Hewlett Packard (HPE) Enhances GreenLake, Intends Expansion

Hewlett Packard Enterprise HPE recently strengthened its edge-to-cloud platform, GreenLake, with new application, analytics and developer services. The advancement allows enterprises to drive a data-first modernization strategy for production workloads across hybrid cloud environments. The platform provides an automated, flexible, scalable and fully managed enterprise-grade private cloud.

The latest upgrade to HPE GreenLake for Private Cloud Enterprise comprises expanded container deployment options for Kubernetes with Amazon Elastic Kubernetes Service Anywhere, infrastructure-as-code and cloud-based toolchains to improve software development, IT operations and continuous integration and continuous deployment (CI/CD) environments.

The upgrade further ensures the availability of six workload-optimized instances for general purpose, compute, memory and storage on the GreenLake for Private Cloud Enterprise. These workloads come with competitive rate card pricing that offers a straightforward pay-as-you-go consumption model. With these developments, HPE intends to enhance the global reach of the GreenLake for Private Cloud Enterprise solution.

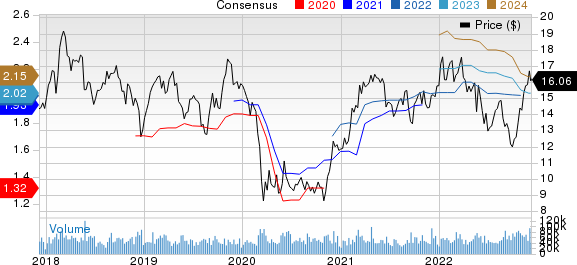

Hewlett Packard Enterprise Company Price and Consensus

Hewlett Packard Enterprise Company price-consensus-chart | Hewlett Packard Enterprise Company Quote

Moreover, the recent update enables organizations to self-serve the management of VMs, containers or bare metal conveniently by utilizing an intuitive user interface console, application programming interfaces (APIs), and command line interface (CLI). This gives them immediate access to their workspace with flexibility to choose from a variety of operating systems, containerized application stacks and toolchain integration services.

The update further features an expanded partner ecosystem which now includes VMWare and IBM-owned Red Hat, availability of HPE GreenLake for Data Fabric and HPE Ezmeral Unified Analytics via Ezmeral early access program and enhancement to consumption for three public cloud vendors.

Hewlett Packard’s GreenLake platform offers customers better visibility into resource utilization across co-located and public cloud-based workloads. The services ensure the administration of applications and data.

The platform continues to win back-to-back deals. Recently, in September, the leading French healthcare software provider, Maincare, adopted the HPE GreenLake to power its highly secure cloud offering, Maincare Hosting Services.

Prior to that, in August, Steel Authority of India Limited (SAIL), India’s largest steel producer, selected the HPE GreenLake edge-to-cloud platform for its Bokaro steel plant to modernize its critical SAP environment, accelerate its digital transformation agenda and reduce its environmental footprint.

In July, one of the leading cloud service providers in France, AntemetA selected HPE GreenLake for Disaster Recovery, a new cloud-native data solution that protects data from the edge to the cloud, to build a manageable, flexible and highly secure private hosting infrastructure to support strategic workloads and drive new business growth.

Hewlett Packard views AI, Industrial IoT and distributed computing as the next major markets. In 2018, the company decided to invest $4 billion through 2022 to enhance its capabilities across the aforementioned space and has linked these businesses to its fast-growing networking business, Aruba Networks.

The company has been benefiting from strong executions in clearing backlogs, improved supply chain and increased customer acceptance. Hewlett Packard’s efforts to shift focus to higher-margin offerings like Intelligent Edge and Aruba Central Hyperconverged Infrastructure are aiding its bottom-line results.

Shares of the company have climbed 4.4% in the past year.

Zacks Rank & Key Picks

Hewlett Packard currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the broader Computer and Technology sector are Celestica CLS, Fabrinet FN and Zscaler ZS. While Celestica flaunts a Zacks Rank #1 (Strong Buy), Fabrinet and Zscaler carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celestica’s fourth-quarter 2022 earnings has increased by 9 cents to 53 cents per share over the past 60 days. For 2022, earnings estimates rose 16 cents to $1.86 per share in the past 60 days.

CLS' earnings beat the Zacks Consensus Estimate in all the preceding four quarters, the average surprise being 11.8%. Shares of the company have increased 2.2% in the past year.

The Zacks Consensus Estimate for Fabrinet's second-quarter fiscal 2023 earnings has been revised 16 cents northward to $1.89 per share over the past 30 days. For fiscal 2023, earnings estimates have improved by 7.6% to $7.48 per share in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, missing once, the average surprise being 5.4%. Shares of the company have gained 11.7% in the past year.

The Zacks Consensus Estimate for Zscaler's first-quarter fiscal 2023 earnings has been revised 7 cents north to 26 cents per share over the past 90 days. For fiscal 2023, earnings estimates have moved south by a penny to $1.17 per share in the past 30 days.

ZS' earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 28.6%. Shares of the company have declined 62.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celestica, Inc. (CLS) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance