Home Builders Q1 Earnings: Tri Pointe Homes (NYSE:TPH) is the Best in the Biz

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the home builders industry, including Tri Pointe Homes (NYSE:TPH) and its peers.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.8%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and home builders stocks have had a rough stretch, with share prices down 5.3% on average since the previous earnings results.

Best Q1: Tri Pointe Homes (NYSE:TPH)

Established in 2009 in California, Tri Pointe Homes (NYSE:TPH) is a United States homebuilder recognized for its innovative and sustainable approach to creating premium, life-enhancing homes.

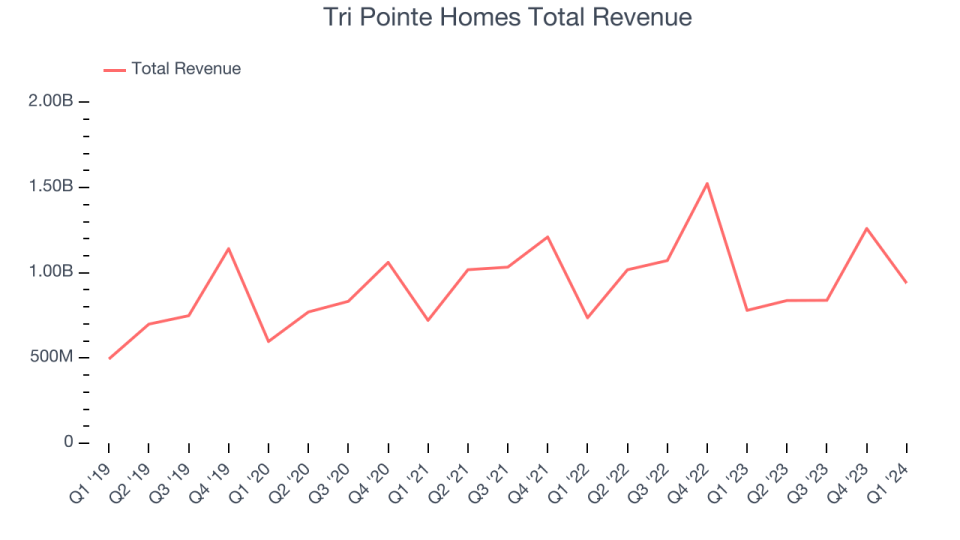

Tri Pointe Homes reported revenues of $939.4 million, up 20.5% year on year, exceeding analysts' expectations by 8.8%. Overall, it was a stunning quarter for the company with an impressive beat of analysts' earnings estimates and a solid beat of analysts' backlog sales estimates.

“I am pleased to report our first quarter results, which again met or exceeded the high end of our guidance across all key operating metrics,” said Doug Bauer, Tri Pointe Homes Chief Executive Officer.

Tri Pointe Homes pulled off the fastest revenue growth of the whole group. The stock is up 3.3% since reporting and currently trades at $37.32.

Is now the time to buy Tri Pointe Homes? Access our full analysis of the earnings results here, it's free.

Taylor Morrison Home (NYSE:TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE:TMHC) builds single family homes and communities across the United States.

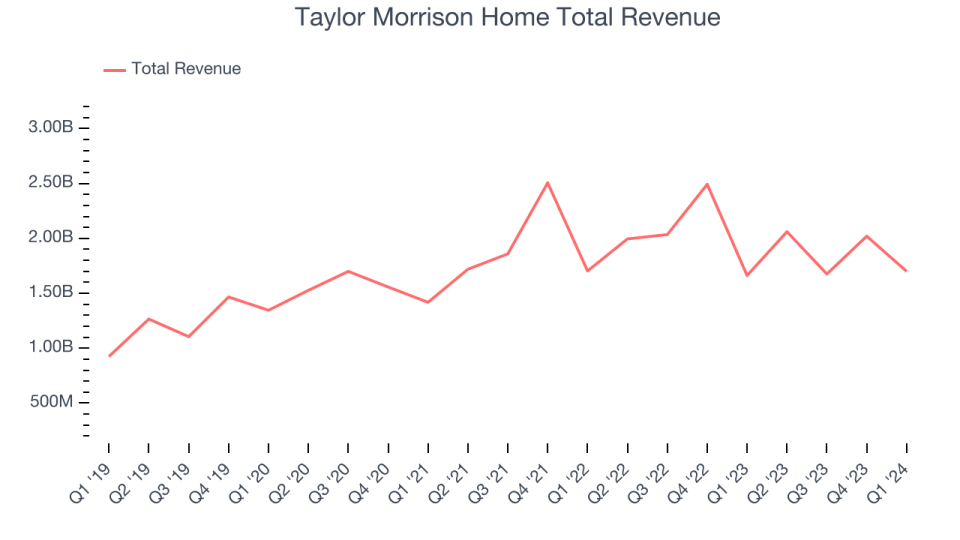

Taylor Morrison Home reported revenues of $1.7 billion, up 2.3% year on year, outperforming analysts' expectations by 2.7%. It was an exceptional quarter for the company with an impressive beat of analysts' backlog sales estimates and a decent beat of analysts' earnings estimates.

Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 4.5% since reporting. It currently trades at $55.17.

Is now the time to buy Taylor Morrison Home? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skyline Champion (NYSE:SKY)

Founded in 1951, Skyline Champion (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Skyline Champion reported revenues of $536.4 million, up 9.1% year on year, falling short of analysts' expectations by 4.4%. It was a weak quarter for the company with a miss of analysts' earnings and volume estimates.

Skyline Champion had the weakest performance against analyst estimates in the group. As expected, the stock is down 10.7% since the results and currently trades at $69.41.

Read our full analysis of Skyline Champion's results here.

Meritage Homes (NYSE:MTH)

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE:MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Meritage Homes reported revenues of $1.47 billion, up 14.8% year on year, surpassing analysts' expectations by 15.5%. Looking more broadly, it was a decent quarter for the company with an impressive beat of analysts' earnings estimates but a miss of analysts' backlog sales estimates.

Meritage Homes delivered the biggest analyst estimates beat among its peers. The stock is up 3.5% since reporting and currently trades at $160.01.

Read our full, actionable report on Meritage Homes here, it's free.

Installed Building Products (NYSE:IBP)

Founded in 1977, Installed Building Products (NYSE:IBP) is a company specializing in the installation of insulation, waterproofing, and other complementary building products for residential and commercial construction.

Installed Building Products reported revenues of $692.9 million, up 5.1% year on year, surpassing analysts' expectations by 1.4%. Looking more broadly, it was a weaker quarter for the company with a miss of analysts' organic revenue estimates.

The stock is down 9.3% since reporting and currently trades at $210.33.

Read our full, actionable report on Installed Building Products here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance