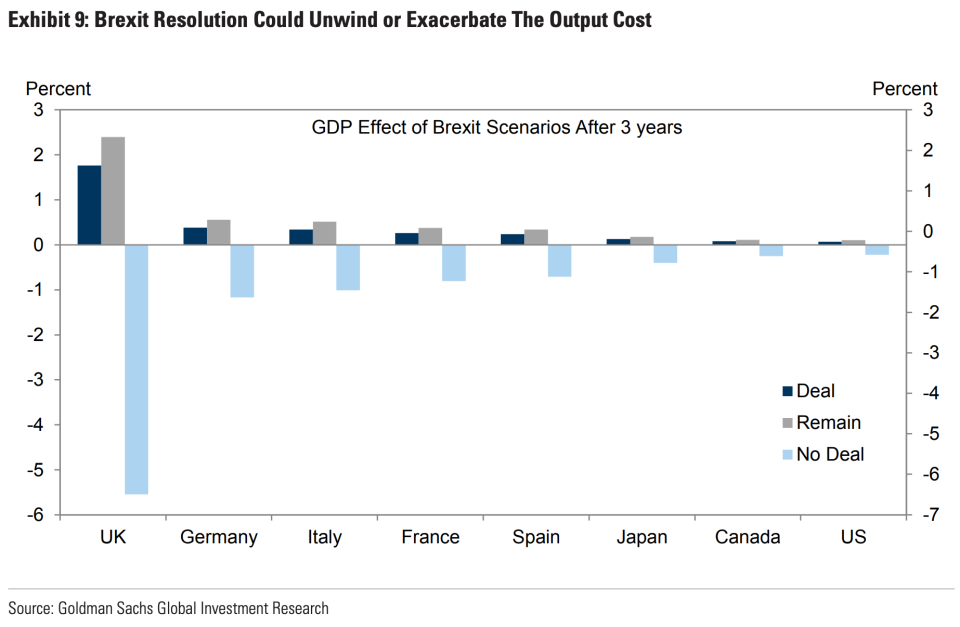

The economic shock of Brexit has not just been felt in Britain. Germany and France have suffered as a result of the lower UK growth due to close trading links, Stehn and his team wrote.

The Brexit vote also led to global fears about political and economic stability, sparking a sell-off in riskier assets like stocks that hit the economies of Italy and Spain.

However, the UK has suffered the biggest economic shock. Goldman’s modelling suggests Italy’s economy has suffered the biggest drag after the UK but it is still less than 1% of GDP.

If the UK remains in the EU, Goldman’s analysis suggests it could recover all the lost economic growth of the last three years. Similarly, if the UK exits the EU with a deal on trade it would “reverse part of the UK’s output underperformance.”

However, a no deal Brexit would cause significantly more economic damage and hit European neighbours.

“On the “no deal” scenario, UK GDP falls by 5.5%, with a 17% Sterling depreciation,” the bank wrote.

Goldman Sachs previously supported the Remain campaign, reportedly making a six figure donation to the campaign in the run up to the June 2016 vote. Former CEO Lloyd Blankfein also tweeted veiled support for a second referendum when he was still in charge of the bank in 2017.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

CBI: Labour’s re-nationalisation plans will cost £175bn and ‘do profound harm’ to pensioners

Hot fintech Ebury burns £19m on expansion as it eyes new investment

Debenhams shares jump 80% as Mike Ashley’s Sports Direct weighs £61m bid

‘Deep frustration and anger’ as business leaders tell MPs to compromise on Brexit

Yahoo Finance

Yahoo Finance