Great Cyclical Dividend Stocks For Every Portfolio

The economic cycle is the underlying driver of consumer cyclical companies’ performances. Companies such as Moss Bros Group and Connect Group offer goods and services that are luxuries, instead of absolute necessities, such as entertainment and gambling. In periods of growth, consumers benefit from higher discretionary income which drives these companies’ profitability. This tends to lead to higher cash flows and hefty dividend income for an investors’ portfolio. I’ve made a list of other value-adding dividend-paying stocks in the consumer cyclical industry for you to consider for your investment portfolio.

Moss Bros Group plc (LSE:MOSB)

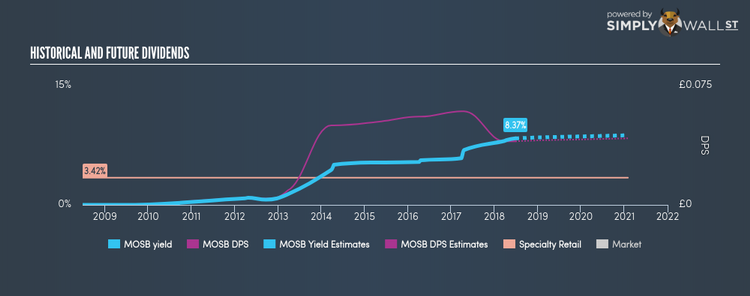

MOSB has a sumptuous dividend yield of 8.37% and has a payout ratio of 75.10% , with analysts expecting a 102.50% payout in the next three years. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from UK£0 to UK£0.04. When we compare Moss Bros Group’s PE ratio with its industry, the company appears favorable. The GB Specialty Retail industry’s average ratio of 12.8 is above that of Moss Bros Group’s (9). Continue research on Moss Bros Group here.

Connect Group PLC (LSE:CNCT)

CNCT has a juicy dividend yield of 29.56% and is paying out 112.02% of profits as dividends . In the case of CNCT, they have increased their dividend per share from UK£0.065 to UK£0.098 so in the past 10 years. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. More on Connect Group here.

ScS Group plc (LSE:SCS)

SCS has a large dividend yield of 6.45% and is distributing 51.76% of earnings as dividends , with the expected payout in three years being 67.67%. Besides capital gain prospects, just the yield is higher than the low risk savings rate – enticing for investors with goals of beating their bank accounts. Plus, a 6.45% yield places it amidst the market’s top dividend payers. ScS Group’s earnings per share growth of 25.08% over the past 12 months outpaced the gb specialty retail industry’s average growth rate of -5.31%. Continue research on ScS Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance