Here's Why Investors Should Retain Vail Resorts (MTN) Stock

Vail Resorts, Inc. MTN is benefiting from a robust season pass program and strategic business initiatives, including enhancements at ski resorts and digital upgrades.

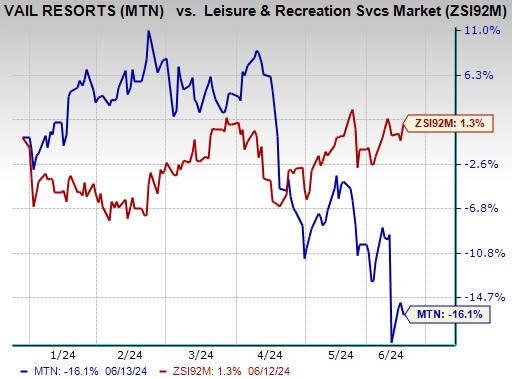

However, shares of this Zacks Rank #3 (Hold) company lost 16.1% in the year-to-date period against the Zacks Leisure and Recreation Services industry’s 1.3% growth.

This company is suffering from decreased visitation trends from skiers, increased expenses and weather-related challenges. Given the nature of business, its operations are primarily driven by the winters, which did not seem to have positively driven its results during the fiscal third quarter of 2024.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors Likely to Drive Growth

Season Pass Program Bodes Well: Vail Resorts has a season pass program under which it offers a variety of season pass products for all mountain resorts and urban ski areas in both domestic and international markets. During the fiscal third-quarter 2024 earnings call, the company highlighted the pass product sales for the 2023/2024 North American ski season, which grew 62% in units and 43% in sales dollars over the past three years. It also stated to have increased pass product pricing by 25% through spring 2024.

The company also reported season pass sales for the upcoming 2024/25 North American ski season. Season-to-date (through May 28, 2024), it stated that pass product sales increased approximately 1% in sales dollars compared with the prior-year period’s (through May 30, 2023) levels.

Strategic Initiatives: Vail Resorts continues to reinvest in its resorts and digital enhancements to boost customer traffic. The company is moving forward with the intended upgrades at its ski resorts, including a new six-person high-speed lift at Whistler Blackcomb accompanied by a new six-person high-speed lift and a fixed grip four-person lift at Hunter Mountain. Also, for Park City, Vail Resorts intends to replace the Sunrise lift with a new 10-person gondola in collaboration with the Canyons Village Management Association in 2025, thereby enhancing access and the overall guest experience.

Regarding digital enhancements, during the fiscal first quarter, Vail Resorts launched the My Epic app, which offered features like Mobile Pass, mobile lift tickets, interactive trail maps, real-time and predictive lift line wait times, and other personalized statistics to enhance the guest experience. The new enhancements under the app, including Direct to Lift Benefit Tickets, aided the 2023/2024 North American ski season and are expected to boost the new season of 2024/25.

Factors Marring Prospects

Softer Visitation Trends: Unfavorable conditions across Vail Resorts’ North American resorts have resulted in reduced visitation levels for quite some time now. The numbers have been below both the prior years’ statistics and the company's initial expectations based on guest numbers and frequency. In the fiscal third quarter, during the 2023/2024 North American and European ski season, total skier visitation declined 7.7% compared to the same period in the fiscal year 2023. The downtrend was driven by a combination of unfavorable conditions and broader industry normalization post-COVID following record visitation in the United States during the 2022/2023 ski season. Skier visitation from lift ticket guests, which declined 17% compared to the year ago period, was particularly impacted.

Weather-Related Risks: Vail Resorts’ nature of business makes it vulnerable to weather-related risks, especially the winters. During the fiscal third-quarter earnings call, the company stated that the winter season showcased weather-related challenges with approximately 28% lower snowfall for the full winter season across its Western North American resorts compared with the same period in the prior year. Also, there was limited natural snow and variable temperatures at its Eastern U.S. resorts, which comprise Midwest, Mid-Atlantic and Northeast resorts.

This factor eventually drove the decline in the number of skier visits during the period, resulting in the downtick of the top line of the company.

Increased Expenses: To counter the negative impacts of the weather and other related issues, Vail Resorts has been considering various strategic investments to upgrade its ski resorts. The upgrades include new high-speed lift changes with increased headcounts and snowmaking system enhancements. Also, enhancements to its digital platform, My Epic app, and the launch of a new platform, My Epic Gear, have taken a toll on the company’s expenses.

During the fiscal third quarter, the company’s total operating expenses increased to $631.1 million from $616.7 million reported a year ago. The uptrend was driven by a rise in the Mountain and Lodging segments’ operating expenses as well as general and administrative expenses and increased variable expenses associated with rising revenues.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has gained 43.9% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 47.2% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 62.9% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.8% and 63.8%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Vail Resorts, Inc. (MTN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance