GuruScreen Movers - June 2nd: Focus on Character Group (CCT)

The UK’s fourth largest toymaker, Character Group, has enjoyed a strong run this year. The price jumped 9% yesterday after the company was tipped in the Investors Chronicle. However, Paul Scott has warned of the dangers of stock tips. They can trigger short-term spikes before the prices revert to their previous levels. Indeed, for these reasons, Paul sometimes sees tips as a selling opportunity.

It is impossible to judge what Character Group will do over the next few days. But to assess the company's longer term prospects, it is useful to analyse whether the firm is exposed to factors which have historically driven share price returns.

Quality minus Junk:

Ben Hobson mentioned Character Group in a recent article on the size-effect (ie. the theory which holds that small stocks outperform larger stocks). Academic research suggests that good quality small stocks tend to outperform good quality large stocks, at least over the long-run. Small caps may be small because they are unprofitable companies, which are unable to grow, and offer unattractive returns to investors. But if you dump the junk and focus on a basket of good quality small companies, the size effect becomes more pronounced and small beats big.

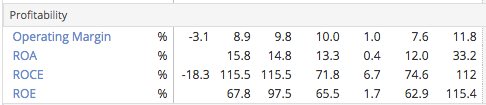

So is Character Group a good quality small company? With a market cap of £91.9m, Character is amongst the smallest companies in the stock market. It also has a QualityRank of 99 out of 100. Companies with a higher QualityRank are usually stable, growing, cashflow generative businesses with high returns on capital. They may also be companies with a strong balance sheet and improving fundamentals. For example, you can see from the table below that Character Group has trended higher in previous years, with wider profit margins and a stronger return on capital.

Character Group also has the traits of a growth stock. Brokers expect earnings to grow more than 50% in 2015, supported by the launch of new product ranges, including a new ‘food play’ collection. Revenues have already grown steadily since 2013, thanks in part to its portfolio of iconic toy brands, including Scooby Doo and Fireman Sam. The strength of these brands means that revenues are perhaps less susceptible to the fads and fickle tastes of the highly competitive toy market.

High Piotroski Score

The Piotroski F-Score is one of the most useful metrics to assess whether a stock has improving fundamentals. The F-Score seeks to identify companies that are profit-making, have improving margins, don’t employ any accounting tricks and have strengthening balance sheets. Character Group has the highest possible F-Score (9 out of 9) and also qualifies for Stockopedia's Piotroski F-Score PE Screen, which searches for companies with cheap P/E ratios and high F-Scores. So perhaps Character Group isn't just a good quality company. It may be a good quality company trading at bargain price. Indeed, the company has a PE ratio of just 9. Assuming that earnings grow by 54% (in line with broker estimations), the company would still have a PE ratio of just 11 - within the cheapest 25% of the market.

Strong Price Momentum

Character Group's share price has popped. Up nearly 10% yesterday. Up 126% over the last 12 months...! Research in the field of behavioural science suggests that investors are often reluctant to buy shares when the price has already gone up. It is more intuitive to buy low and sell high. So when companies announce good news, like record profits, investors underreact and share prices move upwards to reflect new information very slowly. For these reasons, stocks which are rising in price tend to keep going up, at least for a while.

We don't know where Character Group will go from here. However, the company does seem to be exposed to the momentum factor. The firm qualities for the Tiny Titans Screen, which filters for stocks with strong price momentum and a cheap PS ratio. Furthermore, brokers are generally becoming more optimistic about this company. The EPS forecasts have risen from 26.6p to 38.8p over the last twelve months (see below).

Conclusion

Character Group is exposed to four factors which have historically driven share price returns: quality, value, momentum and size. The company is a small cap, but it also has a high QualityRank and Piotroski Score, not to mention cheap PE and PS ratios. Furthermore, the firm has beaten the market over the last years and brokers have become increasingly optimistic about the EPS forecasts. The company’s overall StockRank is 98. To filter the market for potential investment opportunities, why not explore Stockopedia’s GuruScreens and StockRank Portal. If you want to take a free trial of our service, just check out our plans page: www.stockopedia.com/plans/

Read More about Character on Stockopedia

Discuss Character on Stockopedia

Yahoo Finance

Yahoo Finance