Here's Why You Should Retain Inari Medical (NARI) for Now

Inari Medical, Inc. NARI is well-poised for growth, backed by a huge market opportunity for its products and its commitment to understanding the venous system. However, its dependency on the adoption of products is concerning.

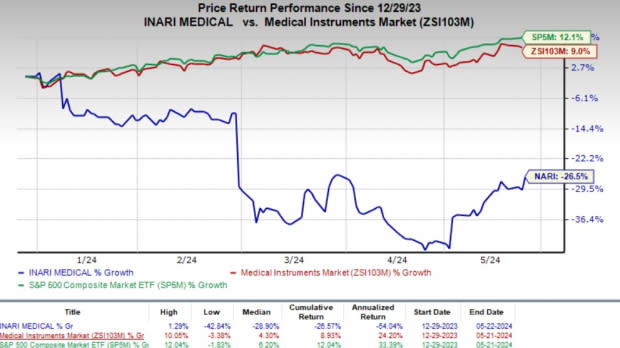

Shares of this Zacks Rank #3 (Hold) company have lost 26.5% year to date against the industry’s 9% growth. The S&P 500 Index has risen 12.1% in the same time frame.

NARI, with a market capitalization of $2.66 billion, is a commercial-stage medical device company. It seeks to develop products for treating and changing the lives of patients suffering from venous diseases.

The company’s negative earnings yield of 1.3% compares favorably with the industry’s (-6.9%). It delivered a trailing four-quarter average earnings surprise of 130.74%.

Image Source: Zacks Investment Research

What’s Driving NARI’s Performance?

Inari Medical is spearheading the creation and commercialization of devices that are built, keeping in mind the specific characteristics of the venous system, its diseases and unique clot morphology. The company’s in-depth knowledge of its target market and commitment to understanding the venous system allowed it to figure out the unmet needs of patients as well as physicians. This, in turn, enabled NARI to quickly innovate and improve its products while updating its clinical and educational programs.

Strong procedural growth across both its product lines, ClotTriever and FlowTriever, drove the company’s top line in 2023, a trend that is likely to be reflected in 2024. Continued expansion of its product portfolio, with new introductions like Protrieve, InThrill and FlowSaver, among others, is driving the adoption of Inari Medical’s products.

The company’s commercial expansion and market development plans have been driving the global Venous Thromboembolism (VTE) business, its major revenue generator. Moreover, rising demand for emerging therapies like RevCore should bring additional revenues in the upcoming quarters, thereby boosting top-line growth. The company is currently engaged in the limited market release of Venacore, the second purpose-built tool within the CBD toolkit, expanding NARI’s emerging therapies category.

In November 2023, the company acquired and launched LimFlow, a pioneer in limb salvage for patients with chronic limb-threatening ischemia (CLTI). The minimally-invasive LimFlow System is designed to bypass blocked arteries in the leg and deliver oxygenated blood back into the foot via the veins in no-option CLTI patients who are facing major amputation and have exhausted all other therapeutic options.

LimFlow system has FDA approval for its Transcatheter Arterialization of Deep Veins system. The acquisition adds a highly differentiated growth platform to Inari Medical’s portfolio that is likely to provide multiple opportunities for expansion, including so in the CLTI patient population. NARI is successfully progressing with the LimFlow integration.

Increased adoption of Inari Medical’s products in Western Europe and case growth in its early-stage markets in Latin America, Canada and the Asia-Pacific region look promising. The company expects to start treating patients in China and Japan in 2024. International markets present a significant opportunity for NARI’s long-term growth. Management expects the international business to represent more than 20% of its future revenues on the back of unmet needs.

What’s Weighing on the Stock?

Most of NARI’s product sales come from a limited number of hospitals. The company’s growth and profitability mainly depend on its ability to boost awareness of its products among physicians and patients. These also depend on how keen physicians and hospitals are to adopt its products and perform catheter-based thrombectomy procedures on patients suffering from venous thromboembolism.

Inari Medical’s inability to validate the benefits of its products and catheter-based thrombectomy procedures should result in limited adoption of the same. Moreover, it might not happen as quickly as expected. These factors, in unison, might negatively impact NARI’s business and financial condition.

Also, as Inari Medical expects to incur further operating loss in the near future, it is unable to assure of its ability to maintain profitability in the future. This, in turn, is likely make it more difficult to finance its business and achieve strategic objectives, thereby hampering its business, financial condition and stock performance.

Estimates Trend

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $598.9 million, indicating a 21.3% increase from the previous year’s reported number. The consensus estimate for the bottom line is pinned at a loss of 58 cents, implying a 546% decline from that recorded a year ago. However, earnings are expected to improve 134% in 2025.

Inari Medical, Inc. Price

Inari Medical, Inc. price | Inari Medical, Inc. Quote

Key Picks

Some better-ranked stocks in the broader medical space areDaVita Inc. DVA, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 40.1% compared with the industry’s 24.1% growth in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.5%.

Boston Scientific’s shares have risen 41.4% against the industry’s 1.3% decline in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.5%. ECL’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.3%.

Ecolab’s shares have rallied 36.2% against the industry’s 9.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance