Here's Why You Should Hold Dover Stock in Your Portfolio Now

Dover Corporation DOV has been displaying an impressive performance, aided by an upbeat outlook, improved performance by the Engineered Systems and Fluids segments, strong demand and solid backlog as well as cost-reduction initiatives. However, weak retail refrigeration demand and input-cost inflation due to the implementation of tariffs remain concerns.

Dover currently carries a Zacks Rank #3 (Buy) and a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) 2 (Buy) or 3, offer the best investment opportunities for investors.

Factors Favoring Dover

Upbeat Guidance

Dover tightened its adjusted earnings per share guidance to $5.75-$5.85 from the prior estimate of $5.65-$5.85 for full-year 2019, backed by encouraging first-half results. This was driven by productivity and cost initiatives, strong demand and solid backlog. Robust order backlog, augmented by customer wins and execution of margin targets, will likely aid third-quarter 2019 results.

Positive Earnings Surprise History

Dover outpaced the Zacks Consensus Estimate over the trailing four quarters, the average positive earnings surprise being 6.91%.

Price Performance

The stock has gained around 12.7% over the past year, outperforming the industry’s growth of 2.3%.

Strong Earnings Growth Prospect

The Zacks Consensus Estimate for Dover’s 2019 earnings is currently pegged at $5.84, reflecting expected year-over-year growth of 17.5%. The same for 2020 stands at $6.27, indicating a year-over-year rise of 7.49%. The stock also has a long-term expected earnings per share growth rate of roughly 11.5%.

Cheap Valuation

Dover’s trailing 12-month EV/EBITDA ratio is 12, while the industry's average trailing 12-month EV/EBITDA is 12.6. Consequently, the stock is cheaper at this point based on the ratio.

Underpriced

Looking at Dover’s price-to-earnings ratio, shares are underpriced at the current level, which seems to be attractive for investors. The company has a trailing P/E ratio of 17.8, which is below the industry average of 21.1.

Growth Drivers in Place

Throughout 2019, the Engineered Systems and Fluids segments’ impressive performance, benefits from cost-containment actions, as well as footprint-optimization projects and retail refrigeration will somewhat negate the impact of soft demand in the Refrigeration & Food Equipment segment.

Dover anticipates to benefit from its targeted cost-reduction initiatives in 2019. The company has executed restructuring programs to better align costs and operations with the current market conditions through targeted facility consolidations, headcount reduction and other measures.

Dover is progressing well with its efforts to simplify the portfolio and focus on markets with growth prospects. In sync with this, it successfully completed the spin-off of its upstream energy businesses — Apergy — last May. Following the spin-off, the company no longer owns the Energy segment and is aligned into three reportable segments. Thus, the divestment will enable Dover to focus on less volatile core platforms by delivering innovative equipment and components, specialty systems, consumable supplies, software and digital solutions, and support services. It will also provide a robust foundation for reinvestment, long-term sustainable revenues, earnings growth and strong free cash-flow generation.

Dover has a tradition of making successful acquisitions in diverse end markets. The company completed the acquisition of All-Flo Pump Co during the June-end quarter, which is likely to be accretive to the margins in the Fluids segment. Moreover, the buyout is anticipated to generate double-digit Return on Invested Capital (ROIC) within three years.

Few Hurdles to Counter

Tariffs imposed on steel and aluminum products have led to higher input costs for Dover. Also, Dover’s Refrigeration & Food Equipment segment has been bearing the brunt of weak retail refrigeration markets. The segment’s margin was affected by lower volumes in the SWEP heat exchanger business, notably in Asia and reduced refrigeration systems demand. Thus, weak refrigeration demand and lower shipments in Asia is likely to hurt margins in the near term. Considering this, Dover’s Refrigeration & Food Equipment segment’s top line will likely remain weak this year.

Bottom Line

Investors might want to hold on to the stock, at present, as it has ample prospects for outperforming peers in the near future.

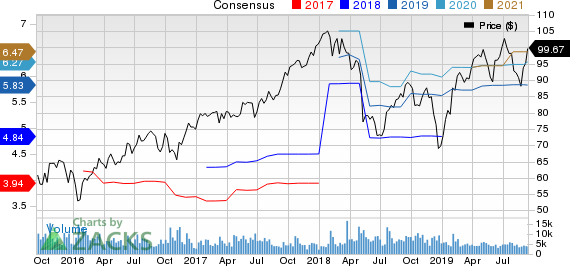

Dover Corporation Price and Consensus

Dover Corporation price-consensus-chart | Dover Corporation Quote

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Albany International Corporation AIN AGCO Corporation AGCO and UFP Technologies, Inc. UFPT. While Albany International sports a Zacks Rank #1, AGCO Corp and UFP Technologies carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albany International has an estimated earnings growth rate of 33.85% for 2019. The company’s shares have gained 41%, year to date.

AGCO Corp has a projected earnings growth rate of 31.11% for the current year. The stock has gained 36.2% so far this year.

UFP Technologies has an expected earnings growth rate of 8.10% for the ongoing year. The stock has appreciated 37.4% over the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UFP Technologies, Inc. (UFPT) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Albany International Corporation (AIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance