Here's Why You Should Retain W&T Offshore in Your Portfolio

W&T Offshore, Inc. WTI is well poised to grow on the back of massive oil-equivalent reserves in the deepwater Gulf of Mexico.

Headquartered in Houston, TX, W&T Offshore, Inc. is a leading oil and natural gas explorer with operations primarily focused on resources located off the coast of the Gulf of Mexico. This enables the $782-million market cap company to develop significant technical expertise in the major prolific oceanic rift basin.

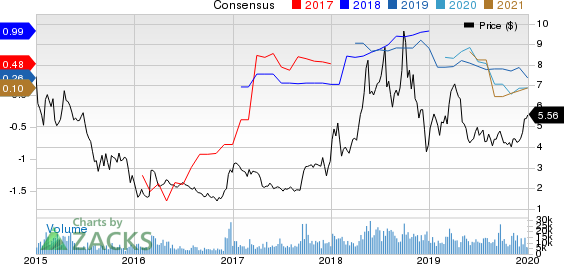

W&T Offshore, Inc. Price and Consensus

W&T Offshore, Inc. price-consensus-chart | W&T Offshore, Inc. Quote

Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

What’s Driving the Stock?

The prolific oil and gas offshore fields in the Gulf of Mexico (GoM) shelf have been primarily boosting the company’s production since its inception. New discoveries in those fields, located at a water depth of 500 feet, will likely boost W&T Offshore’s production. Notably, the GoM provides unique advantages, including low decline rates, world-class permeability and significant potential reserves that are untapped.

W&T Offshore is growing its presence in the deep-water Gulf of Mexico fields, wherein production grew more than 500% and proved reserves surged nearly 900% over the past eight years. Notably, the company acquired interests in the prospective Heidelberg field in the deep-water Gulf of Mexico. Also, deep-water discoveries made in recent years have enhanced its prospects.

The company recorded 137.8 million barrels of oil equivalent (MMBoe) of proven or 1P reserves in the GoM shelf. In the deepwater GoM, the company has 19.8 MMBoe of 1P reserves. Significant proved reserve bases in both the shelf and deepwater resources will likely contribute to the upstream energy player’s cash flows.

W&T Offshore closed the Mobile Bay acquisition from ExxonMobil in third-quarter 2019. The assets, located in the eastern region of the GoM, include some onshore processing facilities adjacent to W&T Offshore’s existing properties. The acquisition is expected to lead to significant synergies and cost savings for the company. Also, this move added net proved reserves of 74 MMBoe to its portfolio. Of the total reserves, the vast majority are categorized as proved developed and producing.

Downsides

There are a few factors that are impeding the growth of the stock lately.

The company expects lease operating expenses through 2019 between $187 million and $193 million, indicating a significant increase from $153.3 million in 2018. Higher operating expenses will deal a major blow to its profits. As liquids comprise majority (53% in third-quarter 2019) of production volumes, the company is prone to oil price-related risks.

Moreover, as of Sep 30, 2019, W&T Offshore had a total long-term debt of $719 million, with cash balance of only $41.7 million, reflecting a weak balance sheet. This can hurt the company's financial flexibility.

To Sum Up

Despite significant prospects as mentioned above, higher operating costs and balance sheet weakness are concerns. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Key Picks

Some better-ranked stocks in the energy sector include CNX Resources Corporation CNX, Marathon Oil Corporation MRO and Frank's International N.V. FI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CNX Resources’ earnings for the current year have witnessed four upward revisions in the past 60 days versus no movement in the opposite direction.

Marathon Oil’s earnings for the current year have witnessed six upward revisions in the past 60 days versus one downward movement.

Frank's International’s bottom line for 2019 is expected to rise 23.8% year over year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Frank's International N.V. (FI) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance