Here's Why You Should Add Choice Hotels (CHH) to Portfolio

Choice Hotels International, Inc. CHH is reaping the rewards of synergies from the integration of Radisson Hotels Americas and gaining momentum in its conversion projects pipeline. Additionally, its emphasis on ongoing expansion strategies through acquisitions and franchise agreements is proving to be advantageous.

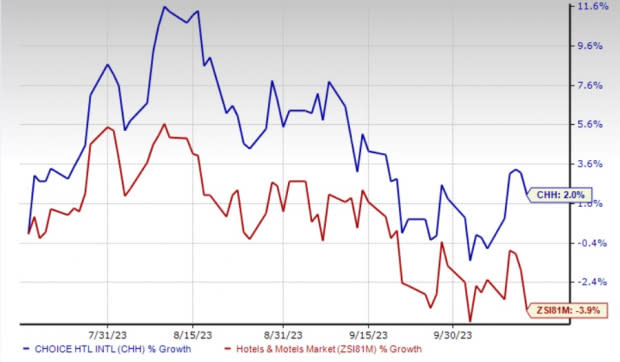

The stock has gained 2% in the past three months against the industry’s decline of 3.9%. In the past 30 days, current-year earnings estimates have witnessed upward revisions of 0.2%.

Growth Drivers

The integration of Radisson Hotels Americas into Choice Hotels system is progressing well. CHH has already surpassed its expectations, delivering adjusted EBITDA of $80 million through this integration. In July 2023, it onboarded nearly 600 Radisson Hotels Americas hotels onto its world-class reservation delivery engine and integrated two award-winning loyalty programs. For 2024, it expects adjusted EBITDA from Radisson Hotels Americas to exceed $80 million.

CHH is benefiting from expansion efforts. In second-quarter 2023, the domestic upscale franchise business witnessed robust growth, with rises of 32% and 44% in units and franchise agreements, respectively, compared with the prior-year quarter’s levels.

Additionally, the domestic upscale pipeline increased 27% on a year-over-year basis, representing 127 hotels. CHH witnessed a 44% year-over-year jump in domestic franchise agreements for its Ascend Hotel collection.

Image Source: Zacks Investment Research

Choice Hotels strengthened its core brand lineup with a 24% year-over-year growth in its domestic upper mid-scale franchise segment, achieving about 2,300 domestic hotels in the first half of 2023. The company enhanced the value proposition to economy transient franchise owners, resulting in a 7-bps year-over-year increase in effective royalty rate for that segment during second-quarter 2023.

On the other hand, the domestic extended-stay pipeline reached 450 hotels as of Jun 30, 2023. At the end of second-quarter 2023, the number of domestic hotels and rooms climbed 6.9% and 8.8%, respectively, year over year. The company’s pipeline for conversion hotels improved 14% year over year.

In 2023, the newly-introduced Everhome Suites extended stay brand experienced a promising start, generating significant interest among developers with 60 ongoing projects. A notable milestone occurred last month with the commencement of construction for the fourth Everhome hotel. These developments signify the brand's growing momentum and success in the market. Given the solid appeal of this new product in the development community, CHH is optimistic in this regard and anticipates higher contracts moving in to 2023.

Zacks Rank

CHH currently carries a Zacks Rank #2 (Buy).

Key Picks

Some other top-ranked stocks from the Zacks Consumer Discretionary sector are:

Strategic Education, Inc. STRA carries a Zacks Rank #2. STRA has a trailing four-quarter earnings surprise of 12.1%, on average. The stock has gained 23.1% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for STRA’s 2023 sales and earnings per share (EPS) indicates growth of 4.9% and 27.9%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 12.5%, on average. The stock has jumped 18.6% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS suggests increases of 14.8% and 23.7%, respectively, from the year-earlier period’s levels.

OneSpaWorld Holdings Limited OSW carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 42.6%, on average. The stock has gained 34% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS implies rises of 44.5% and 117.9%, respectively, from the prior-year period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance