IBM Beats on Q2 Earnings, z14 Mainframe Aids Top-Line Growth

International Business Machines Corp IBM reported second-quarter 2018 non-GAAP earnings of $3.08 per share, which beat the Zacks Consensus Estimate by a nickel. Earnings per share (EPS) increased 4.8% from the year-ago quarter.

The year-over-year growth in EPS can be attributed to higher revenues (10 cents contribution), solid pre-tax margin operating leverage (20 cents contribution) and aggressive share buybacks (seven cents contribution). This was partially offset by higher tax rate (22 cents negative impact).

Revenues of $20 billion outpaced the Zacks Consensus Estimate of $19.62 billion and climbed 3.7% on a year-over-year basis. At constant currency (cc), revenues increased 1.6%.

IBM stated that signings increased 6% to $11.5 billion with 13 deals above $100 million. Services backlog declined 1% from the year-ago quarter to $116 billion.

Shares increased more than 3% in after-hour trading, following the second-quarter announcement. IBM has lost 5.8% year to date, underperforming the industry’s decline of 4.2%.

Europe, Middle-East and Africa Revenues Grow

Geographically, top-line growth was strongest in Europe, Middle-East and Africa. The figure increased 4% from the year-ago quarter, driven by growth in Germany, the United Kingdom, France and Spain.

Revenues from Americas inched up 1%, driven by continued growth in Latin America and modest growth in the United States.

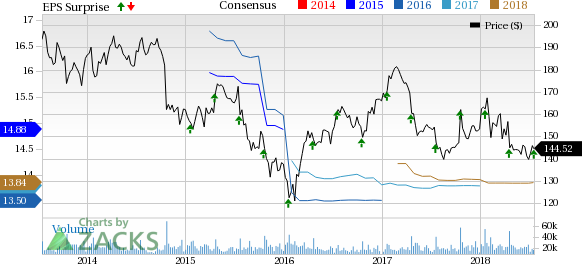

International Business Machines Corporation Price, Consensus and EPS Surprise

International Business Machines Corporation Price, Consensus and EPS Surprise | International Business Machines Corporation Quote

Asia-Pacific revenues remained flat on a year-over-year basis. Japan improved more than 1%.

Strategic Imperatives Growth Continues

Strategic Imperatives (cloud, analytics, mobility and security) grew 13% at cc from the year-ago quarter to $10.1 billion. Security revenues surged 79%, driven by strong demand for the pervasive encryption of IBM Z, and growth in integrated software and services business.

On a trailing 12-month basis, Strategic Imperatives revenues were $39 billion and now represents 48% (up from 47% in the previous quarter) of IBM’s total revenues.

Cloud revenues surged 18% from the year-ago quarter to $4.7 billion. The annual run rate for cloud as-a-service revenue increased 24% at cc on a year-over-year basis to $11.1 billion.

Cloud revenues of $18.5 billion on a trailing 12-month basis now comprises more than 23% of IBM’s total revenues.

Cognitive Down on Weak Transaction Processing

Cognitive Solutions’ revenues-external increased 0.5% year over year (down 1.3% at cc) to $4.58 billion, which lagged the Zacks Consensus Estimate of $4.78 billion.

Segmental revenues pertaining to Strategic Imperatives and Cloud were flat and down 1%, respectively. Cloud as-a-service revenue annual run rate was $2 billion.

Solutions software revenues decreased 1%, while Transaction Processing Software revenues fell 2% on a year-over-year basis.

The top-line growth was negatively impacted by weakness in IBM’s talent, collaboration and commerce businesses that are a combination of on-premise and SaaS offerings. Transaction Processing was hurt by declines in storage software.

Analytics Growth Strong, Watson Impresses

IBM stated that analytics performed well in the quarter, driven by DB2 portfolio, data science offerings and new IBM Cloud Private for Data offering.

Watson continues to add to its clientele, primarily due to strong demand for new virtual assistant offering. IBM stated conversation service usage grew triple digit in the quarter. New clients include the likes of Autodesk ADSK, Vodafone and Bradesco, to name a few. Watson Health benefited from strong performance in areas like Payer and Life Sciences.

Revenues also benefited from strong performance in financial services and Internet-of-Things (IoT) industry verticals. IoT benefited from strong demand for Maximo asset management solution and Tririga facilities management solution.

Financial services growth reflects robust performance in Risk & Regulatory business and Financial Crimes portfolio, well supported by Promontory and enhanced AI technologies.

Blockchain Initiatives Gaining Traction

IBM currently supports 60 active blockchain networks.

During the quarter, the company launched We.trade with nine large banks. It is the first live blockchain-based, bank-to-bank trading platform. Deutsche Bank, HSBC, KBC and Natixis are partners in this initiative.

Moreover, IBM Digital and Mediaocean launched a blockchain consortium comprised of leading advertisers and publishers including Kellogg, Unilever, Kimberly-Clark and Pfizer PFE to set the industry standard for digital ad-buying system.

Global Business Services Revenues Increase

Revenues from Global Business Services-external segment were $4.19 billion, up 2.3% from the year-ago quarter (flat at cc) and were better than the Zacks Consensus Estimate of $4.17 billion.

Segmental revenues pertaining to Strategic Imperatives grew 6%. Cloud practice surged 8%. Cloud as-a-service revenue annual run rate was $1.4 billion.

Both Application Management and Global Process Services revenues decreased 3%. However, Consulting revenues increased 4% year-over-year, driven by strong performance from IBM’s digital business.

However, Application Management signings increased at a double-digit rate, driven by growth in strategic offerings like Cloud Migration Factory and Cloud Application Development.

IBM acquired Oniqua Holdings in the quarter, which strengthens its integrated IoT platform across Cognitive solutions and GBS.

Technology Services & Cloud Platforms: Revenues Dip

Revenues from Technology Services & Cloud Platforms-external increased 2.5% from the year-ago quarter (0.2% at cc) to $8.62 billion, which lagged the consensus estimate. Signings grew double-digit in the quarter.

Segmental revenues pertaining to Strategic Imperatives advanced 24%, driven by hybrid cloud services, security and mobile. Cloud surged 27% from the year-ago quarter. Cloud as-a-service revenue annual run rate was $7.6 billion.

Integration Software increased 1% from the year-ago quarter, driven by solid SaaS performance. The company now has more than 300 clients using IBM Cloud Private offering.

Technical Support Services revenues decreased 4% from the year-ago quarter.

Infrastructure Services increased 1% on a year-over-year basis. The company now has 18 availability zones for the IBM Cloud across the world.

Power, z14 Drive Systems Revenues

Systems revenues soared 24.6% on a year-over-year basis (22.9% at cc) to $2.18 billion, which comfortably surpassed the consensus mark of $1.81 billion.

IBM Z revenues surged 112% year over year on more than 200% MIPS growth, driven by broad-based adoption of the z14 mainframe. Power revenues increased 4% from the year-ago quarter, while Storage hardware revenues climbed 2%.

Storage hardware benefited from strong flash sales, which grew double digit across the portfolio.

Segmental revenues pertaining to Strategic Imperatives surged 55%, while Cloud revenues jumped 28%.

Operating Systems Software revenues declined 1%, while Systems Hardware advanced 31% from the year-ago quarter.

Finally, Global Financing (includes financing and used equipment sales) revenues decreased 6.2% at cc to $394 million.

Operating Details

Non-GAAP gross margin contracted 60 basis points (bps) from the year-ago quarter to 46.5%, primarily due to unfavorable mix and continued investments on the development of IBM Cloud.

Operating expense was better in the quarter, due to realization of acquisition synergies and improving operational efficiencies. IBM continues to invest in fast growing fields like artificial intelligence (AI), security and blockchain.

Pre-tax margin from continuing operations expanded 110 bps to 16.9% on a year-over-year basis.

Cognitive Solutions, Global Business Services and Global Financing segment pre-tax margins expanded 230 bps, 160 bps and 120 bps, respectively, on a year-over-year basis. However, both Technology Services & Cloud Platforms segment pre-tax margins contracted 150 bps.

Systems pre-tax income was $346 million compared with an income of $188 million in the year-ago quarter.

Balance Sheet & Cash Flow Details

IBM ended second-quarter 2018 with $11.93 billion in total cash and marketable securities, as compared with $13.20 billion at the end of first-quarter 2018. Total debt (including global financing) was $45.5 billion, down $0.9 million from the end of previous quarter.

IBM reported cash flow from operations (excluding Global Financing receivables) of $2.9 billion and generated free cash flow of $1.9 billion in the quarter.

In the reported quarter, the company returned $2.4 billion to shareholders through dividends and share repurchases. At the end of the quarter, the company had $2 billion remaining under current buyback authorization.

Guidance

IBM reiterated EPS forecast for 2018. Non-GAAP EPS is expected to be at least $13.80. The Zacks Consensus Estimate is currently pegged at $13.84.

IBM still anticipates 2018 free cash flow of $12 billion.

Zacks Rank & Stocks to Consider

IBM currently carries a Zacks Rank #3 (Hold).

Hewlett Packard Enterprise HPE with Zacks Rank #2 (Buy) is a stock worth considering in the same sector. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long term EPS growth rate for Hewlett Packard Enterprise is currently pegged at 9.34%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Autodesk, Inc. (ADSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance