High Insider Ownership Growth Companies To Watch In June 2024

As global markets experience fluctuations with technology stocks showing notable strength amid favorable inflation data, investors are keenly observing trends that could influence their strategies. In such a market environment, growth companies with high insider ownership can be particularly compelling, as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 30.1% |

Gaming Innovation Group (OB:GIG) | 13.2% | 36.2% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Haci Ömer Sabanci Holding

Simply Wall St Growth Rating: ★★★★★☆

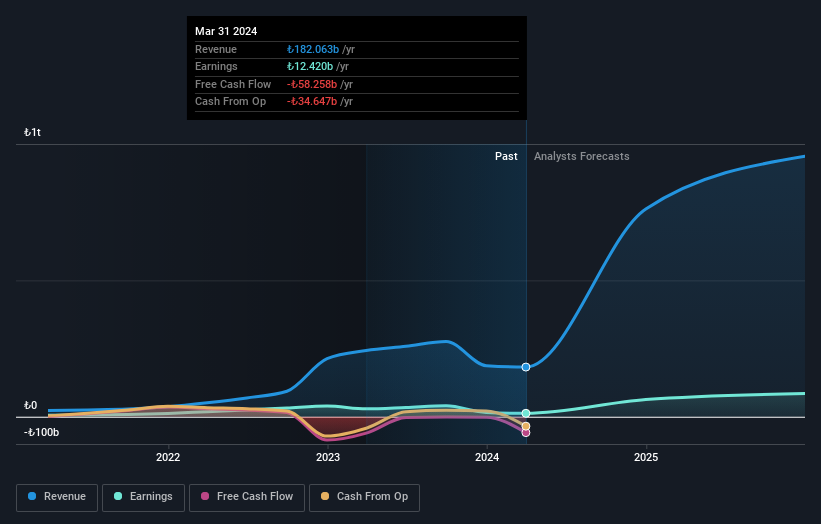

Overview: Haci Ömer Sabanci Holding A.Ş., with a market capitalization of TRY 197.12 billion, is engaged in finance, manufacturing, and trading activities globally.

Operations: The company's revenue is primarily derived from its segments in banking (TRY 388.31 billion), energy (TRY 192.32 billion), digital (TRY 52.76 billion), industry (TRY 49.50 billion), financial services (TRY 44.67 billion), and construction materials (TRY 41.53 billion).

Insider Ownership: 20.5%

Haci Ömer Sabanci Holding A.S. is experiencing robust forecasted revenue and earnings growth, with annual earnings expected to increase significantly at 76.7% and revenue at 68.4%. However, the company faces challenges, including a high bad loans ratio of 2.2% and a recent substantial net loss reported in Q1 2024 (TRY 5,366.16 million). Additionally, profit margins have decreased from last year's 11.9% to this year's 6.8%, indicating potential efficiency issues despite the promising growth metrics.

Mowi

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a global seafood company specializing in farming, producing, and supplying Atlantic salmon products, with a market capitalization of approximately NOK 97.97 billion.

Operations: Mowi's revenue is primarily generated from four segments: Feed (€1.07 billion), Farming (€3.38 billion), Sales & Marketing - Markets (€3.76 billion), and Sales & Marketing - Consumer Products (€3.64 billion).

Insider Ownership: 14.7%

Mowi ASA, a key player in the aquaculture industry, demonstrates strong potential with insiders significantly involved in its governance. Despite a recent dip in net income and earnings per share as reported for Q1 2024, Mowi's revenue growth is forecasted to outpace the Norwegian market significantly. Challenges include a high debt level and dividends that are not well-covered by earnings. Recent board changes could influence future strategic directions, enhancing governance but also introducing uncertainties about execution on ambitious financial forecasts.

Click here and access our complete growth analysis report to understand the dynamics of Mowi.

Our valuation report here indicates Mowi may be undervalued.

Do-Fluoride New Materials

Simply Wall St Growth Rating: ★★★★★☆

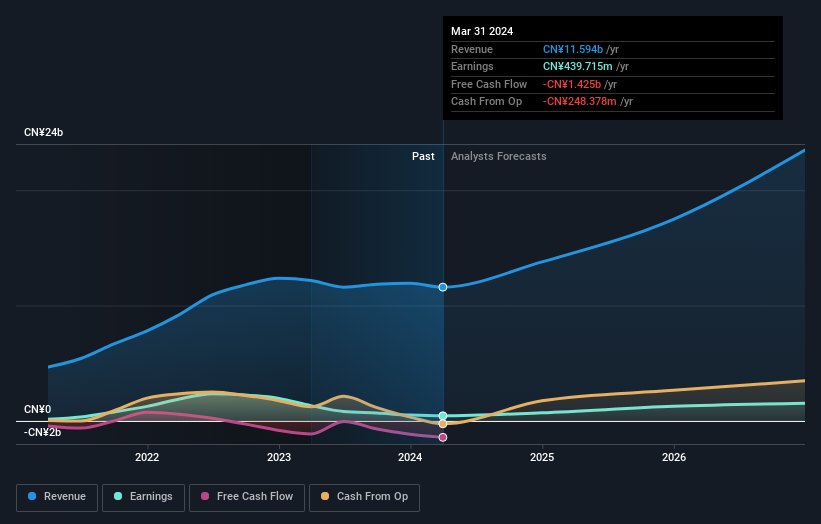

Overview: Do-Fluoride New Materials Co., Ltd. specializes in the development, production, and sale of inorganic fluorides, electronic chemicals, and lithium-ion battery materials both domestically and internationally, with a market capitalization of approximately CN¥15.41 billion.

Operations: The company generates revenue primarily through the sale of inorganic fluorides, electronic chemicals, and materials for lithium-ion batteries.

Insider Ownership: 13.9%

Do-Fluoride New Materials, amidst a backdrop of recent corporate governance changes and a dividend decrease, shows mixed financial dynamics. While its Q1 2024 earnings have dipped compared to the previous year, its revenue and earnings growth projections remain robust, outpacing broader Chinese market expectations. However, concerns arise from a decline in profit margins and the sustainability of dividends given current cash flows. The company's active share buyback program reflects confidence from management but also highlights issues around shareholder dilution over the past year.

Key Takeaways

Reveal the 1447 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include IBSE:SAHOL OB:MOWI and SZSE:002407.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance