Hennessy Japan Small Cap Fund Boosts Stake in Future Corp, Signaling Strong Market Confidence

Insightful Portfolio Adjustments in Q2 2024 Highlight Strategic Market Moves

Established on August 31, 2007, the Hennessy Japan Small Cap Fund (Trades, Portfolio) is renowned for its strategic investments in smaller Japanese companies, aiming for long-term capital appreciation. The fund focuses on companies that are perceived as undervalued relative to their market potential, boasting exceptional management and robust earnings quality. By investing in companies that represent the bottom 15% of Japanese market capitalizations, the fund leverages on-site research to handpick stocks with the best growth prospects and fundamental values.

Summary of New Buys

During the second quarter of 2024, Hennessy Japan Small Cap Fund (Trades, Portfolio) expanded its portfolio by adding seven new stocks. Noteworthy among these was Future Corp (TSE:4722), which now comprises 1.51% of the portfolio with a significant investment of 161,900 shares valued at 1.63 billion. Following closely were Relo Group Inc (TSE:8876) and Canon Marketing Japan Inc (TSE:8060), holding 1.39% and 1.05% of the portfolio respectively.

Key Position Increases

The fund also strategically increased its stakes in seven existing holdings. Treasure Factory Co Ltd (TSE:3093) saw a substantial increase of 56.93% in share count, now holding a total of 188,000 shares valued at 1.95 billion. Another significant increase was in Trusco Nakayama Corp (TSE:9830), which saw a 78.29% rise in shares, totaling 77,200.

Summary of Sold Out Positions

The fund exited positions in six companies, including Maxell Ltd (TSE:6810) and GLORY Ltd (TSE:6457), which previously impacted the portfolio by -1.38% and -1.31% respectively.

Key Position Reductions

Reductions were made in seven stocks, with notable decreases in Nojima Co Ltd (TSE:7419) and Takasago Thermal Engineering Co Ltd (TSE:1969), which saw reductions of 37.29% and 27.43% in shares respectively. These adjustments reflect the fund's dynamic strategy to optimize portfolio performance based on market conditions.

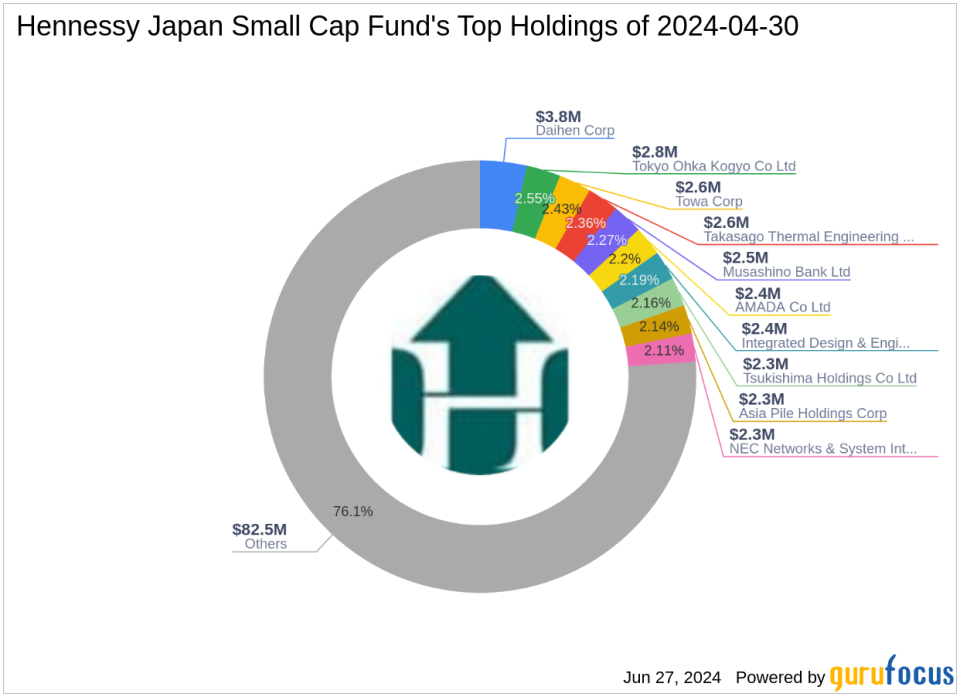

Portfolio Overview

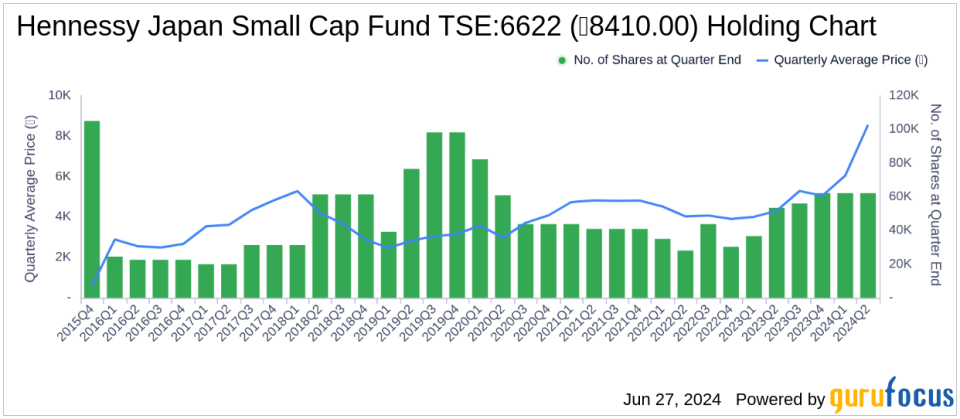

As of the second quarter of 2024, the Hennessy Japan Small Cap Fund (Trades, Portfolio)'s portfolio included 65 stocks. Top holdings included 3.49% in Daihen Corp (TSE:6622), 2.55% in Tokyo Ohka Kogyo Co Ltd (TSE:4186), and 2.43% in Towa Corp (TSE:6315). The fund's investments are predominantly concentrated across 10 industries, showcasing a diverse yet focused market engagement.

The strategic moves by Hennessy Japan Small Cap Fund (Trades, Portfolio) in the second quarter of 2024 underline its commitment to capitalizing on market dynamics and enhancing portfolio value through meticulous stock selection and sectoral allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance