If You Had Bought Redfin (NASDAQ:RDFN) Stock A Year Ago, You Could Pocket A 17% Gain Today

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the Redfin Corporation (NASDAQ:RDFN) share price is 17% higher than it was a year ago, much better than the market return of around 7.3% (not including dividends) in the same period. So that should have shareholders smiling. Redfin hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Redfin

Redfin isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Redfin saw its revenue grow by 34%. That's a fairly respectable growth rate. Buyers pushed the share price 17% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

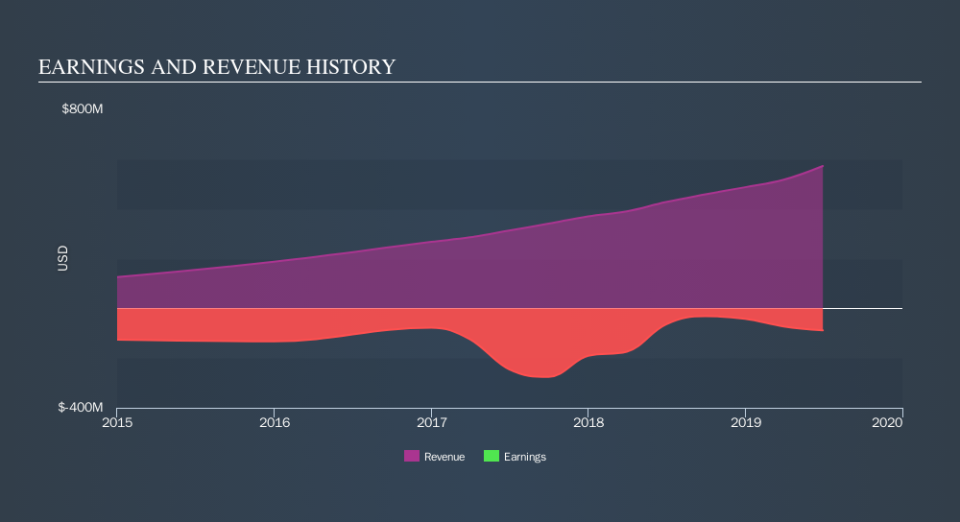

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Redfin will earn in the future (free profit forecasts).

A Different Perspective

Redfin shareholders should be happy with the total gain of 17% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 6.6% in that time. This suggests the company is continuing to win over new investors. You could get a better understanding of Redfin's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance