Hindenburg Report Throws Swiss Fintech Temenos Into Turmoil

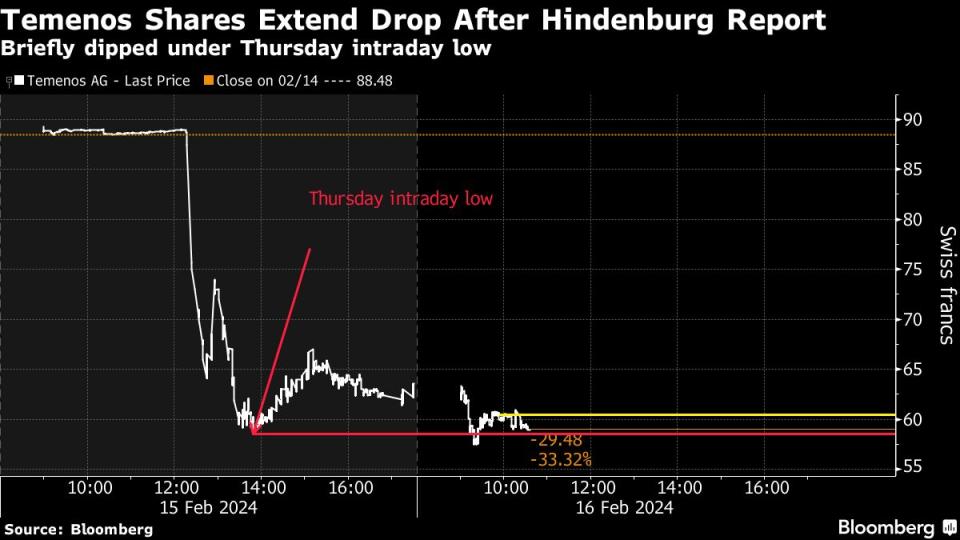

(Bloomberg) -- Temenos AG was a target of activist investors even before a report by Hindenburg Research led to the biggest drop in 15 years in the Swiss banking software company’s shares.

Most Read from Bloomberg

Largest Covid Vaccine Study Yet Finds Links to Health Conditions

China Tightens Grip on Stocks With Net Sale Ban at Open, Close

Capital One to Buy Discover for $35 Billion in Top 2024 Deal

US Tells Allies Russia May Launch Anti-Satellite Nuclear Weapon Into Space This Year

But unlike in the past when investors pointed more broadly to governance issues in its corporate suite, Hindenburg alleges serious flaws in the company’s books, suggesting “major accounting irregularities.” Temenos also “manipulated earnings,” the short seller said in its report, adding that the practices were an “open secret” at the company. Hindenburg said it conducted a four-month investigation during which it interviewed 25 former employees, “including senior leaders.”

Temenos denied the report, which it said “contains factual inaccuracies and analytical errors, together with false and misleading allegations.” Investors will be looking to the company, which counts Swiss billionaire Martin Ebner as its second-biggest shareholder, to counter the claims at length at its Capital Markets Day on Tuesday.

Read more: Why Activist Short Sellers Stir Up Controversy: QuickTake

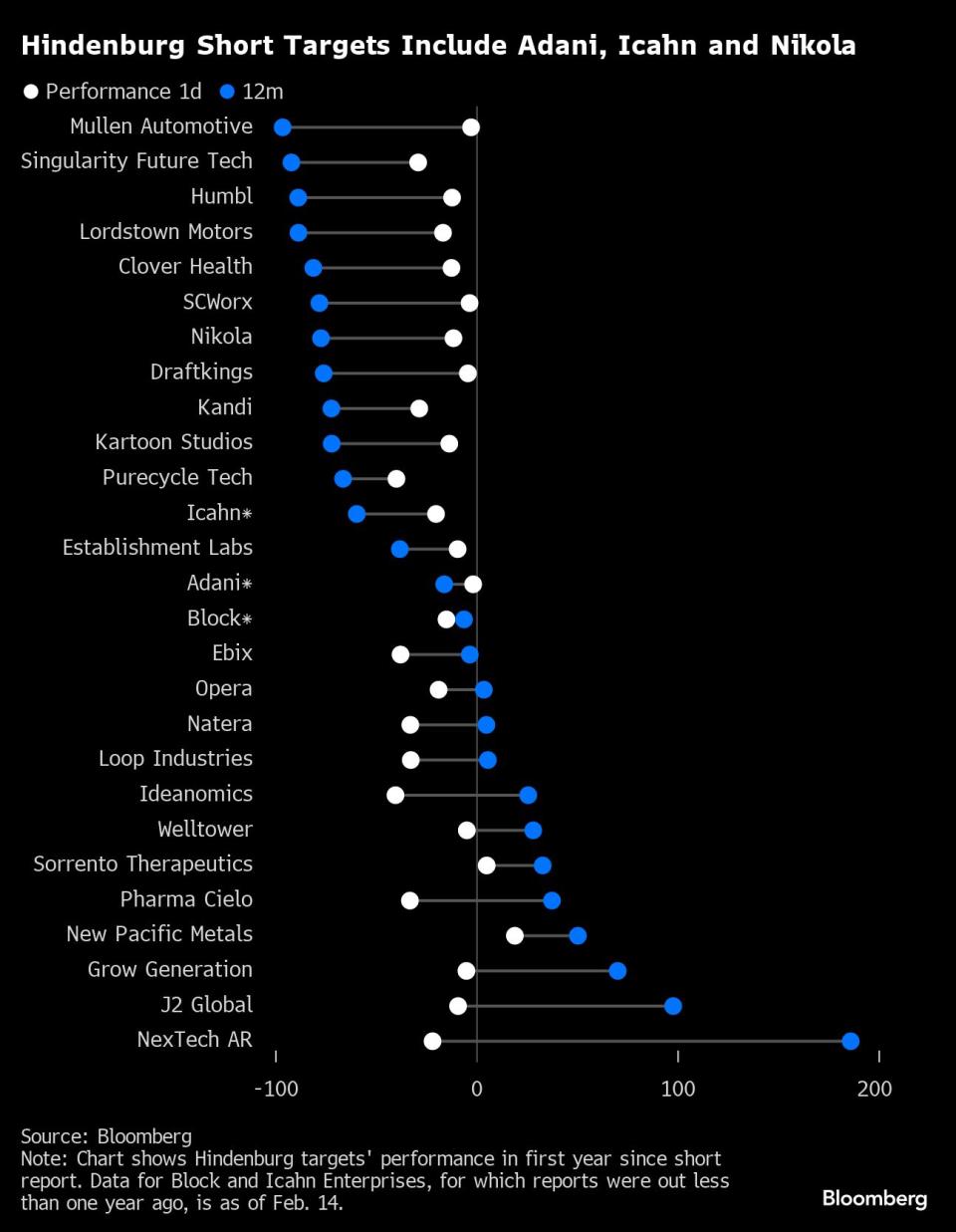

Hindenburg’s past performance suggests the allegations against the Geneva-based company may not go away anytime soon. The activist short seller run by Nate Anderson has taken on the empires of such high-profile businessmen across the world as Gautam Adani, Jack Dorsey, Carl Icahn, wiping out billions of their firms’ market capitalization at one point. Shares of some of its targets have since rebounded.

“Their track record speaks for itself, and investors have learned to listen when they make a call,” said Chris Beauchamp, chief market analyst at online trading platform IG. “They take their time over the research they produce. Hence when they speak, the market pays heed.”

Temenos shares fell as much as 9.5% on Friday, extending the 28% drop the day before. The company is now worth about a third compared to its 2019 peak of 13 billion Swiss francs ($14.7 billion).

Hindenburg’s report contains allegations of failed projects and frustrated customers in North America, a key strategic market. A relatively new division that was meant to diversify away from core banking software into digital banking products is described as a failure. The report alleges that the company indulged in round-tripping revenue, pulled forward contract renewals, backdated contracts and had other “classic accounting red flags.”

“We take these allegations seriously,” Cengiz Sen, an analyst at Julius Baer, wrote in a note, adding that what’s worrying is Hindenburg’s “claim of having interviewed well-informed former senior leaders.”

A spokesperson for Switzerland’s Financial Supervisor Finma declined to comment on Temenos, saying that it doesn’t comment on individual cases. Bloomberg News has also reached out to Hindenburg for comment.

Hindenburg’s Record

Some of Hindenburg’s targets, like Nikola and the Adani Group, are still suffering from the after-effects of damaging claims it made on alleged fraud and market manipulation.

Adani Group managed to get past the worst of the crisis as India’s top court ordered the country’s markets regulator to conclude its investigation by March and said no more probes were needed. Meanwhile, Icahn halved his company’s dividends and promised to refocus on straight activism, which he described as the best investment approach.

Companies like Nikola never really recovered from the blow. Anderson targeted Nikola following a Bloomberg News article on how founder Trevor Milton had exaggerated the capability of his debut semi truck. Nikola, which at one point had a $34 billion market value, is now worth $868 million, and a jury in October 2022 convicted Milton of defrauding investors.

At Temenos, meanwhile, even before the Hindenburg report, analysts were divided on the Swiss company. It had five buy-equivalent ratings, 10 holds and four sells, according to data compiled by Bloomberg. Its shares gained 12% this year through Wednesday’s close after a 54% rally in 2023. A year earlier, the stock slumped 60%.

The company has faced activist investors in the past. Petrus Advisers took a stake in Temenos in October 2022, and piled pressure on it to overhaul its management and set new medium-term targets. The fund scored a win three months later, when Chief Executive Officer Max Chuard stepped down. Andreas Andreades, long-time chairman of the company, has been interim-CEO since, and has said he won’t seek reelection, leaving the company in the midst of a lengthy CEO search.

Takeover Target

The software maker struggled to revive its business after Covid lockdowns tempered demand for on-site banking software. Last year was something of a turnaround year.

Temenos showed “fairly decent traction” in both revenue and margin growth last year, said Bloomberg Intelligence analyst Tamlin Bason. Yet, the firm’s free cash flow continued to struggle, and “there are definitely some credibility gaps there,” he said.

“There have been lingering doubts over how effectively management’s going to be able to meet their medium-term targets,” Bason said.

Temenos, created three decades ago, says on its website that its platform enables 1.2 billion people to carry out their daily banking needs, or 30% of the world’s banking population. The company says two-thirds of the world’s top 1,000 banks and over 70 challenger banks in more than 150 countries rely on its technology. Its clients include Standard Chartered, Julius Baer, and Nordea, according to its website.

Temenos has long been a target for buy-out firms including EQT AB, Permira, Thoma Bravo and KKR & Co. Takeover talks fell apart in 2022 due to pricing divergences among management and shareholders. The latest one was Nordic Capital.

Meanwhile, a representative for Patinex, the holding company of Swiss investor Ebner, declined to comment on the Hindenburg report or on Temenos. Ebner holds nearly 13% of the company through the vehicle.

A key figure in Swiss corporate history, Ebner was an activist investor himself for decades and major driver of boardroom maneuvers, including the creation of UBS Group AG.

In the mid-1980s he founded a bank and set up an investment company. He proceeded to make money by buying big stakes in firms and then using an activist approach to boost their share prices. Toward the end of the 1990s, he became a champion of small investors as he traveled through the countryside wearing a bow tie, short-sleeved shirt and a baseball cap to promote stocks to average Swiss.

--With assistance from Lisa Pham, Henry Ren and Thyagaraju Adinarayan.

(Updates with Hindenburg’s record from 10th paragraph)

Most Read from Bloomberg Businessweek

Gene Therapy Makers Struggle to Find Patients for Miracle Cures

How Bad Movie Dubbing Led to the Fake Biden Campaign Robocalls

The Dangers of Relying on the US to Power the Global Economy

US Citizens Become Collateral Damage in Global Sanctions Fight

Pursuing ‘American Dynamism,’ Andreessen Horowitz Ups Its Game in DC

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance