Google lags behind Amazon and Microsoft's cloud in one important area

(Thomson Reuters)

Google CEO Sundar Pichai

Google's cloud service may want to spent a lot more on hiring enterprise sales people if it wants to catch up to the competition.

According to a research note by Evercore's Ken Sena on Thursday, the number of sales job openings at Google Cloud Platform far lags behind its biggest competitors, including Amazon Web Services, Microsoft Azure, and Salesforce.

Currently, GCP has only 80 sales job openings, a small fraction compared to AWS, Azure, and Salesforce, all of which have over 300 open spots in sales. Based on Sena's own estimates, GCP's sales cost only accounts for 8% of its total operating expenses, a tiny portion compared to some of the larger enterprise players.

And although GCP ramped up its sales hires in recent months, nearly doubling to 50 sales reps in the West Coast alone, Sena notes that Google's investment seems more focused on the technical side than sales — potentially weakening its growth prospects in the enterprise space, which tend to rely heavily on sales people to sign large business customers.

“Google’s Cloud investment seems more focused on tools and infrastructure versus the sales headcount needed to help Google garner greater Cloud market share…as a result, we tend to view AWS’s business as being under less competitive threat than we did previously, which our new estimates better reflect," Sena wrote.

Unlike consumer products that could sometimes become major hits without much sales and marketing efforts, enterprise technology is still an area that's largely dictated by a strong sales culture. It's possible to penetrate small businesses and teams within large businesses without any sales people, but to sell to large businesses who drive the big bucks, a large sales team is essential.

AWS's recent $400 million deal with Salesforce, for example, wouldn't have happened without a large number of enterprise salespeople involved.

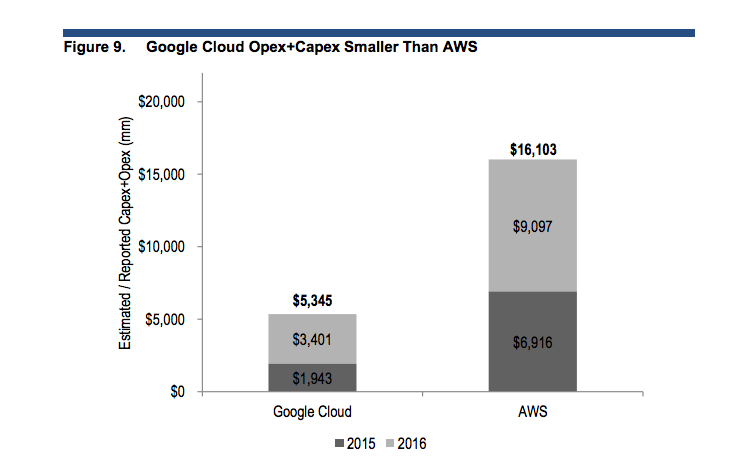

Sena's note argues GCP's level of investment — not just in sales, but across data centers and infrastructure — also falls behind competition. GCP's total expenses was $1.9 billion in 2015 and is expected to grow to $3.4 billion in 2016, a fraction of AWS's $6.9 billion in 2015 and $9.1 billion projected in 2016.

(Evercore)

Still, it's too early to count GCP out of the picture. Google CEO Sundar Pichai has stated that the company will invest "significantly" in GCP this year, and has brought in VMWare cofounder Diane Greene, who's one of the most powerful people in enterprise tech, to lead GCP last year.

Plus, as Sena noted, a lot of GCP's investments are flowing into improving its technical capabilities, giving it a niche advantage over other cloud providers. Its pricing is also more competitive than others, he notes.

In any case, all this leads to the conclusion that GCP won't be a major threat to the market leading AWS in the near future, Sena writes.

"In sum, while big-name customer additions (notably Snapchat, Spotify, and some of Apple’s business) and the hire of Diane Green have created some obvious reasons for concern from an AWS standpoint, our conclusion is that AWS is likely better situated than some may perceive," he writes.

More From Business Insider

Yahoo Finance

Yahoo Finance