Savers targeted with ads on Google for 'bonds' that put all their money at risk

Brits searching for savings deals were being targeted with ads for products that could leave them open to unexpected losses, Yahoo Finance UK can reveal.

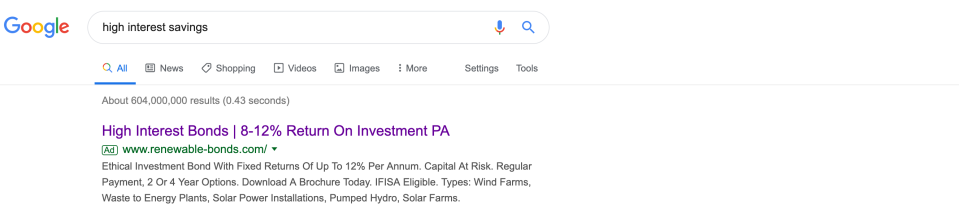

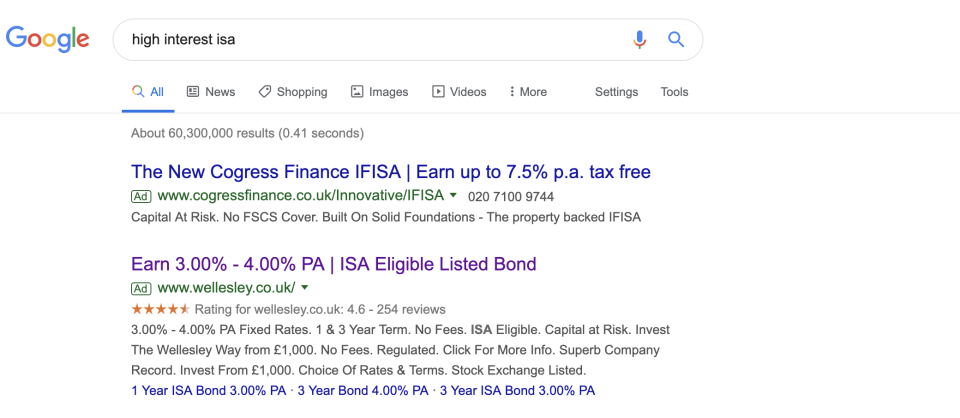

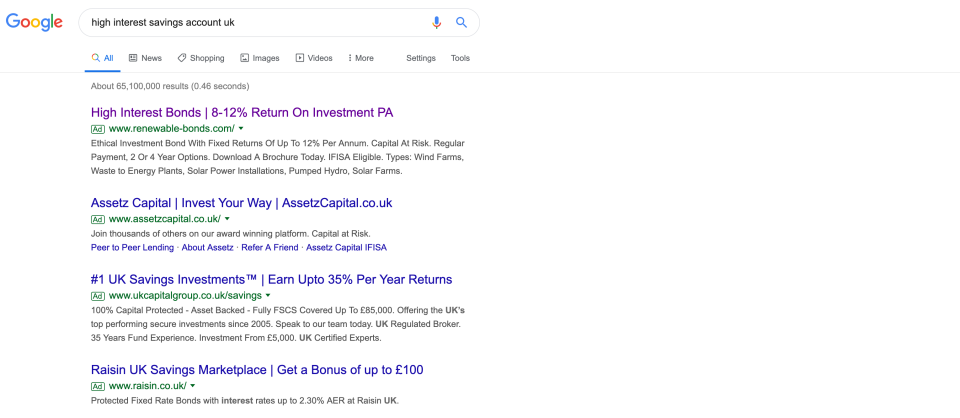

An investigation by Yahoo Finance UK found Google (GOOG) searches for terms like “high interest savings,” “high interest savings accounts,” and “high interest savings accounts uk” returned adverts for mini-bonds, a form of high-risk debt product.

Google said it was reviewing the adverts after Yahoo Finance UK approached the company for comment.

The prominent ads alongside savings results come despite the high-profile failure of London Capital & Finance. The company sold mini-bonds but falsely advertised its products as ISAs. It went bust owing investors £236m ($285m). The Serious Fraud Office is investigating.

Mini-bonds are loans made by retail investors to companies. The products are legal but unregulated. They are also investments, not savings, and are not protected by the Financial Services Compensation Scheme. Buyers of mini-bonds risk losing all the money they put in.

Guidance issued by the UK’s Financial Conduct Authority (FCA) in May said that mini-bonds were generally high risk and warned investors to be “very careful” when considering them.

Iona Bain, a personal finance journalist and consumer advocate, told Yahoo Finance UK she was “alarmed” that Google was still allowing mini-bond providers to advertise alongside savings accounts.

“It's disturbing that companies can hijack key phrases to appear at the top of search results for savings,” she said.

“Google needs to fundamentally reassess how it displays search results for financial products.”

Google said it was reviewing the ads and had taken down a number of them, although didn’t specify which ones.

A spokesperson said: “Because we want ads people see on Google to be useful and relevant, we have advertising policies that describe which ads we don't allow on our platforms. If we find sites with ads breaking our policies, we take appropriate action.”

‘Should be stopped’

Bain expressed concern that the average saver may not appreciate the difference in risk between a mini-bond and savings accounts when presented alongside each other.

“At a very basic level, most people don't fully understand the difference between deposit savings and investment products,” she told Yahoo Finance UK.

“But even knowledgeable people would be forgiven for being confused by the word "bond" which can also be found in the savings world.”

Amanda Cunningham, 50, from Lancashire lost £22,000 investing with London Capital and Finance.

“I wasn’t looking for a mini-bond,” she said. “I didn’t even know what a mini-bond was to be honest.

“With London Capital and Finance, the ISA I was looking at was lumped in with High Street banks and building societies, which are not risky.”

Cunningham told Yahoo Finance UK adverts for mini-bonds in savings searches “should be clamped down, it should be stopped.”

She also called for more prominent risk warnings on Google and on mini-bond websites.

“A lot of it’s not layman terms,” she sad. “It’s not in an understandable format how risky that particular thing is.”

‘Special consideration’

“At a basic level, companies that offer investment products should also be prevented from appearing in advertising for searches that contain the word ‘savings’,” Bain said.

“This market needs special consideration because a) the problem is clearly proving hard to manage and b) few products can be quite as destructive to people's lives as high-risk bonds masquerading as savings accounts.”

Asset Life, a mini-bond firm that raised almost £8m, recently went into administration, the Times reported this week, highlighting the risks in the sector.

The FCA has faced criticism for not doing enough to protect consumers from potentially inappropriate investments like mini-bonds.

The watchdog said in guidance issued in May: “If you consider yourself to be an unsophisticated investor, or unfamiliar with the kind of business the issuer is in, it would be wise to seek independent financial advice before making your decision.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at@OscarWGrut.

Read more:

Male-dominated firms do worse than diverse rivals, Morgan Stanley finds

Short seller denies Burford Capital claims of market manipulation: 'This is entirely normal'

Stockbroker boss questions 'sustainability' of rival challengers

Yahoo Finance

Yahoo Finance