Here's Why You Should Invest in Aldeyra (ALDX) Stock Now

Burlington, MA-based Aldeyra Therapeutics ALDX is a leader in the development of RASP (reactive aldehyde species) modulators for the treatment of immune-mediated diseases. Lately, it has seen success in its studies on its investigational RASP modulator, ADX-629, which has demonstrated potential activity in clinical studies of patients with psoriasis, asthma, COVID, ethanol toxicity, chronic cough and atopic dermatitis.

Aldeyra Therapeutics is conducting a phase II study on ADX-629 in Sjögren-Larsson Syndrome and moderate alcoholic hepatitis. Based on positive biomarker results observed in the adult cohort of the phase II study of ADX-629 in Sjögren-Larsson Syndrome, Aldeyra Therapeutics plans to expand the study to include pediatric patients for which a proposed expansion is expected to be filed with the FDA in the first half of 2024.

At present, there is no FDA-approved therapy for Sjögren-Larsson Syndrome, a rare inborn error of metabolism due to mutations in fatty aldehyde dehydrogenase, which results in the accumulation of fatty alcohols and fatty aldehydes. Initial clinical data from the Sjögren-Larsson Syndrome study on ADX-629 demonstrated broad-based normalization of the majority of abnormal metabolomic signatures along with a reduction in the accumulation of fatty alcohols in patients treated with ADX-629.

Top-line results from the moderate alcoholic hepatitis study are expected in the second half of 2024.

Clinical studies on two other investigational RASP modulators, ADX-246 (atopic dermatitis) and ADX-248 (immune-mediated diseases of the retina), are expected to begin in the first half of 2024.

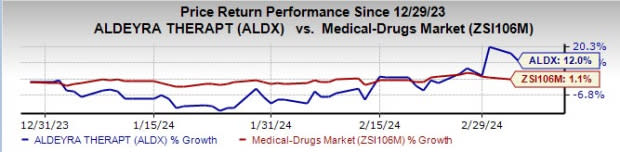

Aldeyra Therapeutics stock has risen 12% so far this year against a increase of 1.1% for the industry.

Image Source: Zacks Investment Research

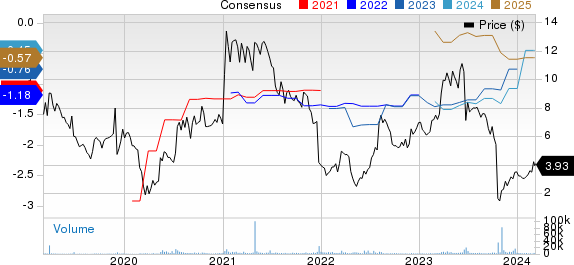

The consensus estimate for 2024 loss has narrowed from $1.08 per share to 45 cents per share over the past 60 days. The company has a Zacks Rank #2 (Buy).

Aldeyra Therapeutics, Inc. Price and Consensus

Aldeyra Therapeutics, Inc. price-consensus-chart | Aldeyra Therapeutics, Inc. Quote

Other Stocks to Consider

Some other top-ranked drug/biotech companies worth considering are Indivior INDV, Collegium Pharmaceutical COLL and Lyra Therapeutics LYRA. While Indivior and Collegium Pharmaceutical sport a Zacks Rank #1 (Strong Buy) each, Lyra Therapeutics has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Indivior’s 2024 earnings per share have increased from $1.83 to $1.95 over the past 30 days. Estimates for 2025 have jumped from $2.37 to $2.60 over the same timeframe. INDV’s stock has surged 42.1% year to date.

Indivior beat estimates in the last three quarters, delivering an earnings surprise of 48.06% on average. Indivior commenced trading on Nasdaq in June 2023.

In the past 30 days, estimates for Collegium Pharmaceutical’s 2024 earnings per share have improved from $6.11 to $6.29. During the same period, estimates for 2025 have improved from $6.63 per share to $6.87 per share. Year to date, shares of COLL have rallied 18.0%.

COLL’s earnings beat estimates in three of the trailing four quarters while delivering in-line results in one, with the average surprise being 7.54%.

In the past 30 days, estimates for Lyra Therapeutics’ 2024 loss per share have narrowed from $1.08 to $1.07 per share. Year to date, shares of LYRA have rallied 6.9%.

LYRA’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 8.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aldeyra Therapeutics, Inc. (ALDX) : Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL) : Free Stock Analysis Report

Lyra Therapeutics, Inc. (LYRA) : Free Stock Analysis Report

Indivior PLC (INDV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance