A Guide to Investing in Hong Kong

Many politicians thought that Britain got a bum deal when Hong Kong became a British colony in 1841. The Prime Minister Lord Palmerston declared that the tiny island was 'a barren rock. It will never be a mart for trade.' This is somewhat ironic. Palmerston's 'barren rock' is now home to over 700,000 millionaires, representing around 12% of the island's population.

It has become a dynamic metropolis, one of the world's leading financial centres and home to the seventh largest stock exchange in the world. Stockopedia will be providing data on Hong Kong stocks very soon. Following on from previous weeks where we’ve covered Singapore and Japan, we’ve put together this guide to help investors navigate and get started in Hong Kong markets.

Why invest in Hong Kong?Open Market Economy

Hong Kong has long been a capitalist outpost in the Far East. Back in 1977 the The Economist wrote that 'a businessman setting up shop in Hong Kong finds low taxes, no foolish government interferences…a government leaning over to encourage him to make as much money as he can.' Hong Kong is now technically part of a communist country, China, but it has retained an open market economy since the British hand over in 1997. It operates a 'one country, two systems' regime whereby the island is free to operate a capitalist economy while managing its own taxes and currency. Regulations have been introduced since 1997, but the Index of Economic Freedom has ranked Hong Kong amongst the freest countries in the world every year since 1995. In 2015 it ranked as the most free economy for the 20th consecutive year. The Index measures restrictions on business, investment, property rights and labour, and considers the impact of corruption and government size on economic growth.

Exposure to China

Hong Kong has benefited from being strategically located near to the dynamic growth economies of the Far East. The island has long served as a bridge between China and the rest of the world, conveying trade and investment both ways. It has therefore been particularly well placed to benefit from China's growth. Furthermore, the Hong Kong stock markets provide exposure to China because many companies that are based in mainland China trade on the Hong Kong Stock Exchange. Examples include China Mobile, which has the world's largest subscription base (over 800m subscribers) and controls over 70% of the Chinese mobile services market. PetroChina, China's biggest oil producer, is also listed in Hong Kong. In the five years following 2002 Warren Buffett achieved a total return of 720% after buying 1.3% of the company.

Outperformance

Given that overseas markets can offer exposure to a varied range of political and economic factors, investors can potentially improve their returns and spread risk through international diversification. We can see from the chart below that the Hang Seng Index has massively outperformed the FTSE 100 since late 1999. During this period UK investors could have improved returns by gaining exposure to Hong Kong stocks.What are the major Hong Kong exchanges?

What are the major Hong Kong exchanges?

The Hong Kong Stock Exchange (SEHK) is the country’s main exchange. It is the third largest exchange in Asia after the Tokyo Stock Exchange and the Shanghai Stock Exchange, with around 1800 listed companies and a total market cap of HK$30.55 trillion (US$3.94 trillion). The Exchange is home to some of the largest companies in the world. For example Sun Hung Kai Properties is among the largest real estate development companies in Asia whose notable buildings include the International Commerce Centre (ICC), currently the tallest building in Hong Kong and the world's fourth tallest building by number of floors. The Lenovo Group, the largest personal computer vendor by unit sales in the world, also trades in Hong Kong.

In 2010 15% of the market capitalisation of the SEHK was owned by Li Ka Shing (right) chairman of CK Hutchison Holdings. According to Forbes, Shing is currently the eighth richest man in the world with a net worth of $31bn. CK Hutchison Holdings' origins can be traced to the 1950s when the company manufactured G.I. Joe action figures for Hasbro. It is now a multinational conglomerate that operates across several industries, including telecoms, infrastructure and energy.

1600 companies are listed on the Main Board and just over 200 trade on the Growth Enterprise Market (GEM). The GEM is a market intended for growth companies from all industries and sizes, while companies that list on the Main Board are generally more established and profitable. It is tougher to list on the Main Board. A company must have a Market Cap of at least HK$200m, while GEM companies only need to have a market cap over HK$100m. Companies on the Main Board must also have a stronger record of profitability, having generated at least HK$50m in the last 3 financial years, while GEM companies on the other hand must have generated a positive cashflow from operating activities of at least HK$20m during the two financial years preceding the IPO. 920 companies listed in Hong Kong are classified as 'Mainland Enterprises'. These can be divided into subgroups, namely H Shares, which are incorporated in China are trade in Hong Kong, and Red Chips, which are Chinese companies incorporated outside of China itself but are nevertheless listed in Hong Kong.

What are the major Hong Kong indices?

The main stock index in Hong Kong is the Hang Seng Index. This is a market cap-weighted index of 40 of the largest companies that trade on the Hong Kong Stock Exchange, representing around 65% of the total market capitalization. We can see from the chart below that the index is heavily weighted towards financials, construction and IT companies. Over half the companies are based in China (ie. are either 'H Shares', 'Red Chip' or 'Other Mainland' companies).

The Hang Seng Index (HSCI) is sub-divided into three indexes based on the sizes of the constituents: the Hang Seng LargeCap Index (HSLI), Hang Seng MidCap Index (HSMI) and Hang Seng SmallCap Index (HSSI) cover the top 80%, the next 15% and the remaining 5% respectively of the total market capitalisation of the HSCI. Investors interested in Chinese stocks may want to check out the Hang Seng Mainland 100, which comprises the 100 largest Hong Kong-listed Mainland companies (inc. H Shares, Red Chips and other Hong Kong-listed Mainland companies). Many analysts use this index as a benchmark to track the Mainland sector of the SEHK.

Which brokers provide access to Hong Kong?

A relatively large number of stockbrokers provide access to Hong Kong. They include:

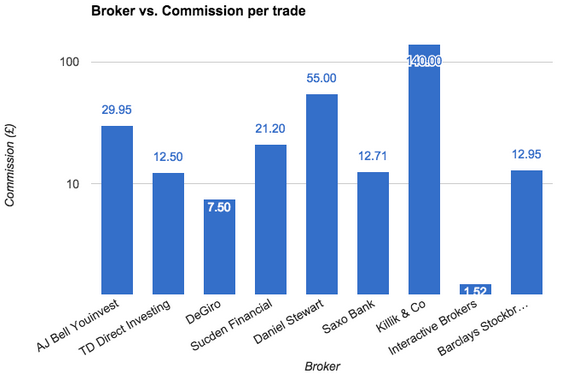

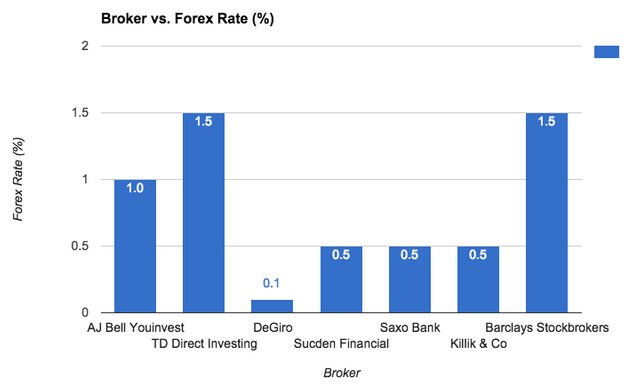

We have put together these charts so that readers can compare the commission and forex rates charged by the above brokers.

Do UK investors pay tax on Hong Kong stocks?

Hong Kong is a low taxation country when it comes to investing in shares. No withholding tax is imposed on dividends paid by Hong Kong companies to foreign recipients. Furthermore, profits on disposal of a Hong Kong share by its foreign investor is exempt from corporation tax and capital gains tax. That being said, UK investors would still need to pay tax to HMRC unless shares were bought and traded using a tax wrapper account (eg. an ISA or SIPP). Furthermore, while taxation is generally low in Hong Kong, investors do need to pay stamp duty. Stamp duty on the transfer of shares is 0.2% (payable equally by seller and buyer i.e. 0.1% each) on the market value of the trade.

Conclusions

We will be providing investors with StockReports and StockRanks for Hong Kong stocks as we go forward and hope that these will help readers identify further investment opportunities in the Far East. We will also be exploring which Hong Kong stocks qualify for the GuruScreens. If any investors have any experience in the Hong Kong markets do please feel free to leave your own opinions below.

Read More about Stock Picks on Stockopedia

See the latest Stockmarket News, Commentary & Analysis on Stockopedia

Yahoo Finance

Yahoo Finance