Here's Why You May Invest in Theravance (TBPH) Stock Now

Theravance Biopharma’s TBPH lead pipeline candidate is ampreloxetine, which is being developed for the treatment of symptomatic neurogenic orthostatic hypotension (nOH) in patients with multiple system atrophy (MSA).

Theravance has collaborated with Viatris VTRS for the commercialization of Yupelri, as a once-daily, nebulized treatment of chronic obstructive pulmonary disease (COPD) in the United States.

Here are some reasons why investors should consider betting on Theravance stock.

Good Rank and Rising Estimates: Theravance currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Theravance’s 2024 earnings per share have improved from breakeven to 6 cents. During the same period, earnings per share estimates for 2025 have moved up from 80 cents to 85 cents.

Prioritizing Resource Allocation Toward Ampreloxetine: Theravance is prioritizing the development of ampreloxetine, a norepinephrine reuptake inhibitor, for the treatment of symptomatic nOH in patients with MSA. The FDA has granted Orphan Drug designation to ampreloxetine for the treatment of symptomatic nOH in patients with MSA.

The phase III CYPRESS study is evaluating ampreloxetine for treating nOH in patients with MSA. Patient enrollment in the study is expected to be completed by the second half of 2024, with top-line data from the same expected in 2025. TBPH plans to submit regulatory filings for ampreloxetine if data from the CYPRESS study is found to be positive.

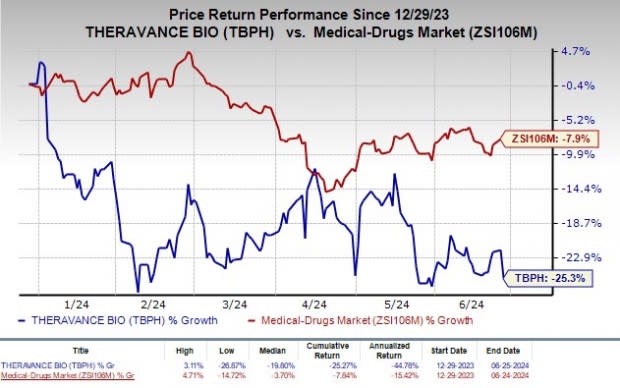

Shares of Theravance have declined 25.3% year to date compared with the industry’s decline of 7.9%.

Image Source: Zacks Investment Research

Yupelri Holds Significant Potential: Yupelri is the first once-daily nebulized, long-acting muscarinic antagonist (LAMA) option for COPD patients. Yupelri provides COPD patients with access to a nebulized LAMA therapy, offering a consistent 24-hour lung function improvement with the convenience of once-daily dosing delivered through any standard jet nebulizer.

Viatris and Theravance share U.S. profits and losses received in connection with the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance receives the remaining 35%. Viatris’ collaboration revenues include Theravance’s 35% share of net sales of Yupelri, as well as its proportionate amount of the total shared costs incurred by the two companies.

Viatris recognizes product sales from Yupelri and also owns a stake in Theravance.Yupelri has been witnessing strong sales uptake so far and the momentum is likely to continue for the rest of 2024.

Restructuring Initiatives Saving Costs: In 2021, Theravance implemented a major cost-reduction program and undertook various strategic actions to prioritize its pipeline development aimed at maximizing shareholder value. The decision was taken following the failure of its two non-respiratory disease-related pipeline candidates in two different clinical studies. The restructuring was completed in the third quarter of 2022, resulting in significant cost savings for the company.

As a result of the portfolio prioritization and streamlining of its operations, the company reduced its workforce by almost 17% in March 2023, leading to substantial cost savings.

Other Stocks to Consider

Some other stocks to consider in the healthcare sector are Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 at present.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, shares of ALGS have declined 39.3%.

ALGS’s earnings beat estimates in three of the trailing four quarters and missed on the other occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, shares of RAPT have plunged 87.6%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Theravance Biopharma, Inc. (TBPH) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance