Growth in UK manufacturing sector slows but continues to ‘recover solidly’

Growth in the UK’s manufacturing sector slowed in June, a closely watched survey suggests, but the sector remained in expansion despite facing stubborn cost pressures.

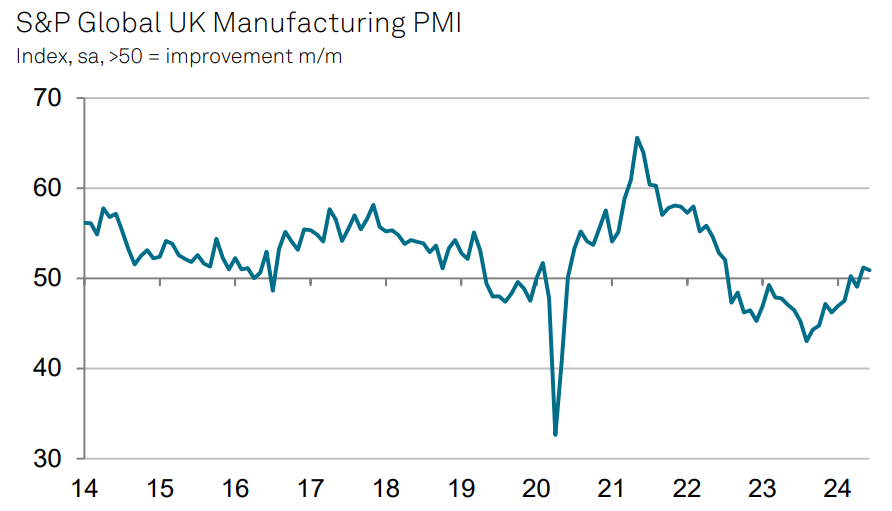

S&P’s purchasing managers’ index (PMI) for the manufacturing sector registered 50.9 in June, down from May’s 22-month high of 51.2 and below the earlier ‘flash’ estimate of 51.4. Any measure over 50 indicates expansion.

Although the PMI showed that activity was slower than last month, the manufacturing sector is still enjoying its strongest spell of growth for over two years.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said manufacturing continues to “recover solidly, respite downward revisions”.

The survey showed that output and new orders expanded for the second successive month, with levels remaining close to May’s level. Firms noted that growth in orders was connected to product promotions and the end of destocking for some clients.

Continued expansion in new business orders was largely driven by the domestic market. “The performance of the domestic market remains a real positive, providing a ripe source of new contract wins,” Rob Dobson, director at S&P Global Market Intelligence said.

This helped to offset continued weakness from overseas markets, with inflows of new work from abroad falling for the 29th month in a row. Part of the latest decline in orders from overseas was linked to shipping delays and rising freight costs, both of which were often the result of the Red Sea crisis.

Although the survey reported output growth, this was mainly confined to large-scale producers. Small and medium-sized firms saw falling output.

Firms still faced rising cost pressures in June, with input prices rising at the fastest pace since January 2023. This also contributed to higher selling prices.

“This renewed upward lurch in manufacturing prices will likely add to concerns over the potential stubbornness of underlying inflationary pressures among hawkish rate setters at the Bank of England,” Dobson said.

With firms still facing stubborn cost pressures, more workers were let go and companies cut back on non-essential spending.

Yahoo Finance

Yahoo Finance