Here's Why We're Watching Acrux's (ASX:ACR) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Acrux (ASX:ACR) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Acrux

How Long Is Acrux's Cash Runway?

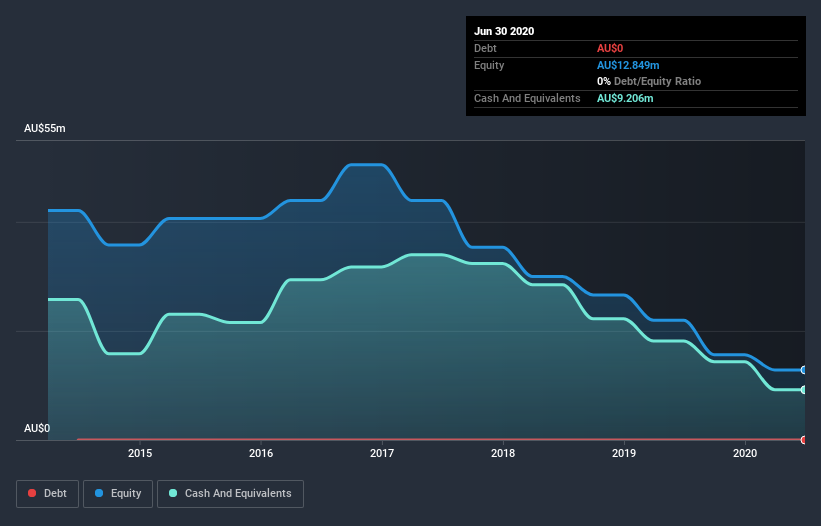

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Acrux last reported its balance sheet in June 2020, it had zero debt and cash worth AU$9.2m. Looking at the last year, the company burnt through AU$8.8m. That means it had a cash runway of around 13 months as of June 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Is Acrux's Cash Burn Changing Over Time?

Whilst it's great to see that Acrux has already begun generating revenue from operations, last year it only produced AU$1.3m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. With cash burn dropping by 15% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Acrux makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Acrux Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Acrux to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Acrux has a market capitalisation of AU$49m and burnt through AU$8.8m last year, which is 18% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Acrux's Cash Burn?

Acrux appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash burn relative to its market cap, while on the other it can also boast very strong cash burn reduction. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking a deeper dive, we've spotted 6 warning signs for Acrux you should be aware of, and 3 of them can't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance