High Insider Ownership Growth Stocks On The ASX In June 2024

Amidst a backdrop of geopolitical tensions impacting the Australian stock market, as evidenced by the slight downturn in ASX futures, investors continue to navigate through fluctuating global and domestic economic signals. In such an environment, stocks with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the company best—its leaders and key stakeholders.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 14.9% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's explore several standout options from the results in the screener.

Kogan.com

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer based in Australia, with a market capitalization of approximately A$448.41 million.

Operations: The company generates revenue through its segments: Mighty Ape in Australia (A$11.39 million), Kogan Parent in Australia (A$274.85 million), Mighty Ape in New Zealand (A$142.52 million), and Kogan Parent in New Zealand (A$33.40 million).

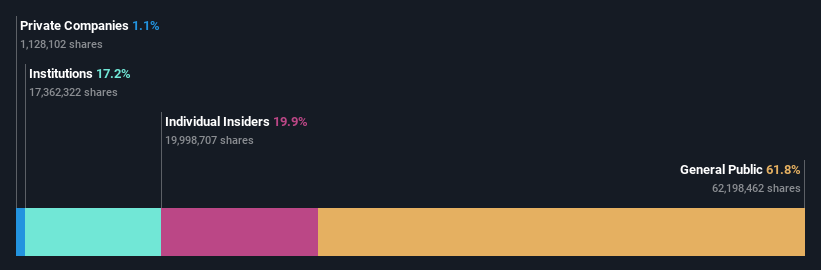

Insider Ownership: 19.8%

Kogan.com recently became profitable and is trading at 57.6% below its estimated fair value, highlighting potential underpricing. While its revenue growth of 6% per year is modest, it surpasses the Australian market average. More impressively, earnings are expected to surge by 35.07% annually over the next three years, outpacing broader market growth significantly. High insider ownership aligns leadership with shareholder interests, although there's no recent insider trading activity to report.

Unlock comprehensive insights into our analysis of Kogan.com stock in this growth report.

The valuation report we've compiled suggests that Kogan.com's current price could be inflated.

Mesoblast

Simply Wall St Growth Rating: ★★★★★☆

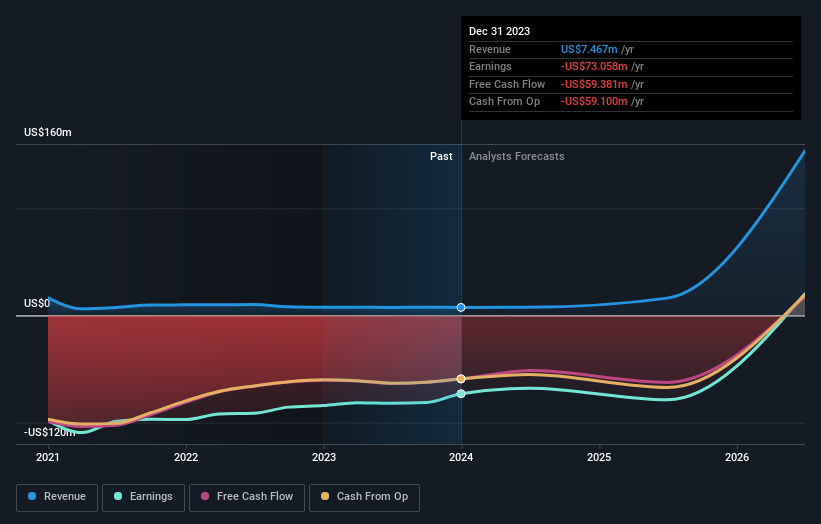

Overview: Mesoblast Limited, operating in Australia, the United States, Singapore, and Switzerland, focuses on developing regenerative medicine products with a market capitalization of approximately A$1.24 billion.

Operations: The company generates revenue primarily from its development of adult stem cell technology platform, totaling A$7.47 million.

Insider Ownership: 22.2%

Mesoblast Limited, a growth company in the Australian market, has seen insider purchases outweigh sales recently, indicating confidence from those closest to the company. Despite a volatile share price and shareholder dilution over the past year, Mesoblast is trading significantly below its estimated fair value. The company's revenue is expected to grow substantially at 55.3% annually, outperforming the broader market. Leadership changes include Jane Bell's appointment as non-executive Chair, enhancing governance with her extensive experience.

Navigate through the intricacies of Mesoblast with our comprehensive analyst estimates report here.

The valuation report we've compiled suggests that Mesoblast's current price could be quite moderate.

Ora Banda Mining

Simply Wall St Growth Rating: ★★★★★☆

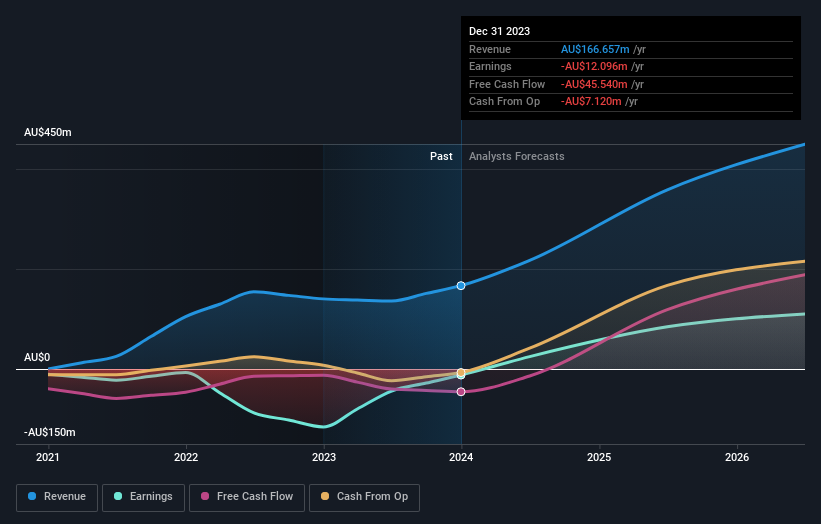

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$686.94 million.

Operations: The company generates revenue primarily from its gold mining segment, totaling A$166.66 million.

Insider Ownership: 10.2%

Ora Banda Mining, recently added to the S&P/ASX All Ordinaries Index, demonstrates promising growth with a significant increase in sales and net income, reversing previous losses. The company is trading well below its estimated fair value and is forecasted to grow revenue by 41.9% annually, surpassing average market growth. However, shareholders have experienced dilution over the past year. Insider trading data for the last three months remains unavailable, leaving some uncertainty about insider confidence levels.

Upon reviewing our latest valuation report, Ora Banda Mining's share price might be too pessimistic.

Key Takeaways

Click this link to deep-dive into the 90 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:KGN ASX:MSB and ASX:OBM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance