High Insider Ownership Growth Companies On The Japanese Exchange In June 2024

Amid a mixed performance in Japan's stock markets, with the Nikkei 225 Index seeing modest gains and the TOPIX Index experiencing slight declines, investors are closely watching insider activities. High insider ownership can be a signal of confidence in a company’s future prospects, particularly valuable in an environment where economic indicators and central bank policies are under intense scrutiny.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Medley (TSE:4480) | 34% | 28.7% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 81% |

Underneath we present a selection of stocks filtered out by our screen.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

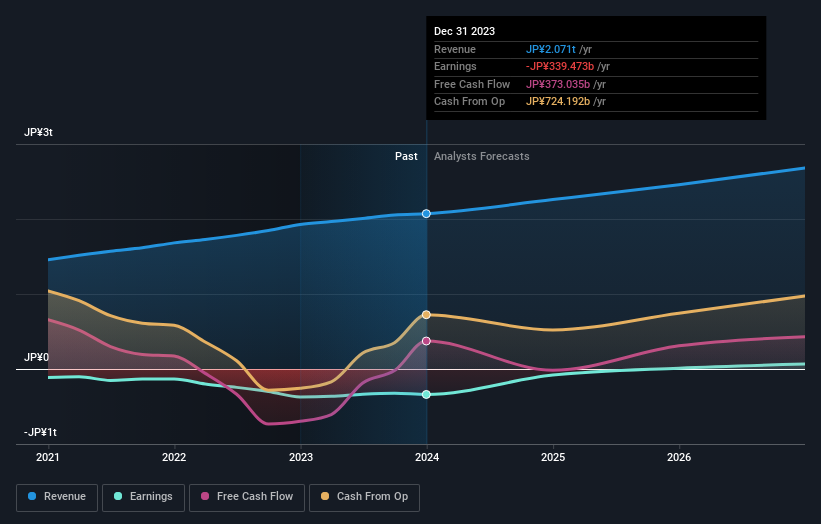

Overview: Rakuten Group, Inc. operates in multiple sectors including e-commerce, fintech, digital content, and communications, serving a diverse international clientele with a market capitalization of approximately ¥1.77 trillion.

Operations: The company generates revenue through its diverse operations in sectors such as online retail, financial services, digital media, and telecommunications.

Insider Ownership: 17.3%

Rakuten Group, positioned in Japan's high insider ownership sector, shows promising signs with an expected shift to profitability within three years, coupled with a revenue growth rate of 7.4% annually—outpacing the Japanese market average. Despite challenges like a low forecasted return on equity at 9.1%, recent corporate activities including a substantial $1.99 billion fixed-income offering suggest strategic financial maneuvering to support its growth trajectory. This aligns with Rakuten's proactive adjustments in corporate strategy and financial structuring to enhance future earnings potential.

CYBERDYNE

Simply Wall St Growth Rating: ★★★★★☆

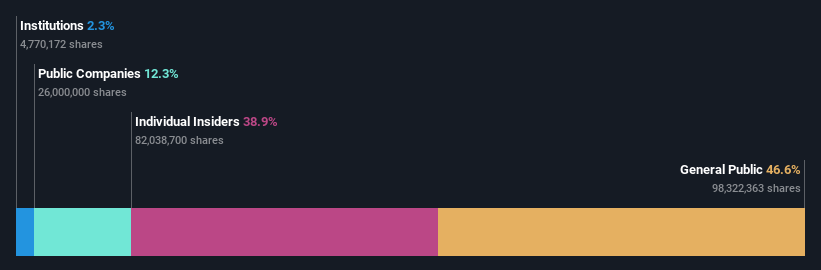

Overview: CYBERDYNE Inc. is a Japanese company engaged in the research, development, production, sale, leasing, and maintenance of medical and warfare equipment and systems with a market capitalization of approximately ¥44.55 billion.

Operations: The company generates revenue primarily through its robot-related business, which amounted to ¥4.35 billion.

Insider Ownership: 38.9%

CYBERDYNE, a growth-oriented firm in Japan with significant insider ownership, is set to expand its market presence following recent US FDA approvals for its innovative Medical HAL products. This regulatory nod could bolster CYBERDYNE's business in the U.S. and globally, enhancing its growth prospects. Despite a highly volatile share price and low forecasted return on equity of 1.1%, the company's revenue is expected to grow by 24.9% annually, outperforming the Japanese market average significantly.

Navigate through the intricacies of CYBERDYNE with our comprehensive analyst estimates report here.

Upon reviewing our latest valuation report, CYBERDYNE's share price might be too optimistic.

Inforich

Simply Wall St Growth Rating: ★★★★★☆

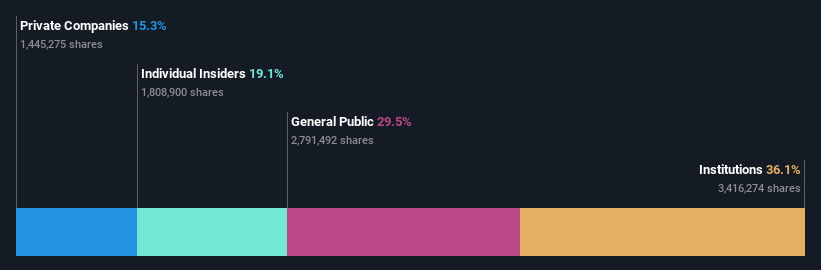

Overview: Inforich Inc., operating in Japan, provides portable power bank sharing services with a market capitalization of approximately ¥41.63 billion.

Operations: The firm operates primarily in the portable power bank sharing sector.

Insider Ownership: 19.1%

Inforich, a Japanese company, is expected to see substantial growth with earnings forecasted to increase by 31.14% annually. Despite recent shareholder dilution and a highly volatile share price, the firm's revenue growth at 23.1% per year outpaces the national market average significantly. Trading at 73.4% below its estimated fair value, Inforich demonstrates potential undervaluation amidst challenging conditions marked by one-off financial impacts.

Where To Now?

Click here to access our complete index of 98 Fast Growing Japanese Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4755 TSE:7779 and TSE:9338.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance