High Insider Ownership Growth Stocks On SEHK To Watch In May 2024

As of May 2024, the Hong Kong market has experienced notable fluctuations, with the Hang Seng Index recently retreating by 4.83%. This movement reflects broader global economic concerns and specific regional challenges, including ongoing issues in China's property sector. In such a landscape, stocks with high insider ownership can be particularly intriguing as they often indicate a strong alignment between company management and shareholder interests, potentially offering stability amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 73.8% |

Beijing Airdoc Technology (SEHK:2251) | 27.2% | 83.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Here's a peek at a few of the choices from the screener.

J&T Global Express

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited operates in express delivery services across Southeast Asia and China, with a market capitalization of approximately HK$73.05 billion.

Operations: The company generates revenue primarily through its air freight transportation segment, totaling approximately $8.85 billion.

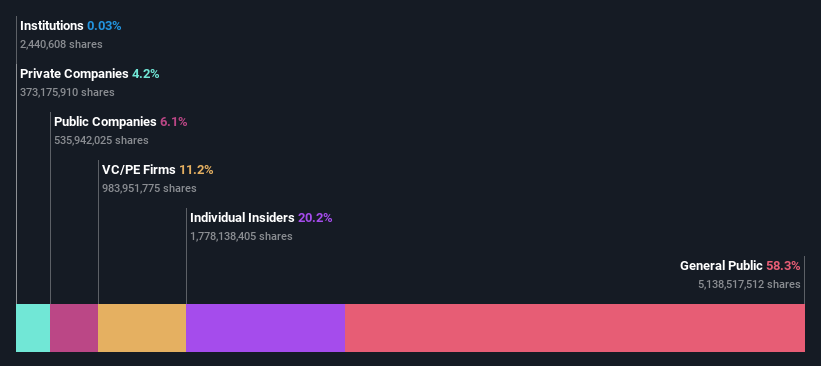

Insider Ownership: 20.2%

Earnings Growth Forecast: 104.1% p.a.

J&T Global Express, a growth-oriented company in Hong Kong with significant insider ownership, has shown robust performance with a 21.8% revenue increase over the past year. Despite recent executive changes, adding experienced board members like Mr. Peter Lai, the company is positioned for continued expansion. It's forecasted to outpace the local market with an annual revenue growth of 15.5%, and earnings expected to surge by 104.1% annually, transitioning into profitability within three years.

Take a closer look at J&T Global Express' potential here in our earnings growth report.

Our valuation report unveils the possibility J&T Global Express' shares may be trading at a premium.

Dongyue Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company that produces and markets polymers, organic silicone, refrigerants, dichloromethane, PVC, and liquid alkali among other products across China and globally, with a market capitalization of approximately HK$16.25 billion.

Operations: The company's revenue is generated from several segments, including polymers (CN¥4.55 billion), refrigerants (CN¥5.48 billion), organic silicone (CN¥4.86 billion), and dichloromethane, PVC, and liquid alkali (CN¥1.21 billion).

Insider Ownership: 15.4%

Earnings Growth Forecast: 35.7% p.a.

Dongyue Group, despite a challenging year with significant declines in net profit and sales, remains a key player among growth companies in Hong Kong due to its high insider ownership. The company reported a sharp decrease in earnings but is positioned for recovery with expected revenue growth outpacing the local market at 15.4% annually. Recent executive reshuffles aim to strengthen compliance and strategic direction, aligning with its long-term growth trajectory despite current financial setbacks.

Click to explore a detailed breakdown of our findings in Dongyue Group's earnings growth report.

Upon reviewing our latest valuation report, Dongyue Group's share price might be too optimistic.

CanSino Biologics

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company based in the People's Republic of China that focuses on developing, manufacturing, and commercializing vaccines, with a market capitalization of approximately HK$9.24 billion.

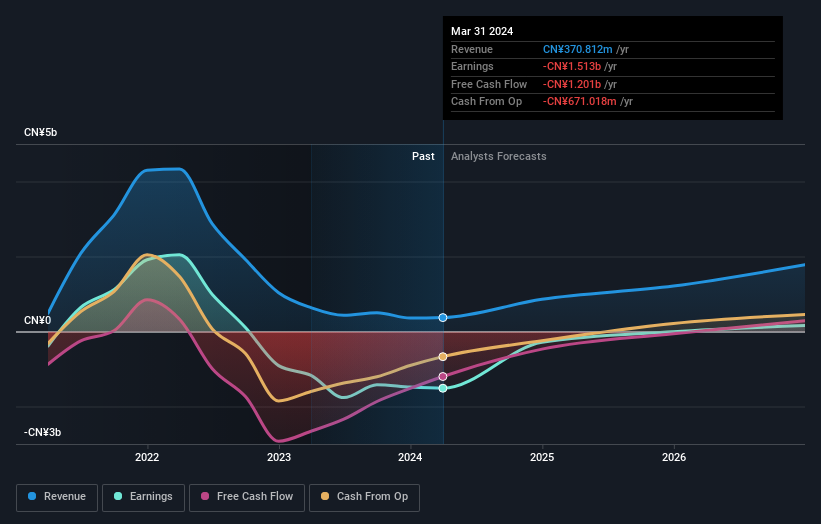

Operations: The company generates revenue primarily from the research and development of vaccine products for human use, totaling CN¥370.81 million.

Insider Ownership: 27.9%

Earnings Growth Forecast: 124.6% p.a.

CanSino Biologics, amidst a challenging financial landscape with increasing losses, continues to invest heavily in R&D, leading to promising clinical trials for vaccines like Hib and PBPV. These developments could potentially enhance its market position upon successful commercialization. Despite a current low return on equity forecast at 5.1% in three years and trading well below fair value, the firm's aggressive growth strategy in the biotech sector is marked by substantial insider ownership, aligning leadership interests with long-term success.

Seize The Opportunity

Access the full spectrum of 52 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1519SEHK:189 and SEHK:6185

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance