HP Inc. Jumps Most Since 2015 Split on Renewed PC Sales

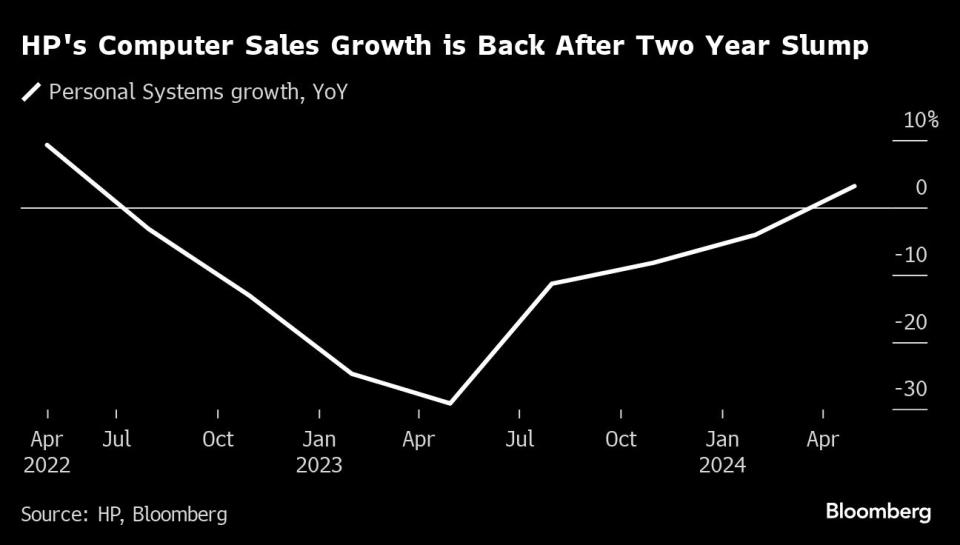

(Bloomberg) -- HP Inc. jumped the most since its 2015 split with sister company Hewlett Packard Enterprise after reporting its first increase in PC sales in two years, an optimistic signal for a long-awaited rebound in the market.

Most Read from Bloomberg

Modi Vows to Retain Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Bonds Rally as Traders Reload Fed Bets After Data: Markets Wrap

Revenue from HP’s computer unit increased 3% to $8.43 billion in the fiscal second quarter, compared with the $8.28 billion expected by analysts. The business had been declining since May 2022 on a year-over-year basis. The jump was due to commercial sales, which rose 6% to $6.24 billion. Consumer sales continued to decline, slipping 3% to $2.18 billion, the company said Wednesday in a statement.

The PC market had seen a historic decline over the last two years after many consumers, businesses and schools purchased laptops in the early months of the pandemic. In the first quarter, shipments picked up 1.5% — the first increase since the end of 2021 — industry analyst IDC said in April. PC-makers have been hopeful those numbers signaled the end of the slump and that growth would accelerate in 2024 with the launch of machines equipped with a new version of Microsoft Corp.’s Windows software as well as hardware that is built with chips to handle artificial intelligence tools.

“Hewlett Packard’s stronger-than-anticipated second quarter commercial PC results fuels confidence for a healthy second half PC sales rebound,” said Woo Jin Ho, an analyst at Bloomberg Intelligence.

AI PCs, such as those HP unveiled last week during a Microsoft conference, will account for about 10% of total shipments in the second half of the year, Chief Executive Officer Enrique Lores said Wednesday in an interview. The financial impact will be “much more relevant” in 2025 and 2026 as HP expects the number to climb to about 50% of shipments three years after launch, he added.

The shares jumped 17% to $38.36 at the close Thursday in New York, the biggest single-day rise since November 2015 when the original Hewlett-Packard Co. split into HP and HPE. The stock had gained 9% this year through Wednesday’s close — falling short of peer Dell Technologies Inc. which has more than doubled in value this year due to its excitement for its AI-capable servers.

See More: Michael Dell Says AI PCs Will Be ‘Pretty Standard’ in 2025

“Along with growth in shipments, AI PCs are also expected to carry higher price tags, providing further opportunity for PC and component makers,” Jitesh Ubrani, an analyst at IDC, said in April.

In the period ended April 30, total sales declined less than 1% to $12.8 billion, compared with analysts’ average projection of $12.6 billion. Profit, excluding some items, was 82 cents a share, about in line with Wall Street estimates.

Sales in HP’s printing business fell 8% to $4.37 billion. The company introduced a subscription plan for printers earlier this year, which Lores said has been seeing success. A similar plan for consumer-oriented computers is being explored, he added.

For the fiscal third quarter, HP projected profit, excluding some items, of 78 cents to 92 cents per share. Analysts, on average, estimated 86 cents, according to data compiled by Bloomberg.

(Updates with share movement in the first and sixth paragraphs.)

Most Read from Bloomberg Businessweek

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

Disney Is Banking On Sequels to Help Get Pixar Back on Track

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance