Watchdog criticises Google over high-risk bond ads: 'We want to see significant progress'

Britain’s top financial watchdog has criticised Google (GOOG) for failing to stop savers being exposed to adverts for high-risk investments.

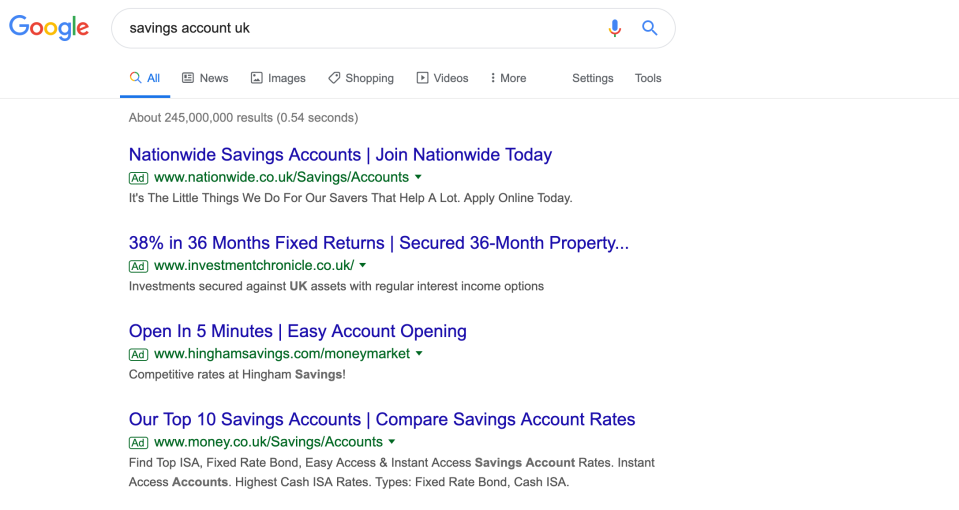

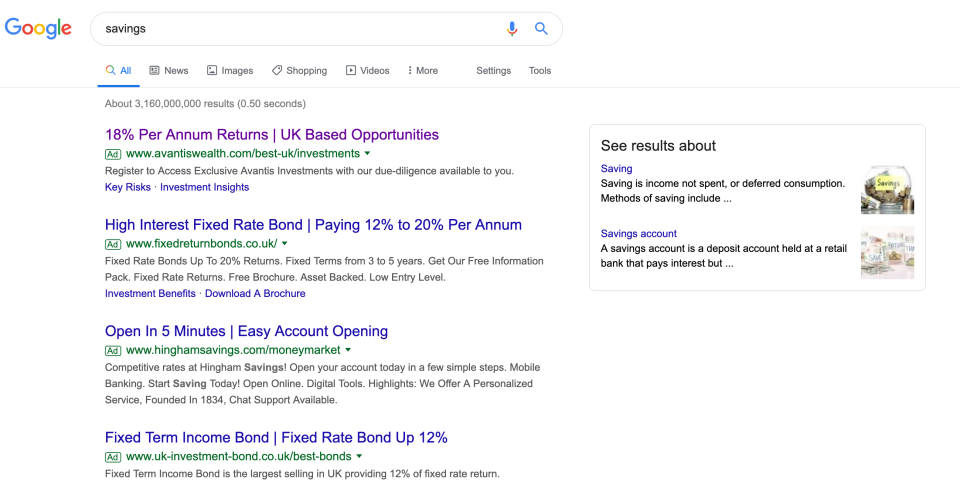

Searches for terms like “savings” and “high interest savings” on Google UK return adverts for mini-bonds, which are high-risk investment products.

Mini-bonds are highly controversial and have attracted scrutiny from regulators and politicians after a series of high profile failures left investors with losses of almost £1bn.

Google has said it is reviewing the mini-bond adverts flagged by Yahoo Finance UK but the adverts do not violate its terms as long as they disclose the risks involved. A spokesperson gave no indication that these rules will be amended.

Financial Conduct Authority (FCA) chief executive Andrew Bailey criticised the search engine’s failure to act.

“We have discussed the issues and particular instances with Google and Internet service providers,” Bailey told Yahoo Finance UK. “We do not consider that the responses so far have been adequate. We want to see significant progress.”

‘Duty of care’

Last week, Yahoo Finance UK reported that searches for terms like “high-interest savings” returned adverts for bonds.

Subsequent investigations have found that even searches for terms such as “savings account” and “savings” this week returned adverts for mini-bonds. In one case, Yahoo Finance UK saw a product being advertised that offered a 38% interest rate.

READ MORE: Savers targeted with ads on Google for 'bonds' that put all their money at risk

Mini-bonds are not the same as savings. They are high-risk investments that are not protected by the Financial Services Compensation Scheme. As a result, investors in mini-bonds risk losing all the money they put in.

Jason Hollands, a managing direct at wealth management and financial advice group Tilney, told Yahoo Finance UK that members of the public could be misled by the adverts.

“It does concern me that people will come across this stuff and not understand what they’re getting in to,” Hollands said.

Search engines like Google “have a duty of care to address this,” he said. “Great care needs to be taken to ensure these things are not inappropriately marketed.”

Google said on Thursday it was still reviewing the adverts highlighted and re-iterated the statement given to Yahoo Finance UK last week.

“Because we want ads people see on Google to be useful and relevant, we have advertising policies that describe which ads we don't allow on our platforms,” a spokesperson said. “If we find sites with ads breaking our policies, we take appropriate action.”

Losses reach almost £1bn

Losses related to collapsed mini-bond schemes have reached almost £1bn so far this year, according to BondReview.co.uk, a blog that covers the sector. High profile failures include London Capital & Finance, which collapsed in February owning £237m, and Store First, a storage company that raised over £200m in bonds.

The FCA has been criticised over its handling of the collapse of London Capital & Finance, with calls for Bailey to resign over the matter. An independent inquiry has been opened into the company’s collapse.

The Serious Fraud Office is investigating the collapse of London Capital & Finance and arrests have been made related to the case.

However, mini-bonds themselves are legal and the losses do not necessarily relate to any wrongdoing. Investors can still lose money even if the businesses they invest with are totally above board.

Guidance issued by FCA in May said mini-bonds were generally high risk and warned investors to be “very careful” when considering them.

However, Bailey went beyond this in his comments to Yahoo Finance UK, issuing one of his strongest warnings to date on the investments.

“We strongly urge people not to buy such products, or at least take independent advice first,” Bailey told Yahoo Finance UK.

“Typically, they are young and startup businesses, which in themselves carry a lot more risk,” Hollands said.

“There may be perfectly legitimate businesses who are raising money to grow their businesses and offer an attractive yield on it, but obviously, as an investor, you really need to go in with your eyes wide open and actually, have a level of understanding that is beyond most members of the public.

“You need to understand: how is this business going to use that money? Is that level of interest being dangled in front of me covered by the cash flow of that business or is that really a target? And are there any assets behind it?”

Hollands said Tilney would not recommend mini-bonds to any of its clients and the projects “should only be considered by people who are quite financially savvy and are prepared to do the homework.”

Mini-bond and corporate debt issuance more generally has exploded in size in the decade since the financial crisis. Investment companies focusing solely on debt have grown by 493% since 2009, the Association of Investment Companies (AIC) said earlier this week.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Savers targeted with ads on Google for 'bonds' that put all their money at risk

Male-dominated firms do worse than diverse rivals, Morgan Stanley finds

Yahoo Finance

Yahoo Finance