Government borrowing in April higher than forecast in blow to Chancellor

Chancellor Jeremy Hunt has been dealt a blow after official figures revealed borrowing for April overshot forecasts, hitting £20.5 billion, in the fourth-highest April since records began in 1993.

The Office for National Statistics (ONS) estimated that public sector net borrowing was £1.5 billion more than in 2023, partly pushed up by falling national insurance contributions.

Britain’s official forecaster, the Office for Budget Responsibility (OBR), had estimated borrowing would come in at £19.3 billion for April.

It comes after borrowing of £11.9 billion in March, which was £4.7 billion less than a year ago, but higher than economists expected.

Economists watch borrowing figures closely to see how much fiscal space the Government has for measures such as tax cuts.

Mr Hunt has already indicated that he will seek to reduce national insurance again before the election “if we can afford to”.

The Chancellor has already cut 4p off national insurance contributions, costing around £20 billion.

Grant Fitzner, the chief economist at the ONS, said: “While central Government spending and income overall both rose on this time last year, a large drop in national insurance contributions meant receipts did not grow as fast as spending.

“Here, falls in expenditure on energy support were offset by increases in benefit spending from the annual uprating.

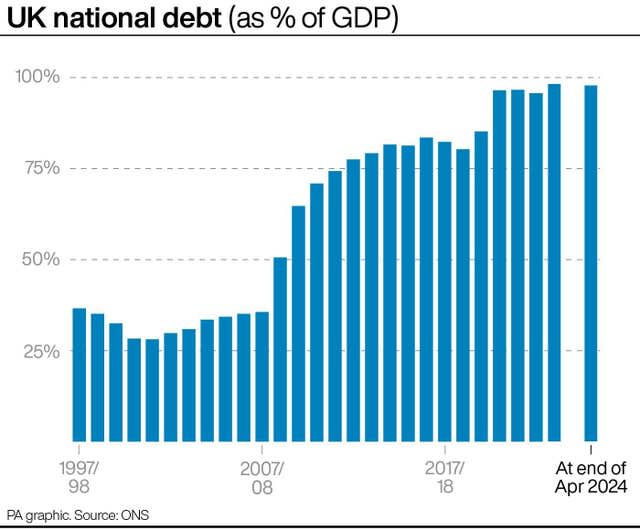

“Relative to the size of the economy, debt remains at levels last seen in the early 1960s.”

The borrowing overshoot was also partly down to higher debt payments, with the government having to pay £8.6 billion to service its debt in April. This was the highest amount for 10 months.

Overall, the figures show the UK’s overall national debt was £2.69 trillion in April, or 97.9% of gross domestic product (GDP), and 2.5 percentage points more than at the end of April 2023.

Grateful to 🇬🇧 UK Chancellor @Jeremy_Hunt for the warm welcome to London today. I thanked him for Parliament’s approval to increase UK’s IMF quota subscription and commended the UK authorities for staying the course to maintain macroeconomic and financial stability in the UK. pic.twitter.com/RfxI7gwQmG

— Kristalina Georgieva (@KGeorgieva) May 21, 2024

A spokesperson for the Treasury said: “We rightly protected millions of jobs during Covid and paid half of people’s energy bills after Putin’s invasion of Ukraine sent bills skyrocketing – but it wouldn’t be fair to leave future generations to pick up the tab.

“That’s why we must stick to the plan to get debt falling. The economy is turning a corner, with strong growth this quarter and inflation close to target, allowing us to cut taxes for the average worker by £900 a year.”

Peter Arnold, UK chief economist at consulting giant EY, said the figures indicated that the Government would have little room for tax cuts before the next election.

“The overshoot against the OBR’s forecast reflected both softer growth in tax revenues and higher spending,” he said.

“The EY ITEM Club thinks this underperformance will continue through the rest of the financial year, given that gilt yields and Bank Rate are set to be higher than the assumptions used in the OBR’s March forecast, implying higher-than-expected debt servicing costs.

“Some of this impact looks likely to endure to the end of the OBR’s five-year forecast horizon, cutting the already-slim headroom against the government’s main fiscal rule.

“The annual roll forward of the forecast horizon would be supportive of the fiscal arithmetic, but equally there’s always the risk that at some point the OBR will revisit its optimistic growth forecasts.

“Therefore, the scope for another tax-cutting fiscal event before the election looks limited, unless the Chancellor opts to make further changes and asks the OBR to assume even greater spending restraint.”

Public sector net borrowing excluding public sector banks was £20.5 billion in April 2024, the fourth highest April borrowing since monthly records began in 1993.

Read more➡️ https://t.co/MeQW2gu0ot pic.twitter.com/VnJLaTMxrP

— Office for National Statistics (ONS) (@ONS) May 22, 2024

The borrowing figures come after the International Monetary Fund (IMF) warned the Government over the UK’s public finances.

In its health check on the economy, the body said the Government has to find an extra £30 billion to balance its debt burden.

It said: “Difficult choices will need to be made over the medium term to stabilise public debt, given significant pressures on public services and critical investment needs.”

The Washington-based body also criticised Mr Hunt’s policy of reducing national insurance and said the Government should not cut taxes again in the run-up to an election.

Yahoo Finance

Yahoo Finance