Here's Why Investors Should Invest in Kirby (KEX) Stock Now

Kirby Corporation KEX performed well in the past year and has the potential to sustain the momentum in the future. If you have not taken advantage of its share price appreciation yet, it’s time to do so.

Let’s take a look at the factors that make the stock a strong investment pick at the moment.

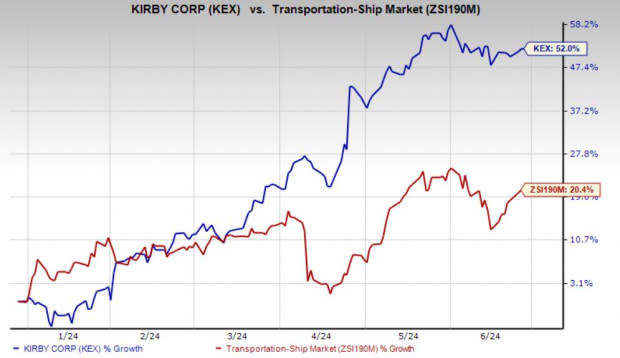

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run on the bourse so far this year. Shares of KEX have gained 52% year to date, outperforming the industry’s growth of 20.4%.

Image Source: Zacks Investment Research

Solid Zacks Rank: Kirby presently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank #1 or 2 (Buy) offer the best investment opportunities. Thus, the company is a compelling investment proposition at the moment.

Northward Estimate Revisions: The positivity surrounding the stock is evident from the northward movement of estimate revisions. The Zacks Consensus Estimate for second-quarter 2024 earnings has moved up 9.1% in the past 90 days. For 2024, the Zacks Consensus Estimate has moved up 7.3% in the past 90 days.

Positive Earnings Surprise History: Kirby has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 10.26%.

Earnings Expectations: Earnings growth and stock price gains often indicate a company’s prospects. For second-quarter 2024, KEX’s earnings are expected to grow 38.95% year over year. For 2024, KEX’s earnings are expected to grow 42.47% year over year.

Driving Factors: Kirby’s consistent measures to reward its shareholders through share buybacks are appreciative. During 2023, Kirby repurchased 1,485,159 shares for $112.8 million. In the first quarter of 2024, Kirby repurchased 498,505 shares for $41.8 million. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line.

Kirby’s strong cash flow generating ability raises optimism about the stock. In first-quarter 2024, Kirby generated $123.3 million of cash from operating activities compared with $16.5 million in the year-ago quarter. In 2023, Kirby generated $540.2 million of cash from operating activities, which is higher than $294.1 million generated in 2022. For 2024, net cash flow provided by operating activities is anticipated to be in the $600-$700 million band. This expectation is higher than $540.2 million generated in 2023.

Other Stocks to Consider

Some other top-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance