Government puts £10 billion behind state guarantees on trade credit insurance

The Government today said it would be putting up £10 billion of taxpayers' money to guarantee UK companies' trade deals are paid for during the covid-19 crisis.

Treasury officials have agreed to support the private sector's trade credit insurance system, under which insurance companies guarantee businesses will be paid if the firm they are transacting with defaults or goes bust before paying.

Insurers availing themselves of the scheme will not be allowed to make profits or pay dividends from credit insurance which uses the state backstop scheme and are banned from paying bonuses to senior staff.

The trade credit insurance move will add comfort to thousands of UK companies who have struggled to retain cover from private insurers due to the high risk of defaults in the current environment. Cover has either been withdrawn completely in some cases, or premiums have become prohibitively expensive.

The scheme, which was first flagged last month, will run for nine months, backdated to 1 April, but can be extended if needed.

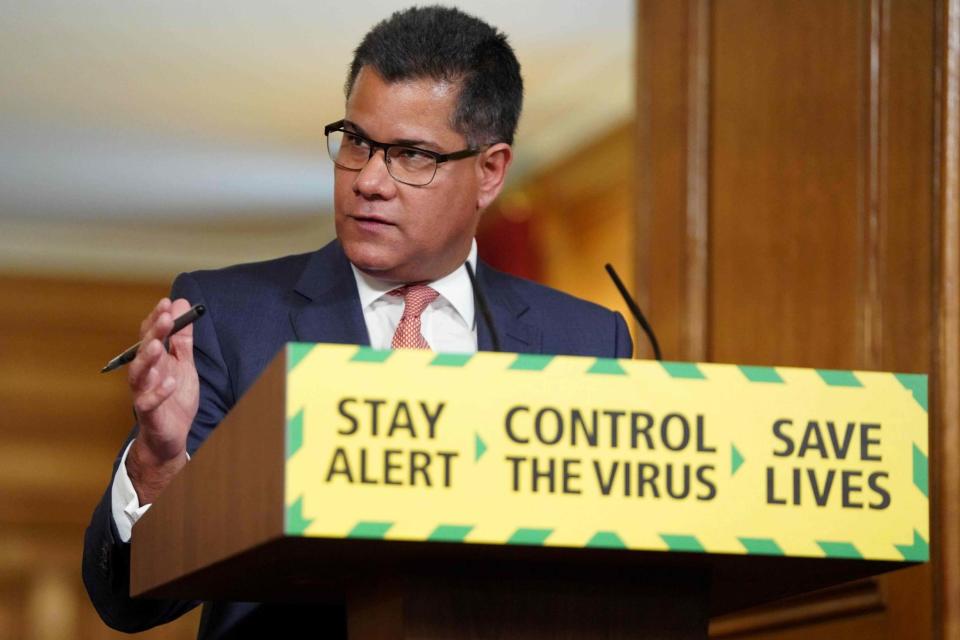

Business secretary Alok Sharma said the move would "bring peace of mind" to businesses, allowing them to keep trading and maintain liquidity in supply chains.

Sky News reported last night that the scheme could see the government bearing the first 20% of losses on trade credit insurance contracts, with insurers responsible for the rest.

Such details were not immediately forthcoming as the deal was announced this morning.

Yahoo Finance

Yahoo Finance