Henderson Land Development Co Ltd's Dividend Analysis

Exploring the Sustainability and Growth of Henderson Land Development Co Ltd's Dividends

Henderson Land Development Co Ltd (HLDCY) recently announced a dividend of $0.17 per share, payable on 2024-06-28, with the ex-dividend date set for 2024-06-06. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Henderson Land Development Co Ltd's dividend performance and assess its sustainability.

What Does Henderson Land Development Co Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Henderson Land Development is a prominent property developer in Hong Kong, specializing in urban redevelopment and farmland conversion. Founded in 1976 and listed in 1981, its founder Lee Shau Kee has been a significant figure, with his stake recently reduced to below 72.8% following disposals in December 2017the first since 1993. These changes decrease the likelihood of privatization. Following Lee's stepping down in May 2019, his sons now lead the company. Henderson Land also holds substantial stakes in four listed entities, influencing various sectors from gas to hospitality.

A Glimpse at Henderson Land Development Co Ltd's Dividend History

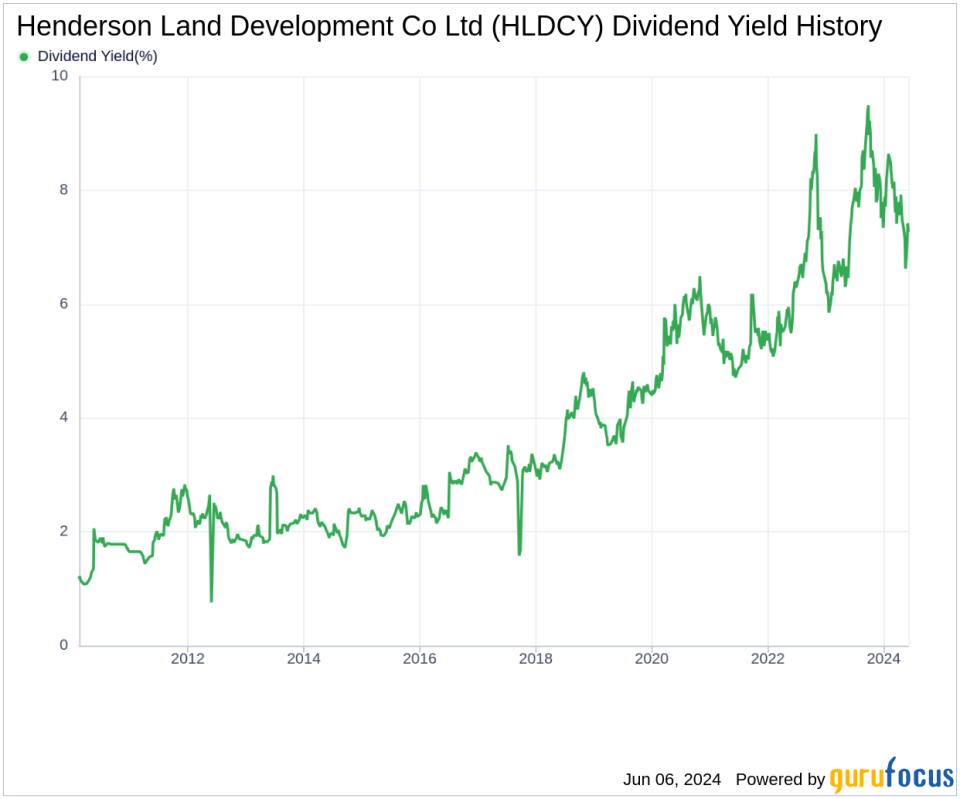

Henderson Land Development Co Ltd has upheld a steady dividend payment track since 2003, with dividends distributed bi-annually. Below is a chart depicting the annual Dividends Per Share to track historical trends.

Breaking Down Henderson Land Development Co Ltd's Dividend Yield and Growth

Henderson Land Development Co Ltd currently boasts a 12-month trailing dividend yield of 7.26% and a 12-month forward dividend yield of 7.27%, indicating anticipated increases in dividend payments over the next year. Over the past five years, this rate has increased by 3.50% annually, and over the past decade, the annual dividends per share growth rate has been an impressive 13.90%. The 5-year yield on cost as of today is approximately 8.62%.

The Sustainability Question: Payout Ratio and Profitability

To evaluate the sustainability of the dividend, it's crucial to consider the company's payout ratio. The dividend payout ratio of 0.90 as of 2023-12-31 suggests that the company retains a significant portion of its earnings, which supports future growth and stability. Henderson Land Development Co Ltd's profitability rank of 7 out of 10, combined with consistent positive net income over the past decade, underscores its robust profitability.

Growth Metrics: The Future Outlook

Assessing the sustainability of dividends also involves examining a company's growth metrics. Henderson Land Development Co Ltd's growth rank of 7 suggests a favorable growth trajectory. Although its revenue per share and 5-year EBITDA growth rate underperform compared to global competitors, its ability to maintain a stable dividend amidst these challenges is noteworthy.

In conclusion, while Henderson Land Development Co Ltd faces some growth challenges, its strong dividend yield, consistent dividend growth, and solid profitability metrics suggest a potentially sustainable dividend profile. Investors should continue to monitor these aspects closely to make informed decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance