GSK Studies on Depemokimab for Severe Asthma Meet Primary Goals

GSK’s GSK two-phase III studies, which evaluated depemokimab for treating severe asthma characterized by type II inflammation, met their primary endpoints.

The primary endpoints of the SWIFT-1 and SWIFT-2 studies were a reduction in the annualized rate of clinically significant exacerbations (asthma attacks) over 52 weeks. Positive headline data from the SWIFT-1 and SWIFT-2 studies showed that treatment with depemokimab resulted in statistically significant and clinically meaningful reductions in exacerbations over 52 weeks versus placebo. The safety profile of depemokimab was comparable to that of placebo across both studies. The data are being further analyzed and full results will be presented at an upcoming scientific congress.

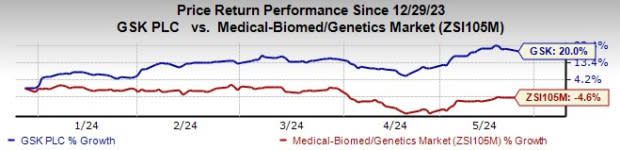

GSK’s stock has risen 20% so far this year against a decline of 4.6% for the industry.

Image Source: Zacks Investment Research

Type II inflammation is responsible for severe asthma experienced by more than 80% of patients with this condition. Type II inflammation is typically identified by elevated levels of eosinophils (a type of white blood cell) and drives severe asthma exacerbation.

Depemokimab is a biologic that targets interleukin-5 (IL-5), which is a key cytokine (protein) in type II inflammation. IL-5 inhibitors play a key role in reducing type II inflammation.

Currently approved IL-5 antagonists are GSK’s Nucala and Teva Pharmaceuticals’ TEVA Cinqair (reslizumab). Nucala is approved for severe asthma with an eosinophilic phenotype for patients 6 years and older. It is administered once every four weeks by a subcutaneous injection. Teva’s Cinqair is an intravenous (IV) therapy approved for adult patients with severe asthma and an eosinophilic phenotype. Teva’s Cinqair is also administered once every four weeks.

Depemokimab has the potential to become the first ultra-long-acting biologic for severe asthma with a six-month dosing schedule. Depemokimab offers a dosing schedule of just two injections per year and thus can greatly benefit patients managing multiple therapies.

Depemokimab is currently not approved for any indication. Depemokimab is also being evaluated in late-stage studies for eosinophilic granulomatosis with polyangiitis, hyper-eosinophilic syndrome and chronic rhinosinusitis with nasal polyps.

Zacks Rank & Stocks to Consider

GSK currently has a Zacks Rank #3 (Hold).

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

Some better-ranked stocks in the healthcare sector are Atara Biotherapeutics ATRA and Entera Bio ENTX, carrying a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Atara Biotherapeutics’ 2024 loss per share have narrowed from $1.78 per share to $1.22 per share. Estimates for 2025 have narrowed from 95 cents per share to 58 cents per share. This year, shares of Atara Biotherapeutics have risen 35.2%.

Earnings of ADMA Biologics beat estimates in two of the last four quarters while missing in the other two. ATRA delivered a four-quarter average earnings surprise of 9.17%.

In the past 60 days, the consensus estimate for Entera Bio’s2024 loss has narrowed from 75 cents per share to 25 cents per share. This year, shares of ENTX have risen 298.3%.

ENTX beat estimates in three of the trailing four quarters and missed the mark once, delivering an average earnings surprise of 6.50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance