U.S. prosecutor query, quarterly loss hit already reeling shares of Icahn's company

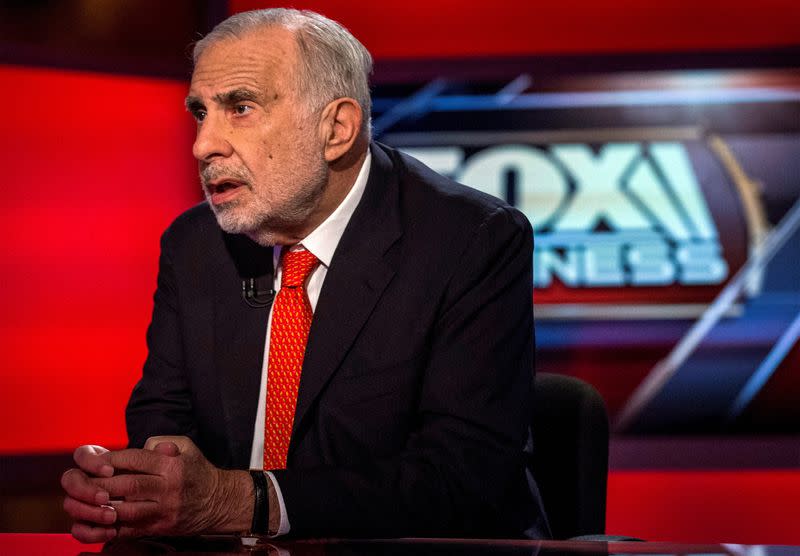

(Reuters) -Billionaire Carl Icahn's holding company said on Wednesday it was contacted by U.S. prosecutors, and it posted a surprise quarterly loss, sending its shares down 15% in the latest blow to the activist investor's efforts to defend his empire from a wave of short selling days after a report by Hindenburg Research.

It was not yet clear whether the interest from federal prosecutors was related to Hindenburg's allegations that Icahn Enterprises LP (IEP) inflated the value of its holdings and ran a "Ponzi-like" scheme to pay its dividend.

Still, it was a setback for Icahn, a pioneer of shareholder activism who is noted for dressing down companies over their governance and transparency, but has not fielded such scrutiny himself.

Since May 2, when Hindenburg published its critical report, IEP shares have lost close to 40% of their value -- almost $7 billion -- and the net worth of Icahn, who owns 85% in IEP, has shrunk by a similar amount to $10 billion.

IEP said on Wednesday it had received inquiries from prosecutors in the Southern District of New York "seeking production of information relating to it and certain of its affiliates’ corporate governance, capitalization, securities offerings, dividends, valuation, marketing materials, due diligence and other materials."

The company said it was cooperating with the request, and that the U.S. Attorney's office has not made any claims or allegations against it or Icahn.

A spokesman for the U.S. Attorney's office declined to comment.

Icahn has called Hindeburg's report "self-serving" and he reiterated his defense of IEP on Wednesday. "Hindenburg Research, founded by Nathan Anderson, would be more aptly named Blitzkrieg Research given its tactics of wantonly destroying property and harming innocent civilians," he said in a statement.

Icahn has been seeking to reassure investors that IEP's dividend is safe after Hindenburg alleged it is unsustainable because it relies on Icahn taking his own dividend in stock and IEP raising cash regularly by selling more stock.

While the company said it would maintain its first-quarter dividend at $2 per unit, its first-quarter loss and the prosecutors' queries raised new questions among some investors and legal experts about the company's ability to sell stock down the line.

"Management folks at brokerage firms take a conservative view when allegations of financial irregularities are made about an issuer or when agencies become involved, even in the early phases of an investigation," said Clark Hill securities lawyer Randy Katz.

IEP posted a net loss of $270 million, with the bankruptcy of its car parts distributor IEH Auto Parts Holding resulting in a one-time, non-cash charge of $226 million.

Excluding one-time items, Icahn Enterprises reported a loss of 11 cents per share, missing analysts' average estimate of a 19 cents profit, according to Refinitiv data.

Revenue for the quarter ended March 31 came in at $2.6 billion compared to $4.1 billion a year earlier.

IEP has $1.9 billion of cash and $4 billion of additional liquidity, Icahn said in a statement. IEP added that its valuation methods were standard in the industry, and cited six examples of its assets where their sale prices were well in excess of their stated marks prior to the sales.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru and Koh Gui Qing and Echo Wang in New York; Editing by Arun Koyyur, Rosalba O'Brien, Chizu Nomiyama and David Gregorio)

Yahoo Finance

Yahoo Finance