Here's Why You Should Avoid Schneider (SNDR) Stock Now

Schneider National, Inc. (SNDR) is currently mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Reduced earnings per share guidance looks disappointing and raises concerns about the stock. Schneider now anticipates 2024 adjusted earnings per share in the range of $0.85 - $1.00 (prior view: $1.15 - $1.30). Further, SNDR has a disappointing earnings surprise history. The company's earnings lagged the Zacks Consensus Estimate in three of the last four quarters (surpassing the mark in the other). The average miss is 21.07%.

Schneider's liquidity position raises concerns about the stock. Schneider exited the first quarter of 2023 with cash and cash equivalents of $67.3 million, lower than the long-term debt was $96.6 million, implying that the company does not have enough cash to meet its debt obligations.

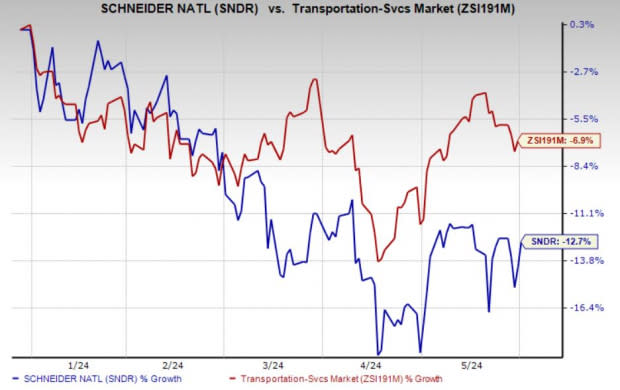

Partly due to these headwinds, shares of Schneider have declined 12.7% compared with the 6.9% loss of the industry it belongs to so far this year.

Image Source: Zacks Investment Research

On the flip side, SNDR’s consistent measures to reward its shareholders through dividends and share buybacks are appreciative. During first-quarter 2024, SNDR paid dividends of $16.5 million and repurchased shares worth $13 million. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line.

Zacks Rank and Stocks to Consider

Currently, Schneider carries a Zacks Rank #5 (Strong Sell).

Some other top-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance