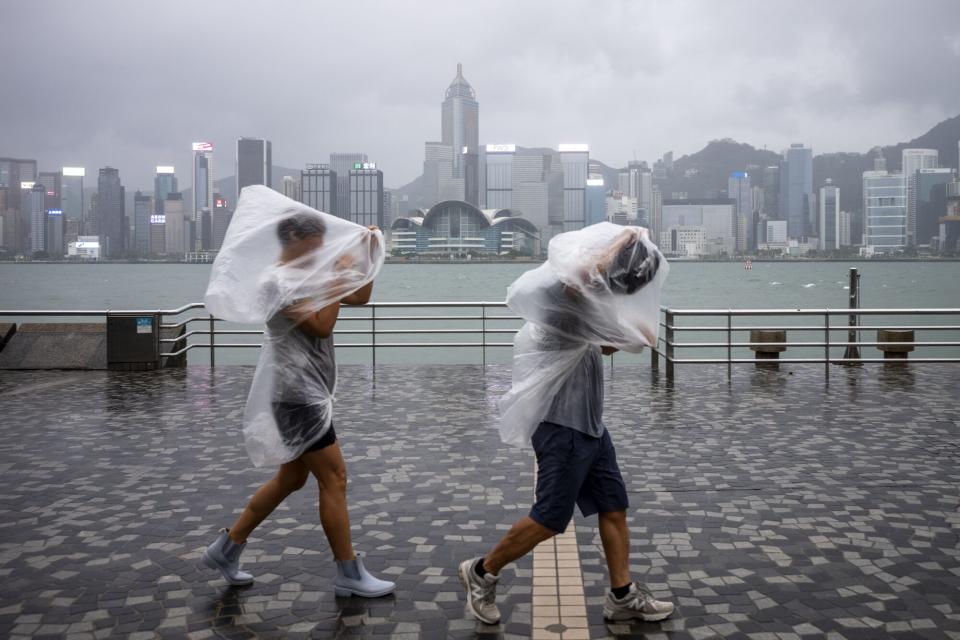

Hong Kong Plans to Start Trading During Typhoons in September

(Bloomberg) -- Hong Kong plans to stop shutting the stock market during severe weather as soon as September to allow trading in such conditions like in other advanced economies, according to people familiar of the matter.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

Hong Kong Exchanges & Clearing Ltd. is expected to announce the framework in the next few weeks, the people said, who asked not to be identified discussing private information. The plan is still being finalized and subject to last minute changes, the people said.

The move will put an end to a decades-old local tradition of shutting trading of the $5.2 trillion market during typhoons and heavy rainstorms. The former British colony has been an outlier among major financial hubs in having rules to close markets during inclement weather. The practice became increasingly questioned during the pandemic when widespread work-from-home set ups showed little hindrance to trading.

A spokesperson for the exchange said it’s actively working with the Hong Kong government, market regulator and the city’s central bank to finalize the model and publish its conclusions by mid-year.

The proposal will facilitate continued trading and “strengthen Hong Kong’s position as a two-way gateway between the international and Mainland markets and consolidate our competitiveness as an international financial centre,” a government spokesperson said in a statement. “It remains our target to announce relevant implementation details as well as the timetable in the middle of this year.”

Top government officials have pushed hard to have the plan in place as early as possible and a three-month preparation period is seen as feasible, the people said. It would test the exchange’s abilities to stay open right away since the start would fall in the middle of the typhoon season.

HKEX originally aimed to start trading through typhoons by July this year, but met opposition from smaller brokers and banks due to personnel and cost challenges. A pledge of banking support late last year from the Hong Kong Monetary Authority eased opposition and helped push the plan forward, the people said.

The framework is expected to apply under all weather types and severity. Exemptions and grace periods might be granted to smaller brokers who are not ready by the launch, two of the people said.

A compromise that would only have markets shut during Typhoon Signal No. 9 or 10 — the highest alerts — was rejected, according to two people.

Typically about six to eight typhoons hit the city every year, though not all bring schools, traffic and markets to a halt. This year about five to eight tropical cyclones are expected, according to the local observatory.

The Securities and Futures Commission and the Hong Kong Monetary Authority are supportive and both regulators said they understood HKEX will publish the consultation outcome soon, according to spokespeople.

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance