Here's Why Alphabet (GOOGL) is a Must-Buy Stock Right Now

Investors looking for maximum returns should consider Alphabet GOOGL adding to their portfolios due to its solid fundamental strength.

Shares of the search giant have risen 23.2% year to date, outperforming the Zacks Computer & Technology sector’s growth of 18.1% and the S&P 500 index’s return of 11.5% during the same time frame.

This outperformance reflects the company’s back-to-back quarters of impressive financial performance. Alphabet’s earnings per share surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 11.3%. In its last reported quarter, the top and bottom lines beat the consensus mark and witnessed strong year-over-year growth.

We believe that GOOGL shares have further room for expansion, given the company’s growing efforts to bolster its generative AI capabilities. Its leading position in the search engine space, strengthening cloud footprint, solid momentum in YouTube and Android, and growing traction in the autonomous driving space should aid Alphabet’s prospects further.

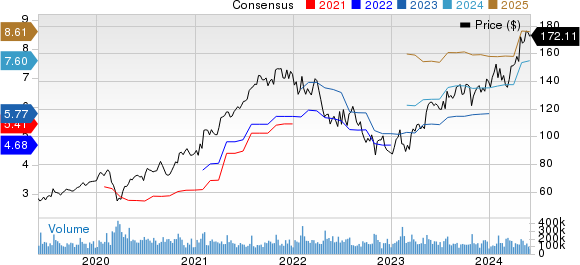

The upswing in the company’s estimates testifies to the aforesaid fact. The Zacks Consensus Estimate for 2024 revenues and earnings is pegged at $295.53 billion and $7.61 per share, respectively. This indicates year-over-year improvements of 15.2% in the top line and 31.2% in the bottom line. The EPS estimate has also moved 0.5% north over the past 30 days.

Let us delve deeper into the fundamental strength of Alphabet.

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Growing Generative AI Capabilities: Key Catalyst

Google is well-poised to capitalize on the growing proliferation of generative AI-backed chatbots on the back of Bard, which enables users to collaborate with experimental AI with new features that include image capabilities, coding support and app integration.

The company is cashing in on the increasing demand for Large Language Models (LLMs) with its most powerful AI model called Gemini. Growing momentum in Google’s Vertex AI, which enables developers to train, tune, augment and deploy applications using generative AI models, is another positive.

Google recently introduced various open-source tools to support generative AI projects and infrastructure.

The new tools include the likes of MaxDiffusion — a collection of reference implementations of various diffusion models, JetStream — a new engine to run generative AI models, MaxText — a collection of text-generating AI models targeting tensor processing units (TPUs), and NVIDIA’s GPUs in the cloud.

The company’s launch of an enterprise-focused AI code completion and assistance tool called Gemini Code Assist is noteworthy.

Growing generative AI capabilities position Alphabet well to capitalize on the growth prospects in the booming generative AI market, which, per a report from Fortune Business Insights, is expected to reach $667.96 billion by 2030, seeing a CAGR of 47.5% between 2023 and 2030.

Search Efforts Aid Prospects

The strong efforts of Google toward innovation in AI techniques for the advancement of its search business are noteworthy.

Growing momentum in Search Generative Experience, which leverages the generative AI technology to make search results more natural and intuitive, should benefit Google’s search business in the near term.

Google’s initiative to improve search results by combining LLMs’ capabilities with multi-search and visual exploration features is another positive. The growing momentum of Bard bodes well for search revenues.

The company’s strength in the mobile search category on the back of mobile-friendly algorithms, robust product listings and flight search capabilities is a plus. These factors will continue to boost the search traffic on the Chrome browser.

Cloud Strength Drives Growth

Alphabet has been growing rapidly in the booming cloud-computing market. Google Cloud has turned out to be the key growth driver of Alphabet, owing to strengthening cloud service offerings. The solid adoption of the Google Cloud Platform and Google Workspace has been driving growth in the Google Cloud segment.

Google’s growing investments in infrastructure, security, data management, analytics and AI are major positives. Its strategic partnerships and acquisitions, and growing number of data centers are helping Google to expand its cloud footprint worldwide. The increasing number of cloud regions and availability zones globally is a major positive.

The solid adoption of generative AI-powered Workspace tools is a plus. Strength in Google’s Kubernetes offerings is contributing well to driving customer momentum.

GOOGL’s efforts in integrating data lakes, data warehouses, data governance and advanced machine learning into a single platform are bolstering its prospects in the data cloud market.

To Conclude

We believe that Alphabet presents a compelling investment opportunity due to its strong market position in generative AI, search engine and cloud. Strong financial health, combined with its commitment to innovation and strategic growth, positions it well for sustained success.

Alphabet currently sports a Zacks Rank #1 (Strong Buy) with a Growth Score of B, a combination that offers a good investment opportunity, per the Zacks proprietary methodology. You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks in the broader technology sector are NVIDIA NVDA, Tyler Technologies TYL and Nutanix NTNX, each flaunting Zacks Rank #1 at present.

NVIDIA has surged 131.9% year to date. The Zacks Consensus Estimate for NVIDIA’s fiscal 2025 revenues is pegged at $116.4 billion, which indicates year-over-year growth of 91%. The consensus mark for earnings is pegged at $25.10 per share, which implies a 93.7% increase from that reported in fiscal 2024.

Tyler Technologies has gained 14.2% year to date. The Zacks Consensus Estimate for TYL’s fiscal 2024 revenues is pinned at $2.12 billion, which indicates year-over-year growth of 8.8%. The consensus mark for earnings is pegged at $9.19 per share, which implies a 17.8% increase from the fiscal 2023 actual.

Nutanix has gained 18.1% year to date. The Zacks Consensus Estimate for NTNX’s fiscal 2024 revenues is pegged at $2.14 billion, which indicates year-over-year growth of 14.7%. The consensus mark for earnings is pegged at $1.08 per share, which implies an 80% increase from the fiscal 2023 reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Tyler Technologies, Inc. (TYL) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance