Harmony's (HMY) Earnings Down, Revenues Increase Y/Y in FY22

Harmony Gold Mining Company Limited HMY logged adjusted earnings of 33 cents per share for fiscal 2022 (ended Jun 30, 2022), down 49% from adjusted earnings of 64 cents recorded a year ago.

For fiscal 2022, revenues rose 2% year over year to $2,804 million. The company gained from higher gold prices. However, it saw lower production in fiscal 2022.

Average gold prices received for the fiscal rose roughly 6% year over year to $1,829 per ounce (oz).

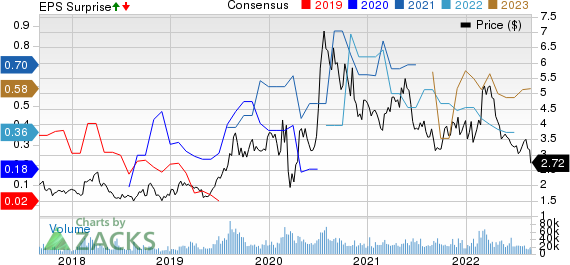

Harmony Gold Mining Company Limited Price, Consensus and EPS Surprise

Harmony Gold Mining Company Limited price-consensus-eps-surprise-chart | Harmony Gold Mining Company Limited Quote

Production and Costs

Gold production was 1,486,517 oz for fiscal 2022, down around 3% year over year.

Cash operating costs per oz increased 18% year over year to $1,434. All-in sustaining costs went up 17% year over year to $1,709 per oz.

Financial Overview

As of Jun 30, 2022, cash and cash equivalents declined around 24% year over year to $150 million.

Operating free cash flow declined 55% year over year to $191 million in fiscal 2022.

Long-term debt was $195 million at the end of fiscal 2022, down around 6% year over year.

Outlook

Harmony Gold expects to produce 1.4-1.5 million oz of gold in fiscal 2023.

The company said that the solid platform it has built has placed it in a strong position to deliver operationally. It has a strategy to prioritize capital for high-grade and high-margin projects, which it expects to generate the best possible returns and allow it to meet long-term objectives, Harmony noted.

Zacks Rank & Key Picks

Harmony Gold currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Daqo New Energy Corp. DQ, Sociedad Quimica y Minera de Chile S.A. SQM and The Chemours Company CC.

Daqo New Energy, currently carrying a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 177.5% for the current year. The Zacks Consensus Estimate for DQ's earnings for the current fiscal has been revised 20.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 10.8%. DQ has gained around 6% over a year.

Sociedad has a projected earnings growth rate of 520.5% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 34% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average being 28.2%. SQM has rallied roughly 95% in a year. The company carries a Zacks Rank #2 (Buy).

Chemours has a projected earnings growth rate of 40% for the current year. The Zacks Consensus Estimate for CC's current-year earnings has been revised 7.3% upward in the past 60 days.

Chemours’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 28.3%, on average. CC has gained around 3% in a year and currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance