Hewlett Packard (HPE) to Transform Chemist Warehouse Data Center

Hewlett Packard Enterprise HPE recently announced that it has been selected by the largest Australian pharmacy retail chain operator — Chemist Warehouse — to provide hyperconverged platform and virtual desktop infrastructure (“VDI”) solutions.

Per the agreement, HPE’s ProLiant servers will power Chemist Warehouse’s IT infrastructure solutions. HPE’s ProLiant DL325 Gen10 Plus servers using 2nd Gen AMD EPYC processors will be transforming the pharmacy retailer’s on-premise data center into a completely hyperconverged platform and VDI.

Founded in 2000, the Melbourne-based pharmacy retailer serves over 1.5 million customers per week. Chemist Warehouse has more than 400 stores located across Australia, and is expanding further into countries like China, Ireland and New Zealand.

The latest move will boost Chemist Warehouse’s energy efficiency by consuming 30% less power than required under the existing setup. Thus, it will be enhancing the pharmacy’s automation and sustainability efforts. Besides, the move will generate better sales and improved customer experiences for the Chemist Warehouse.

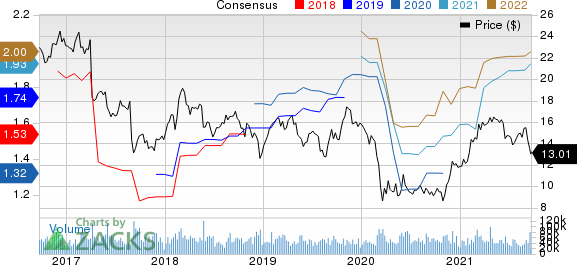

Hewlett Packard Enterprise Company Price and Consensus

Hewlett Packard Enterprise Company price-consensus-chart | Hewlett Packard Enterprise Company Quote

Meanwhile, HPE will be enhancing its workload optimized server portfolio through this deal. In fiscal 2020, the compute segment accounted for almost 45% of HPE’s total revenues.

With more and more companies shifting to fully automated and remote environment, the demand for HPE’s cloud computing offerings is high. In March 2021, the company announced that its ProLiant server suite along with its Apollo systems offering has delivered up to 39% stronger and more efficient performance, per VMmark 3.1.1 benchmark.

However, the COVID-19 pandemic-led supply and logistics disruptions are anticipated to harm HPE’s near-term results.

Zacks Rank & Key Picks

HPE currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are MaxLinear MXL, Paycom Software PAYC and Semtech Corporation SMTC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate of MaxLinear, Paycom and Semtech are pegged at 20%, 25% and 12.5%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Semtech Corporation (SMTC) : Free Stock Analysis Report

MaxLinear, Inc (MXL) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance